2024 Preview

What to expect from Bitcoin and altcoins in 2024.

2023 is over, and it definitely didn’t play out like most had expected. The year began with Bitcoin still well below $20,000 and the market terrified to touch altcoins. Still, the majority expected prices to go much lower and a recession to hit. Those who went with the crowd and macro “experts” were left waiting while the bold or technically skilled took on risk and it paid off.

Note: Remember how you felt one year ago today, and never forget it — these are the moments when you want to be fearless and buy even though you are scared to do so.

Now we look ahead at 2024, with a bigger focus on Q1. This special issue will address the possibility of a pullback in Bitcoin or if it keeps ripping higher, altcoin season, and what happens when it’s all over.

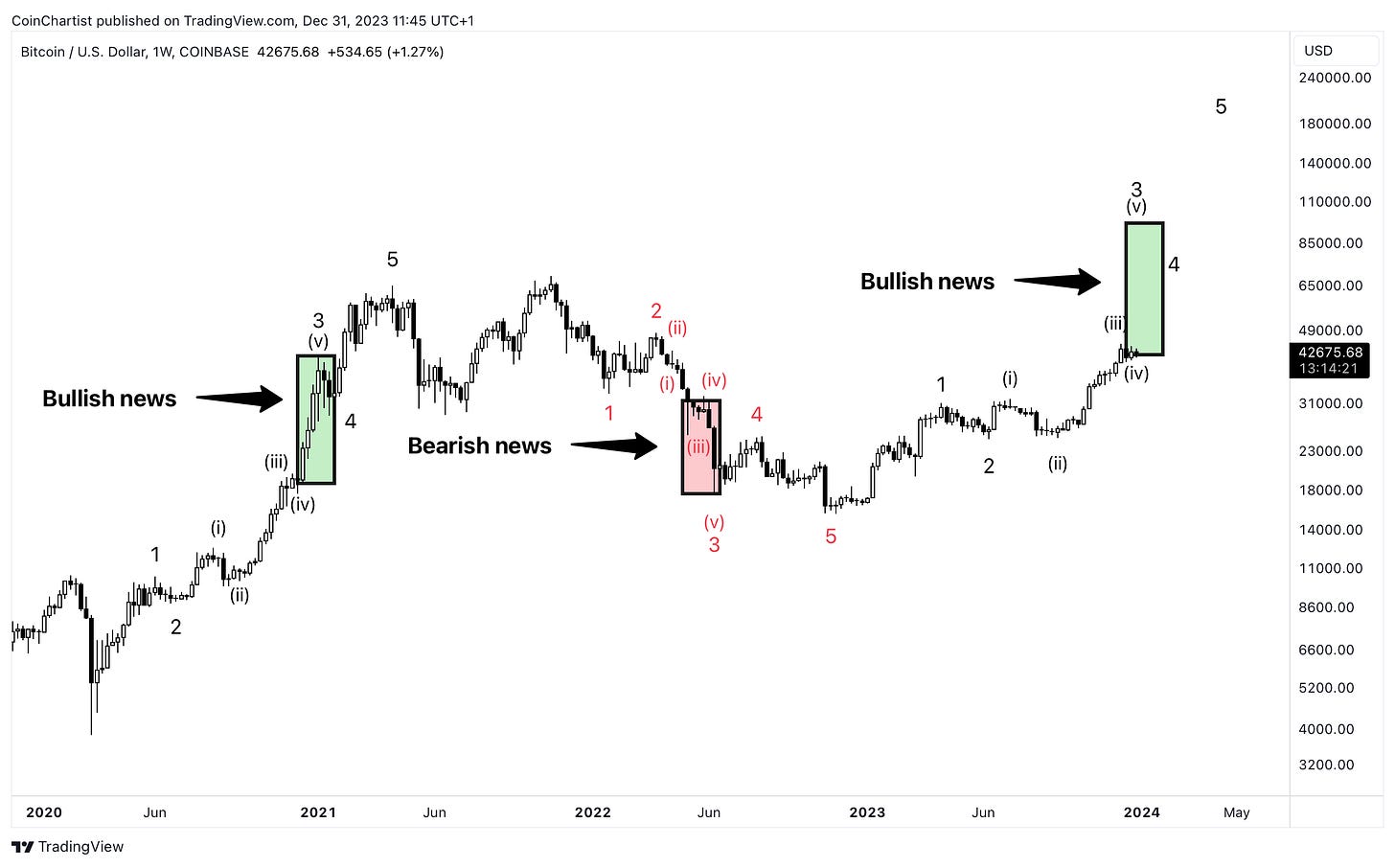

Bitcoin will close 2023 almost 3x higher than its 2022 bottom at $15,000. But what happens in the coming months, especially as spot BTC ETFs begin to see approvals from the SEC? According to my Elliott Wave Principle count Bitcoin ideally should be entering its most bullish phase where it moves the strongest and fastest. The reason for this is because of how mass crowd psychology unfolds. This is the part of the trend where stubborn hold outs finally give in and flip bullish. This is driven by a backdrop of bullish news. You may recall back in 2020 through early 2021, where the green box is highlighted, that the price action was supported by MicroStrategy buying BTC, Tesla buying and accepting BTC, and other factors. Even the red box showing a downward impulse was driven by the worst news of the bear market. If another impulse takes Bitcoin much higher, it will be driven by ETF approvals and the onslaught of investment these firms and products will be receiving.

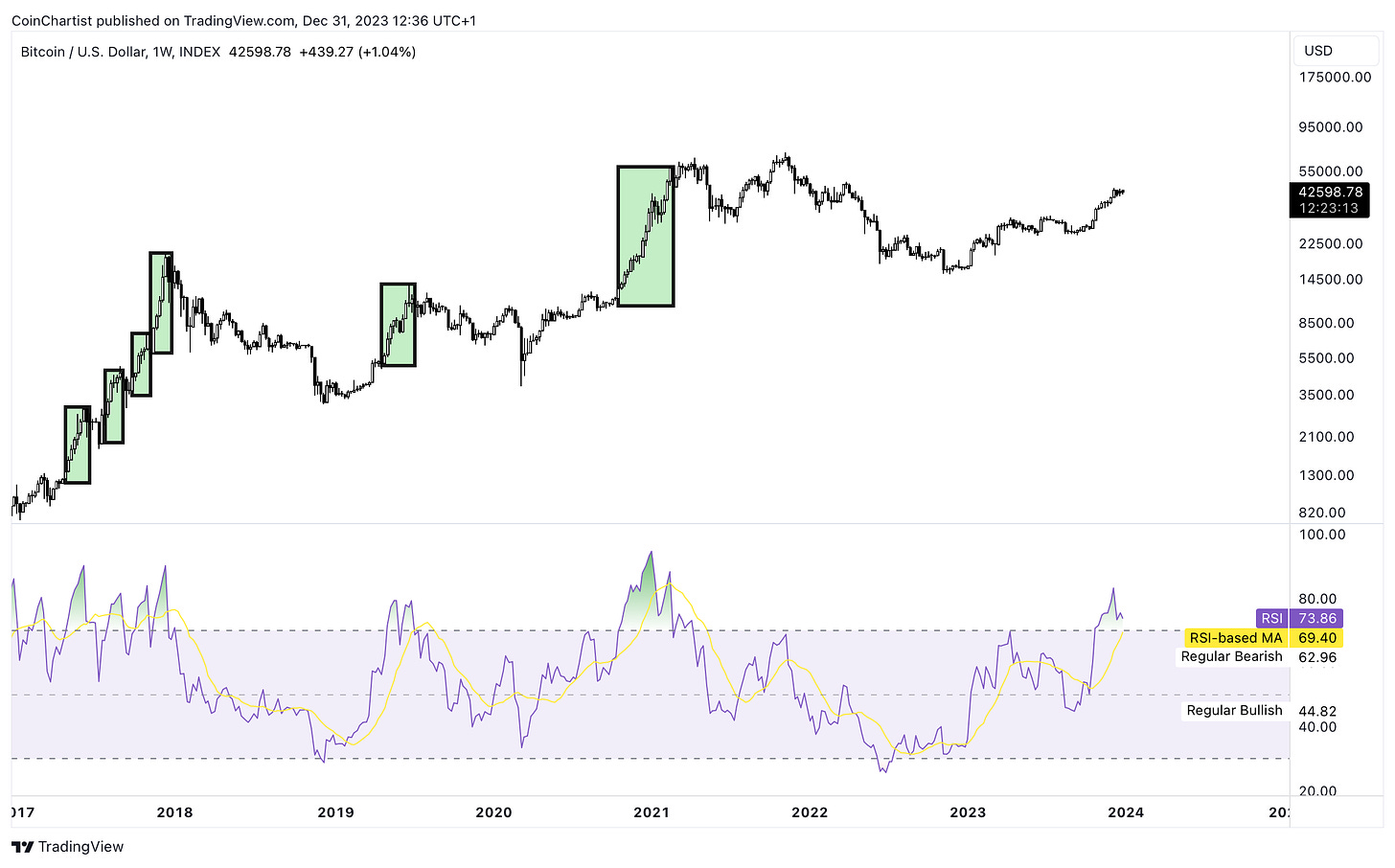

If for some reason, the initial ETF approvals are a sell the news event, and Bitcoin sees a deep correction, I still don’t think that is the end of the bull run. We will just be witnessing something more like 2017, versus anything we’ve seen in the last several years since. The weekly RSI in this case would act as our guide. Losing 70 on the weekly RSI would be a tell that this time is different than 2020 and 2021. A scenario like this could be possible as institutions might be more likely to secure profits than retail.

Keep reading with a 7-day free trial

Subscribe to CoinChartist to keep reading this post and get 7 days of free access to the full post archives.