Disclaimer: The information provided in this Substack newsletter is for general informational purposes only and should not be considered as financial advice. Investing involves risk, and past performance is not indicative of future results. Please conduct your own research or consult a financial advisor before making any investment decisions. The newsletter disclaims any liability for losses or damages arising from the use of this information.

2025 Preview overview:

A look at yearly candlesticks and the four-year cycle

Bitcoin top technicals – are we there yet?

The roadmap for Bitcoin’s final advance

Is this the end of the primary uptrend?

Capital rotation into altcoins has begun

Why altcoins could spend most of 2025 bullish while Bitcoin tops early

2024 has come to a close and it ended with Bitcoin having reached the major psychological milestone of $100,000. Hitting this number hasn’t had all that much impact on price action, with BTCUSD trading just below it. There’s been no major selloff or profit-take to speak of. Technical indicators aren’t showing signs of topping… yet.

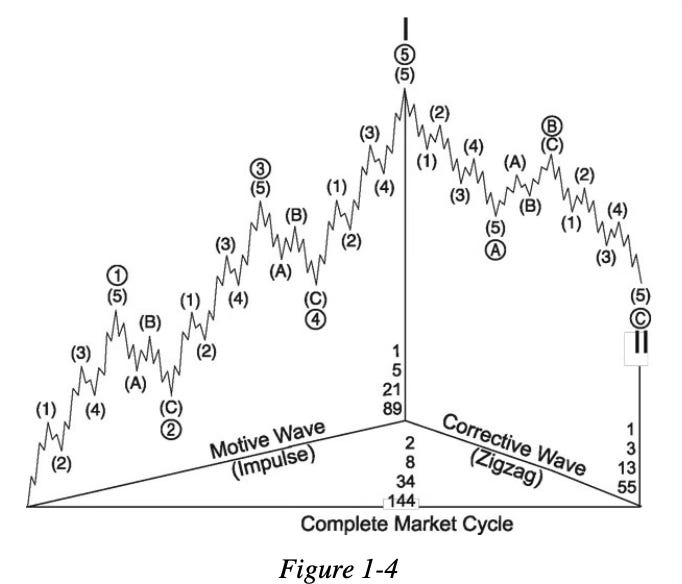

But if you’ve been reading this newsletter since its inception, you might have noticed a strict adherence to a basic five-wave Elliott Wave Motive Wave pattern. Following this trajectory off the 2022 bear market lows has proven profitable for me, allowing me to properly anticipate alternation between corrective phases and rallies.

It is this basic roadmap above that also is telling me that we’ve almost reached our final destination, and it is almost time to get off this ride. What’s more interesting, is that there feels like barely any euphoria in the crypto market currently – and because of that, I am expecting a cycle very different from the past to unfold in 2025.

At $100,000 per coin, Bitcoin is mostly attractive to a very specific type of investor – those with vast wealth they need to store. The target investor of Bitcoin now is an institution, hedge fund, or a company that wants to diversify its treasury holdings. Because of the high price of entry, retail isn’t exactly paying attention to Bitcoin. So there’s barely any excitement.

This issue previewing the year ahead presents a primary thesis of an early 2025 peak in Bitcoin, with alternative theories for a more extended bull run later into 2025. I also explore my theory for altcoins, which is a far lengthier rotation phase than we’re used to in the past. For example, in 2017, Bitcoin topped out in December, while most altcoins peaked in January or February 2018. This time around, I think that altcoins could continue to see topping behavior for as much as six to nine more months after Bitcoin peaks.

It will be only then when the crypto market reaches the euphoria one might expect related to a cyclical peak. By this point, smart money will have rotated its BTC profits into alts and have dumped their pumped alt bags on retail. In fact, it is this capital rotation that I believe will prompt a longer altcoin season where certain sectors take longer to finish their rallies.

While retail hunts and chases altcoin profits, smart money will be distributing their coins both through selling Bitcoin and rotating into altcoins for higher ROI plays. After two years of uptrend, reaching above $100,000 per coin, smart money will be the first to realize that Bitcoin’s ROI for this cycle is tapped out, and begin seeking more profitable opportunities in the altcoin market. Frankly, I sense this phase has just begun, which is why we’re potentially seeing Bitcoin Dominance start to roll over.

Remember, this is not financial advice. Do your own research. Consider alternatives and prepare for any outcome. Take what the market gives you. I find value in being prepared and trying to anticipate the next move, hence why I am always looking ahead. But failure to be flexible and ditch your plan when it becomes invalidated can be dangerous. Even myself, who feels confidently in what I about to show you, understands I can be wildly wrong and might have to adapt. Compare my thesis with others, and try to come up with your own. At the very least, begin to come up with price targets you’d consider selling at, and begin to strategize, because regardless of the exact timing – a top is more than likely coming in 2025. Let’s explore why.

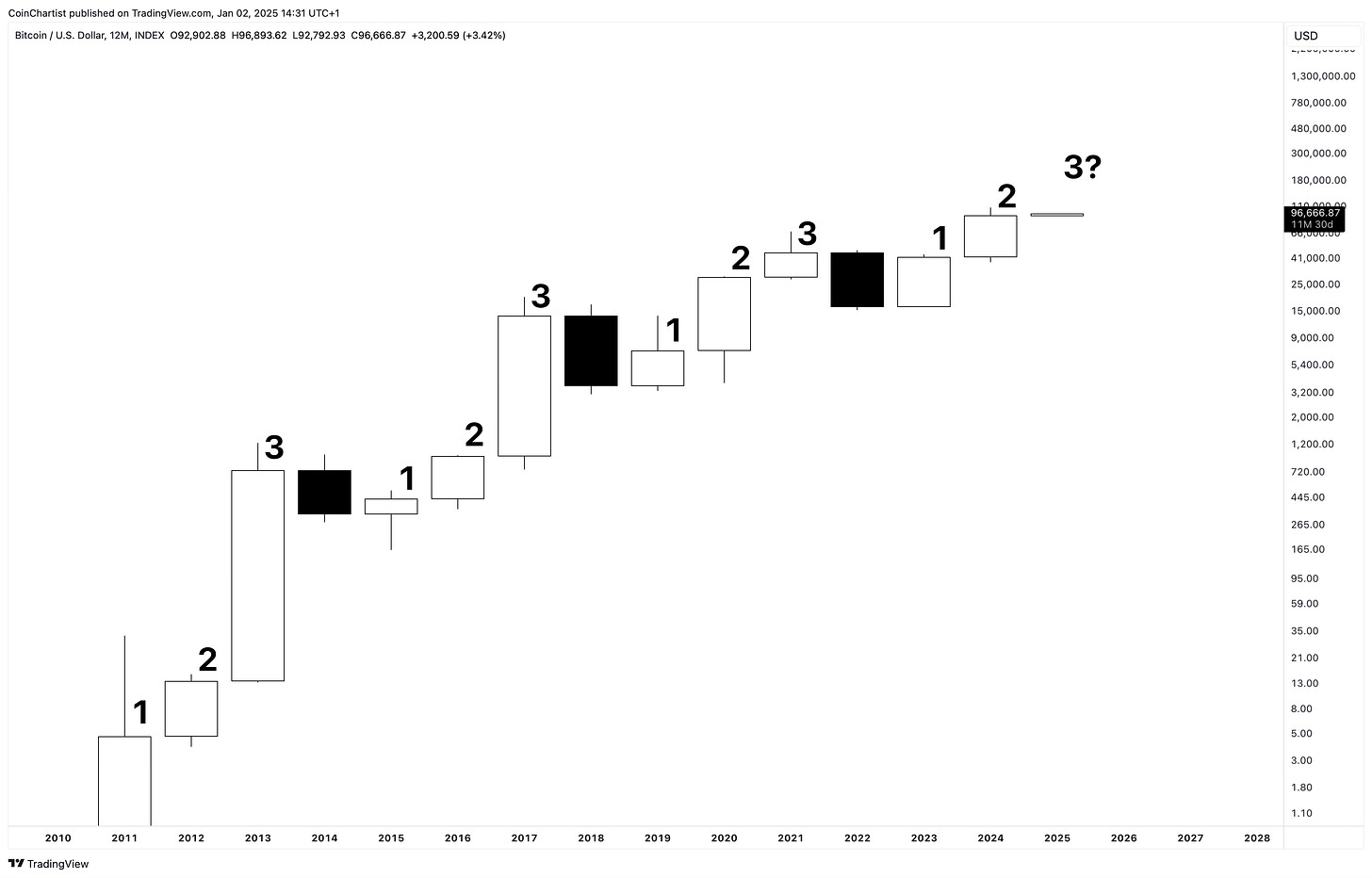

This chart has been making its way around the X platform, and it makes sense. Four-year BTC cycles have made for a reliable pattern in Japanese candlesticks, where there is three up years, followed by a down year. This tells us that we can expect 2025 to be a white bullish candle when it is all over. While this has been true historically, there is no telling how the 2025 candlestick will end. Another way to look at this data, is that on the third candlestick after the down year, Bitcoin topped for the cycle. That would also suggest that a top will be put in during 2025 at some point. I tend to think that, yes, Bitcoin tops this year, but that it also surprises and gives us a black candle – probably a Doji marking a top of the larger cycle. Later in this issue, I explore wave counts that show us why I expect a lengthier bear market after this next cyclical peak.

Keep reading with a 7-day free trial

Subscribe to CoinChartist (VIP) to keep reading this post and get 7 days of free access to the full post archives.