#51 | Now Or Never

After a fear-filled selloff, technical signal are mixed. Bitcoin and crypto must bounce here, or are at risk of shocking new lows.

Disclaimer: The information provided in this Substack newsletter is for general informational purposes only and should not be considered as financial advice. Investing involves risk, and past performance is not indicative of future results. Please conduct your own research or consult a financial advisor before making any investment decisions. The newsletter disclaims any liability for losses or damages arising from the use of this information.

Issue #51 overview:

Bitcoin retraced to a key ratio that could suggest the selloff is over. Is it?

Updated Wave counts provide bullish and mega bearish scenarios

Bitcoin exhibits both bearish and bullish technicals

Altcoins appear to be in danger – here’s why

Solana shows more resilience than Ethereum

Updated charts and thoughts on the VIX, S&P 500 and US Dollar.

In several recent issues, the idea that we’d get a sharp correction in Bitcoin was heavily discussed. After this weekend’s selloff into Monday’s open, there is no denying that the correction suddenly took a lot sharper of a shape. What we now need to assess, is if the correction has ended, and if not, if the uptrend has instead ended and what that might entail.

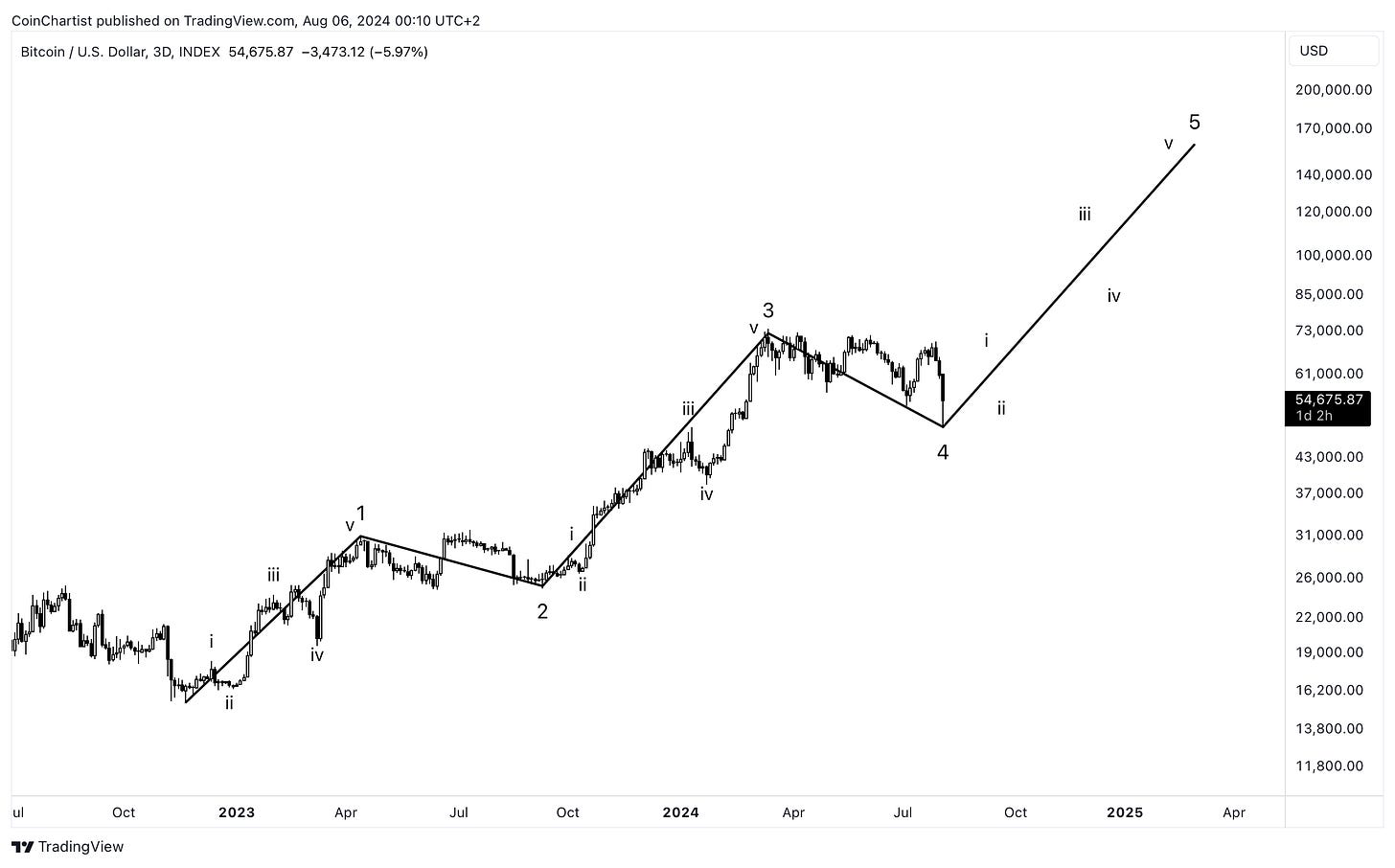

According to Elliott Wave Principle, specific waves tend to adhere to corresponding Fibonacci ratios. For example, Wave 4 commonly retraces 0.382 of Wave 3. I’ve had this correction labeled as a Wave 4 correction for almost six months now. If the correction is over and Bitcoin found a bottom, then it stopped precisely at the 0.382 Fib retracement ratio of Wave 3.

Considering the fear that this latest correction instilled in the market, if the bottom is in, it might take a while before investors and traders believe that to be the case. This could cause price to run a lot higher and faster than many are expecting, but this is pure speculation. The above represents a possible path of Wave 5 with five sub-waves counted out.

In Elliott Wave Principle, corrective behavior comes in three movements, labeled as ABC. If Bitcoin keeps plummeting, and fails to make a new high above the current Wave 3 high, then price action could be counted as an ABC. This is dangerous, as it could be part of a larger degree ABC correction that began in 2022. Theoretically, based on the bearish count, Bitcoin could set a new low below the FTX collapse low in November 2022.

However, this seems unlikely, as it would put Bitcoin deep below the bottom of the Power Law Corridor, which has supported Bitcoin throughout its entire history of trading. As you can see on the chart, not even the COVID crash or the FTX collapse was able to move far below the bottom of the corridor. Of course, in a real global recession, anything is possible.

The bottom of the Power Law Corridor coincides around the same price as the Wave 4 invalidation level. Per Elliott Wave Principle’s rules around an impulse, Wave 4 cannot enter Wave 1 territory. If Bitcoin trades below $31,000, then we might need to consider the more bearish scenario.

Keep reading with a 7-day free trial

Subscribe to CoinChartist (VIP) to keep reading this post and get 7 days of free access to the full post archives.