#55 | Final Advance

Is Bitcoin about to begin its final move up in the current bull market? What does that mean for altcoins?

Disclaimer: The information provided in this Substack newsletter is for general informational purposes only and should not be considered as financial advice. Investing involves risk, and past performance is not indicative of future results. Please conduct your own research or consult a financial advisor before making any investment decisions. The newsletter disclaims any liability for losses or damages arising from the use of this information.

#55 overview:

Bitcoin bullish momentum crossover and combining multiple timeframes

Predicting the path of Bitcoin’s final advance with time and price targets

A comparison of technicals between this and the last “uptober”

Cyclical Sine Waves point to the long-awaited start of altcoin season

Gold reaches a 40-year-old trend line and why this could be bullish for BTC

Sizing up Silver against altcoins – another potential alt season signal

Bitcoin is currently attempting to break out from recent downtrend resistance and leave the downward sloping channel that’s constrained price action for more than six months now. This issue looks at the variety of factors that could be behind the sudden strength in BTC, using traditional technical analysis, Elliott Wave Principle, and intermarket analysis. Could this finally be the end of sideways corrective behavior and the beginning of the final advance of this bull run? And how could all of this impact altcoins?

One of the most-watched technical signals across crypto right now, is Bitcoin’s MACD (or LMACD in my case) crossing bullish on the weekly timeframe. This Special Spotlight will examine that pending bullish crossover and explain how different timeframes combine to give an even clearer picture of momentum.

Beginning with the daily timeframe, we can see that the LMACD is still below the dashed line. Rising above this dashed line has historically led to larger moves to the upside. The LMACD helps to visualize momentum. The higher the reading, the stronger the bullish momentum. Even though the LMACD is below this dashed line, it is currently crossed bullish and is above the zero (0.0 reading) on the histogram.

Moving up timeframes to the 3-day, we can see that the LMACD is currently diverging upward, showing an increase in momentum after a short pause. On the 3-day, the LMACD is above the zero line and currently crossed bullish much like the daily. The diverging price behavior can be seen ahead of the last two minor uptrends beginning in November 2022 and again in October 2023.

Looking at the weekly LMACD (the timeframe everyone is talking about), we can see that there is a pending bullish crossover. At the time of this writing, the crossover signal has triggered and the histogram has flipped green. The bullish crossover is taking place above the zero line. A bullish crossover from the same level back in October 2023 led to an almost 200% rally.

Going even higher timeframe-wise, the 2-week is the lone timeframe in this series that is currently crossed bearish. However, the two Moving Averages are well above the zero line on the LMACD. Momentum is also starting to curl back upward, causing the histogram to turn pink and inch closer to turning green. Importantly, this is all taking place as BTC holds above former ATH resistance turned support.

Last but not least, the monthly LMACD is beginning to diverge upward. Ultimately, we want to see the two Moving Averages climb higher, avoiding a bearish crossover. Another positive sign would be the histogram turning back to dark green highlighting increasing momentum. The tool on this timeframe is the highest above the zero line out of any other timeframes we’ve reviewed, yet is still nowhere near the levels where Bitcoin has topped out historically. What this could be telling us is that Bitcoin is about to continue its bull run and is nowhere near a cyclical peak.

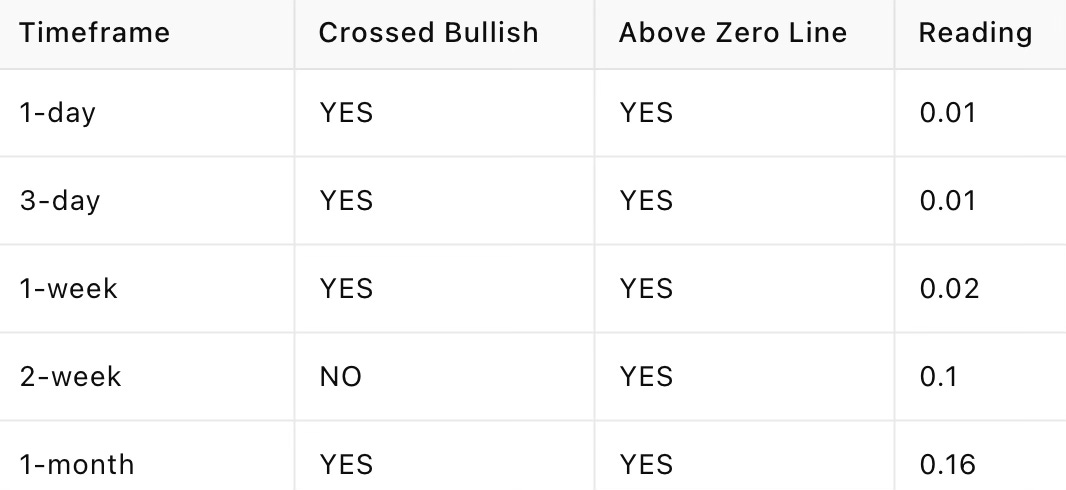

The above table includes all of the important signal data related to the LMACD on all timeframes covered. The LMACD gives a buy signal when it crosses bullish, and then another signal when it passes above the zero line. With this understanding, we can see that there are dual buy signals on every single timeframe except for the 2-week. And with the 2-week starting to curl upward, all timeframes could soon be in sync. When momentum is bullish and rising on all of the most important timeframes, you get incredible power behind price moves – perfect for setting the stage for the final advance.

This week’s Wave Watch will provide the best possible case for why the final advance could potentially be beginning. We also explore time and price targets according to Elliott Wave Principle concepts.

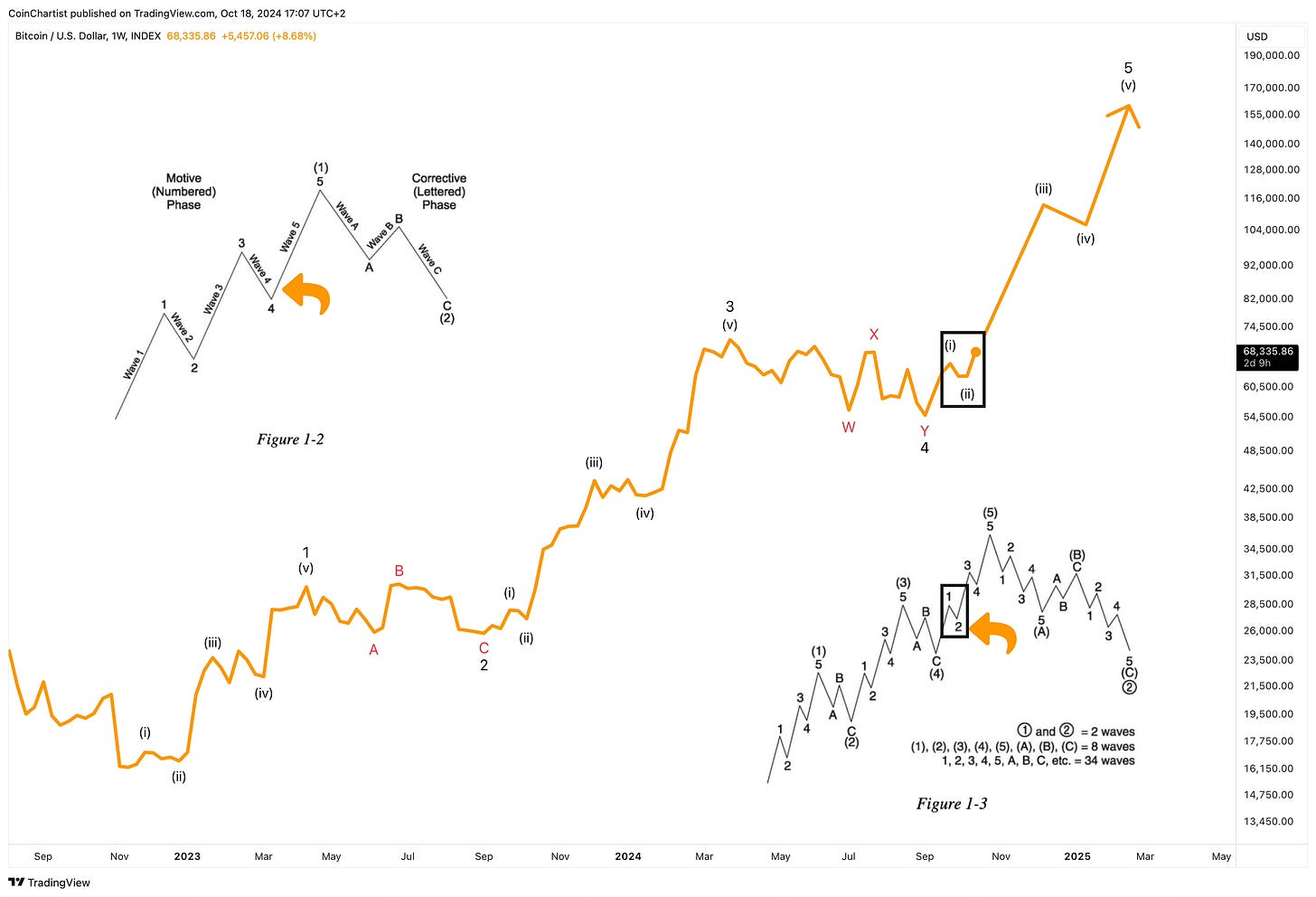

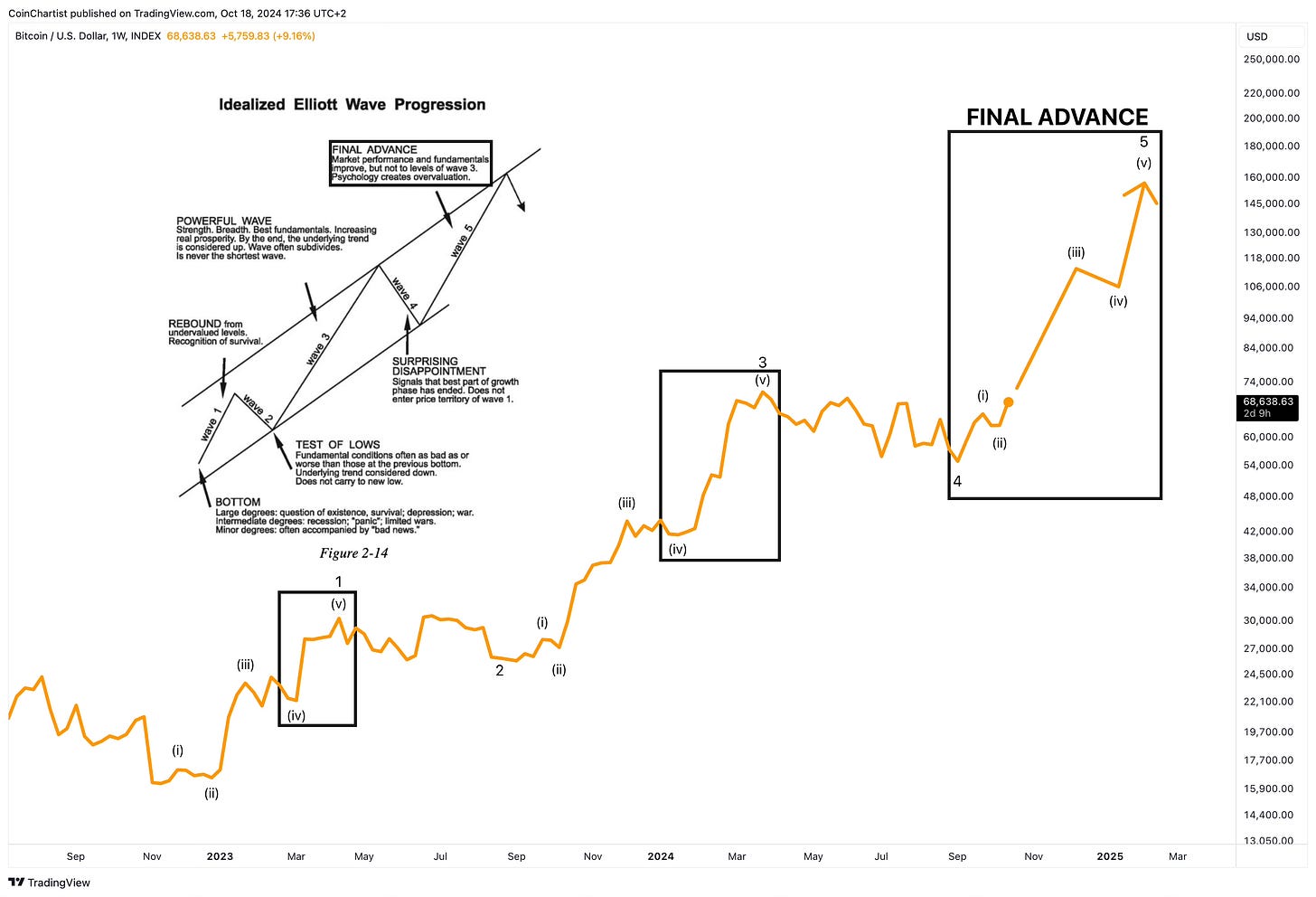

This Bitcoin line chart allows us to ignore wicks and give a proper Elliott Wave count. The upper left-hand corner diagram shows where we are in the larger five-wave bull market, while the lower-right corner provides a zoomed in look representing where we are in what is potentially the final advance.

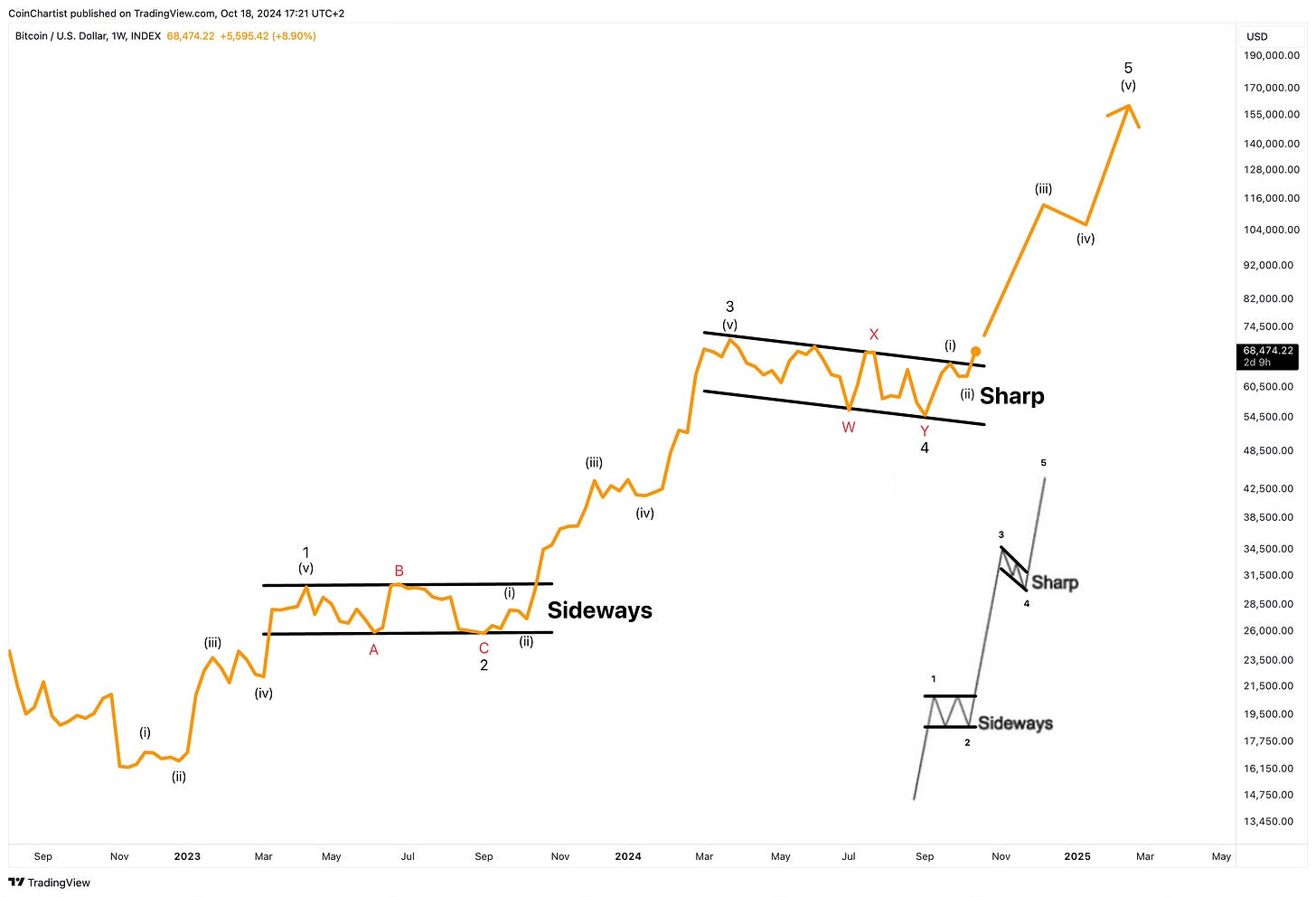

The diagram shows that, according to Elliott Wave Principle, markets move up in five distinct waves. Waves 1, 3, and 5 move with the primary trend (up), while waves 2 and 4 correct the trend. Elliott Wave Principle offers a guideline to tell where we are in an uptrend (also called a motive wave). The guideline of alternation says that wave 2 and 4 will alternate between sideways and sharp corrections. Although the last six or seven months sure felt like sideways behavior, the slope of the correction was downward, while 2023’s correction was indeed sideways. Bitcoin’s path thus far almost precisely matches the diagram.

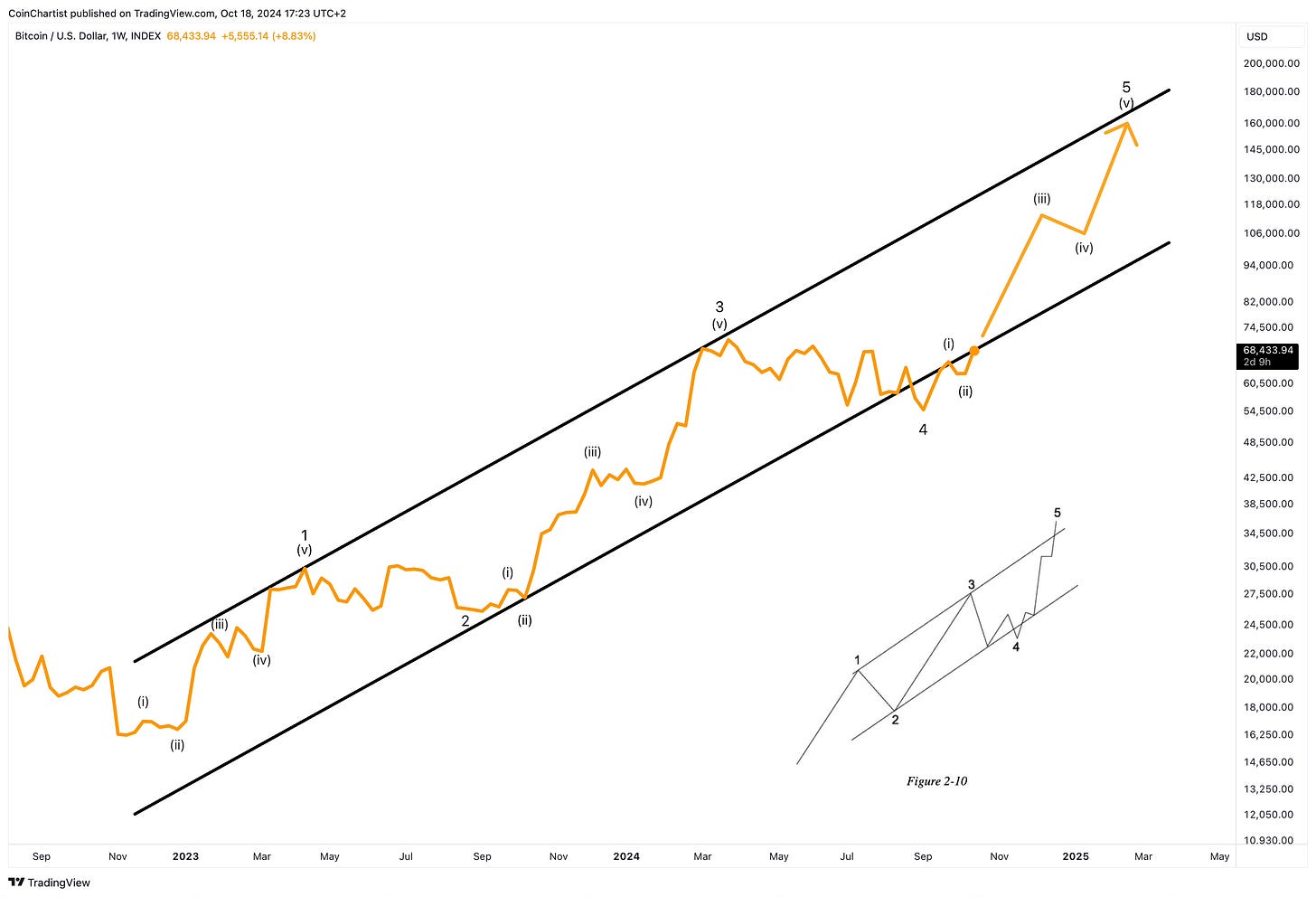

Covered in past issues, the “Wall of Worry” is still valuable to observe, even though the lower boundary has been broken through. If wave 4 terminates below the lower boundary as an “throw-under”, it increases the chances of a swift reversal back into the channel, culminating in a “throw-over.” Price is currently at the lower boundary. A couple thousand dollars more and Bitcoin will be back in the channel.

While we can’t be 100% certain yet that wave 4 has ended, the sentiment around the last six to seven months accurately reflects the expectations around wave 4 corrections. Wave 4s are referred to as “surprising disappointment". A past issue was dedicated to this idea if you’d like to learn more. Essentially, wave 4s can be somewhat easy to spot because they alternate from the last correction of the same degree (covered above) and they tend to trend sideways. Market participants are expecting much higher price targets, when a wave 4 begins, causing this surprise disappointment. BTC struggling with resistance from three years ago was certainly a cause for surprising disappointment.

If wave 4 is indeed over, the final advance (wave 5) should be already underway. The correction two weeks ago holding a higher low could be a sub-wave i of v. If that’s the case, wave iii of 5 should be beginning, which will likely be the longest and strongest of all sub-waves. The psychology surrounding a wave 5 causes extreme overvaluation (due to euphoria and FOMO) that ultimately causes a cyclical peak and a switch to a bear market.

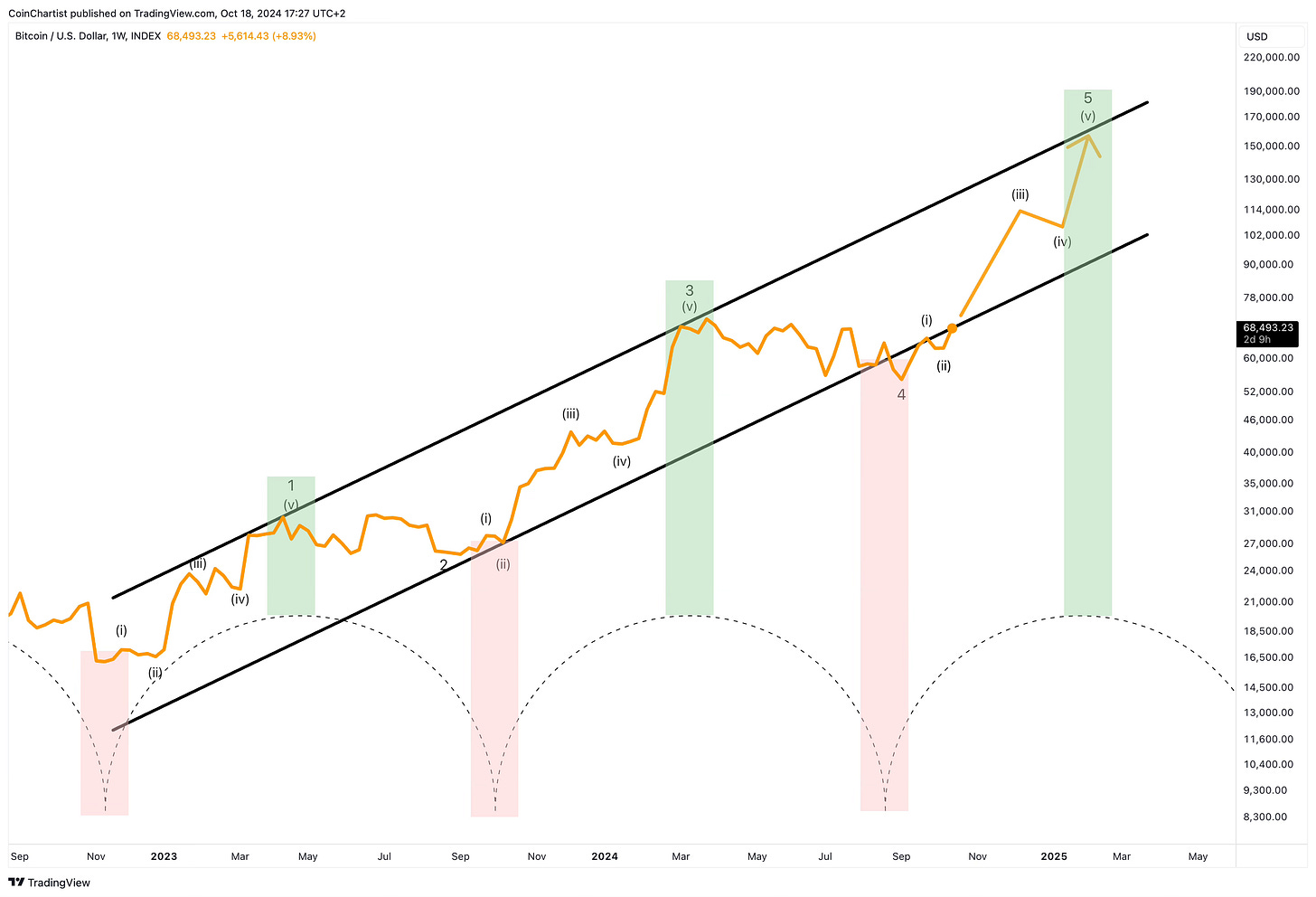

If the final advance has begun, when might it be all over? Market timing is a lot more difficult than calling price targets. Both are extremely difficult to get right with accuracy. However, cycle theory could suggest that Bitcoin tops out around Q1 2025. Note how the green highlighted box extends from the top of each cyclical crest. The red highlighted boxes instead extend down to each cyclical trough in perfect harmony. In fact, each rounded structure is potentially a 1/3 harmonic of a larger cycle.

Last, but probably what everyone reading is most interested in: price targets. While I have long looked toward $160,000 per BTC to be my cycle top target, I am extending this higher to $180,000. According to Elliott Wave Principle, if wave 5 is to be extended, then it usually reaches 161.8% of waves 1 and 3 combined. $180,000 is the 1.618 Fibonacci extension of the full length of wave 1 and 3. It also coincides with the top of the “Wall of Worry” uptrend channel.

ATTENTION: If you’re interested in learning Elliott Wave Principle yourself, or even fact-checking my work, my partners at Elliott Wave International are offering FREE instant access to a 30-minute guide to Elliott Wave Principle. It covers all of the most important concepts, patterns, rules, guidelines, and more – all for no cost.

Click on the book below for instant access or click here:

If Bitcoin’s wave 4 correction is coming to an end this October, let’s compare technical signals across the current setup and last October.

To begin, Bitcoin is working on the same golden cross of the 50-day Moving Average and the 200-day Moving Average. It BTCUSD continues higher or stays at current levels for the next week or two, it should be enough to cause the golden cross on the daily.

Although the LMACD was covered extensively in the Special Spotlight section, I wanted to separately highlight how the LMACD is turning up at the same exact level as October 2023. Pay attention to the immediate strength and upside that followed. It is important to note that Bitcoin needs to close the weekly session at $68,000 or higher for this bullish crossover to confirm. It is also worth being cautious for now, because bears could fight hard to uncross the signal in next week’s session.

After turning off the Ichimoku Cloud and removing the Chikou Span we have a clearer view of the Tenkan-sen and Kijun-sen, which are crossing bullish with the latest price action. This same crossover occurred just before last October’s bullish impulse higher.

Although it doesn’t look like much, a higher high on the RSI after a low is made is a buy signal. This is even more effective if the RSI falls into oversold territory but since this is mid-bull cycle, we won’t see such oversold levels on the RSI. Note the same higher high buy signal last October and how this is once again happening alongside a large white candlestick.

The Stochastic is also rising into overbought territory, which is ironically its most bullish zone where we see the most corresponding strength in Bitcoin. Ideally, the Stoch hovers above 80 and remains there for the next two-to-three months minimum.

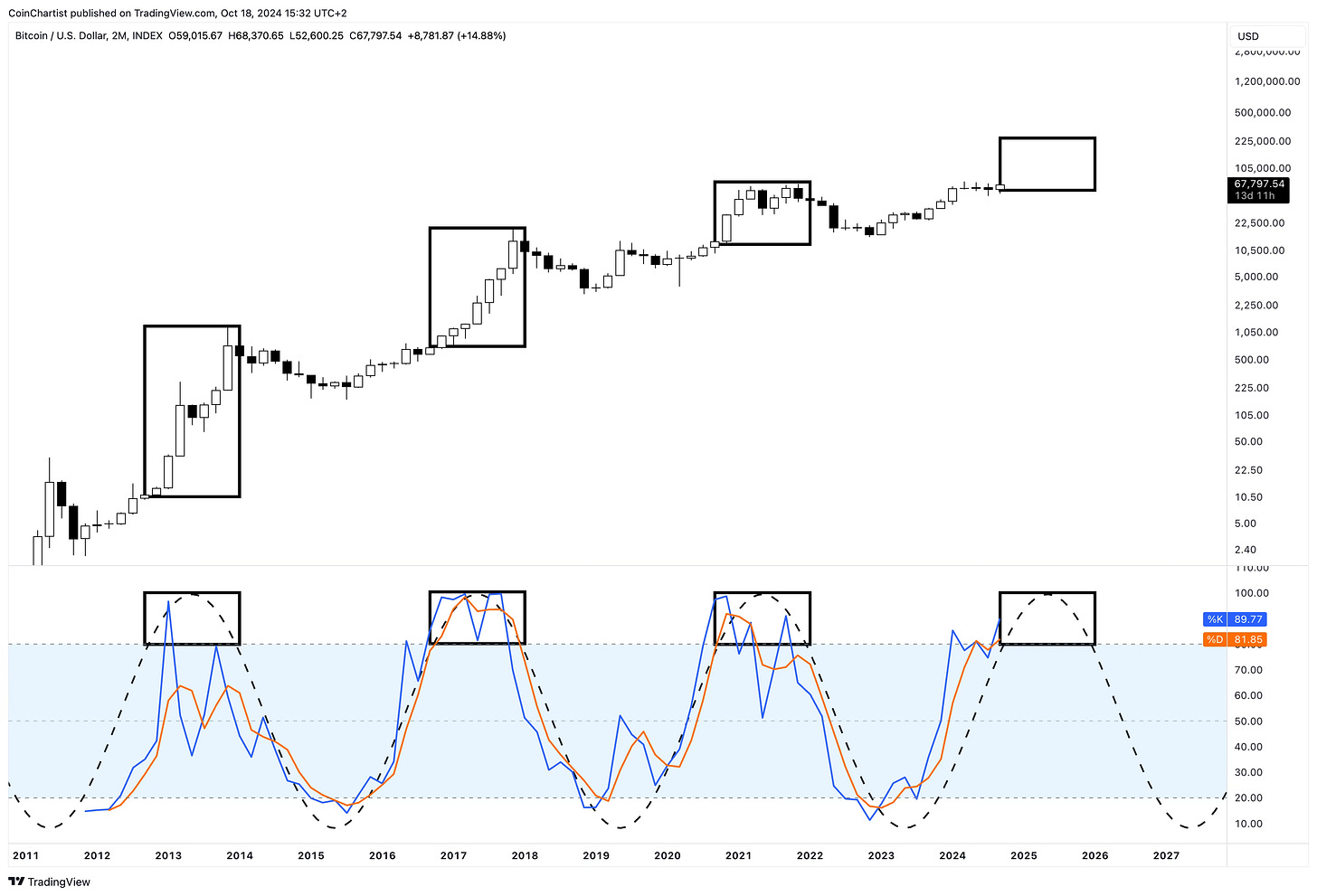

Using Sine Waves on the 2M Stochastic we can see the cyclical behavior of Bitcoin beginning to reach its strongest phase historically. The Stoch is starting to enter the bull zone above 80 on the two-month timeframe, and is ready for a big move if history repeats.

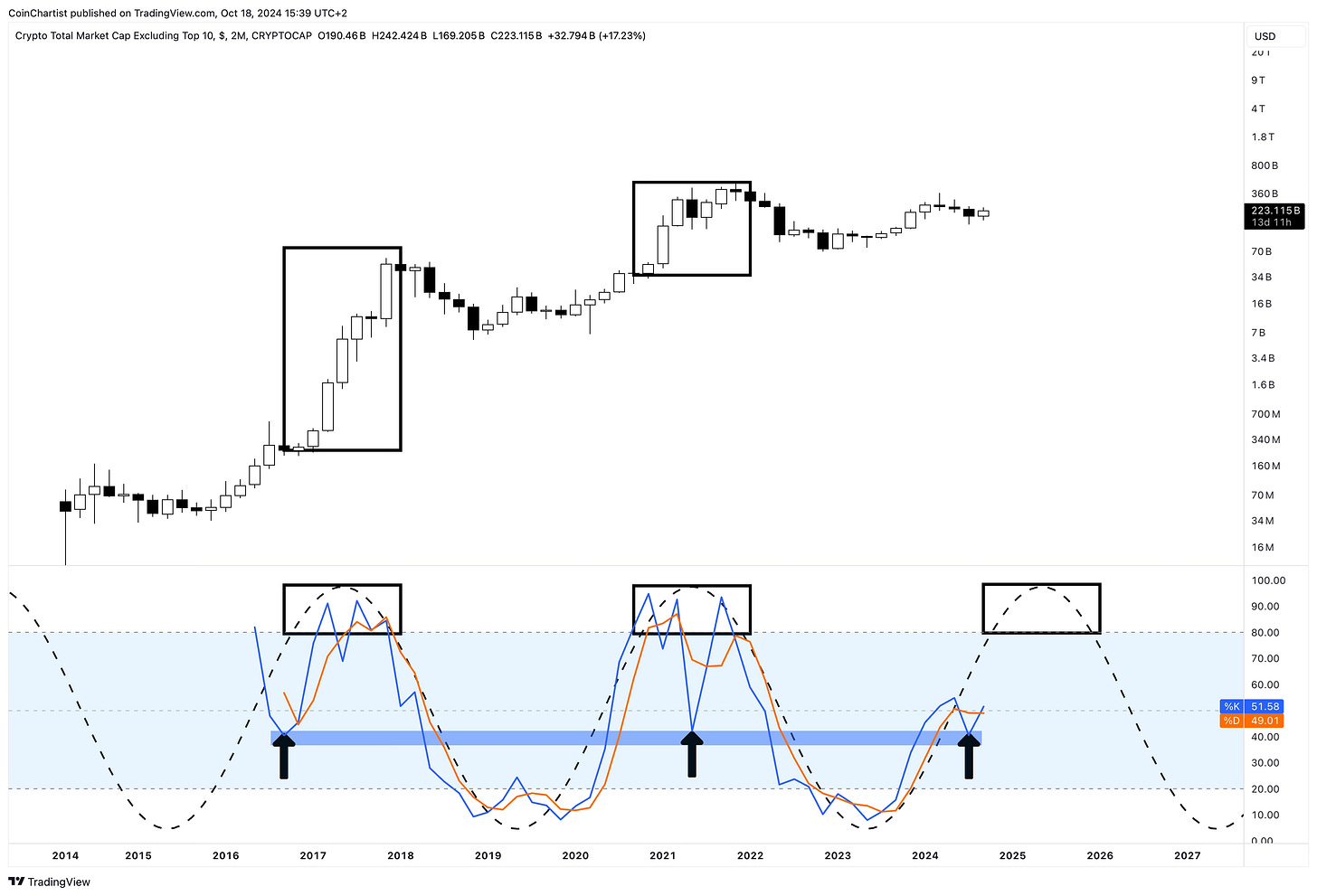

Altcoins are starting to once again show signs of life, especially around memes and other select categories. A widespread alt season still feels like an impossibility at this point, but that could also be the point at which things turn around. Rather than look at low timeframe charts for alts, we’re examining the cyclical behavior of various altcoin charts using the Stochastic you just saw work effectively on Bitcoin.

First, we are looking at Others, which is a TradingView aggregate of all altcoins outside of the top ten coins by market cap. This excludes the likes of Bitcoin, Ethereum, Solana, and more. Much like BTC, the 2M Stochastic hints at recurring cyclical behavior. Interestingly, the Stoch is crossing upward at a level that has resulted in continuation during past cycles. Stoch is also pushing above a reading of 50, which means the trend is strengthening.

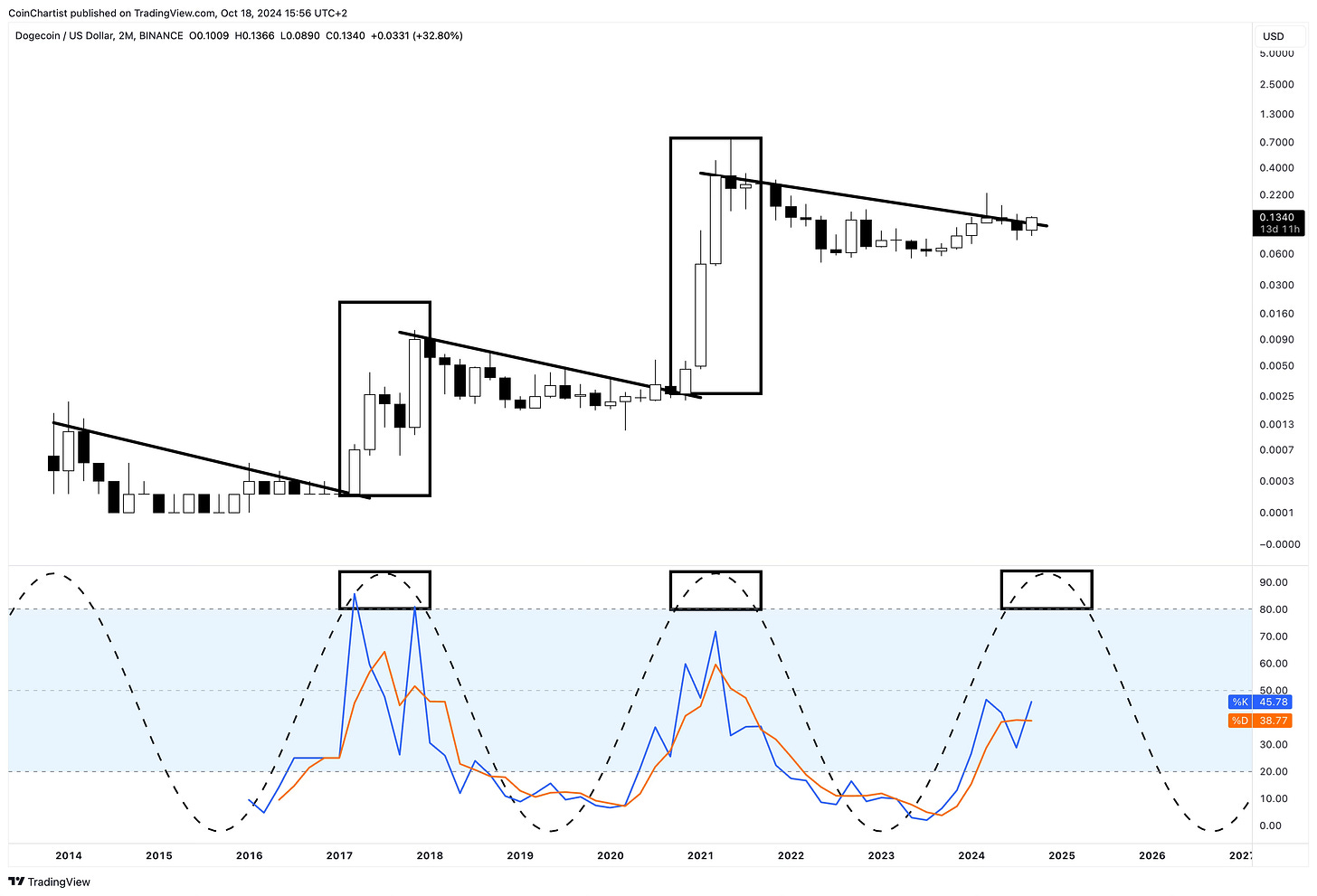

Dogecoin’s cyclical swings using the Stochastic are less pronounced, despite last cycle’s breakout resulting in a 29,000% surge. Dogecoin is once again breaking out of downtrend resistance, just as the Stoch crosses bullish and approaches the 50 level on the indicator.

Despite a vastly different look, Litecoin’s Stochastic patterns closely mimic that of the Others chart we started with. Litecoin has a lower reading, hence the more subdued price action. However, that appears to be changing as LTC flips bullish on the 2M Stoch.

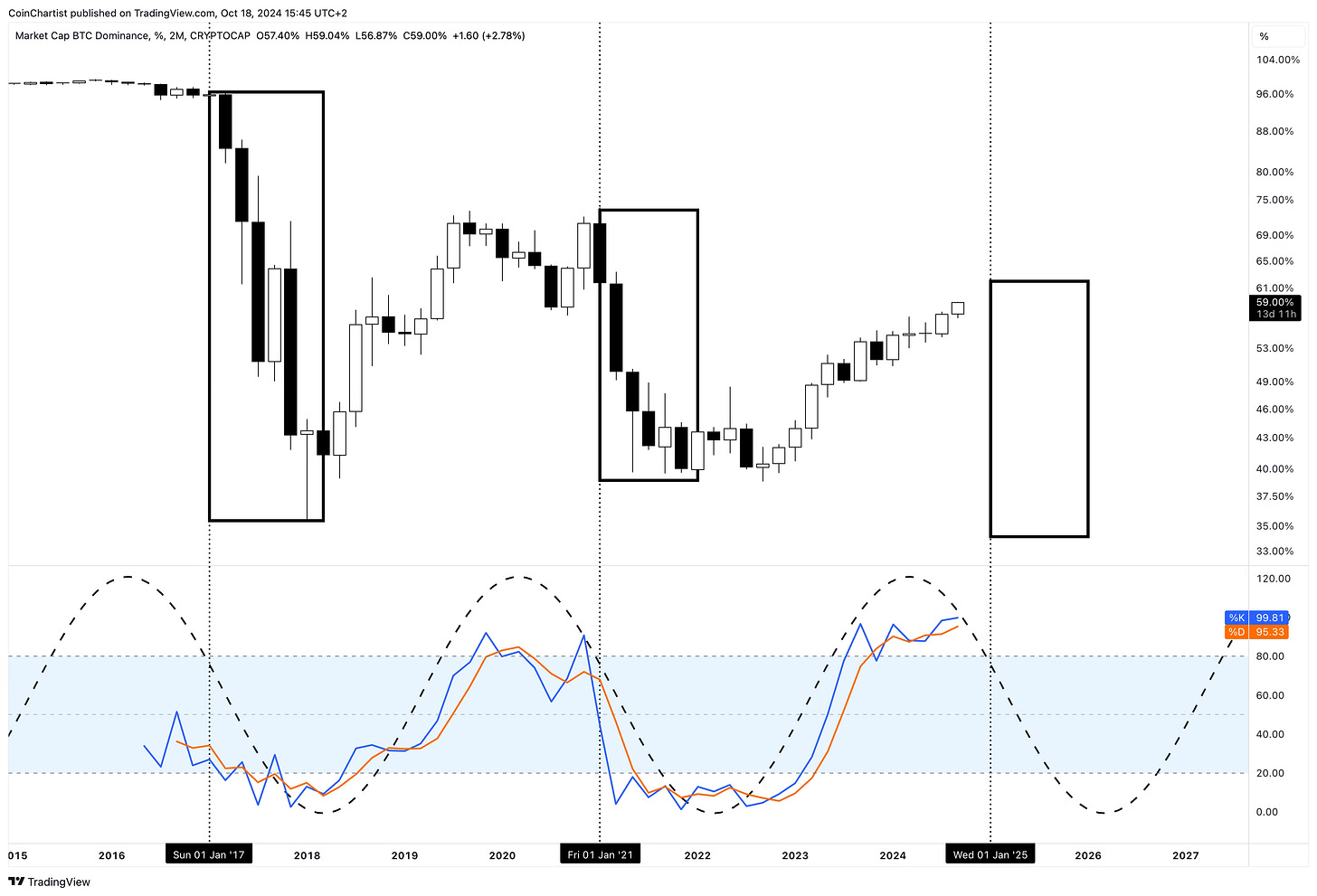

Even Bitcoin Dominance exhibits some cyclical action using Sine Waves on the Stochastic. Based on BTC.D’s current upside strength and cyclical behavior, altcoin season might not start until Q1 2025.

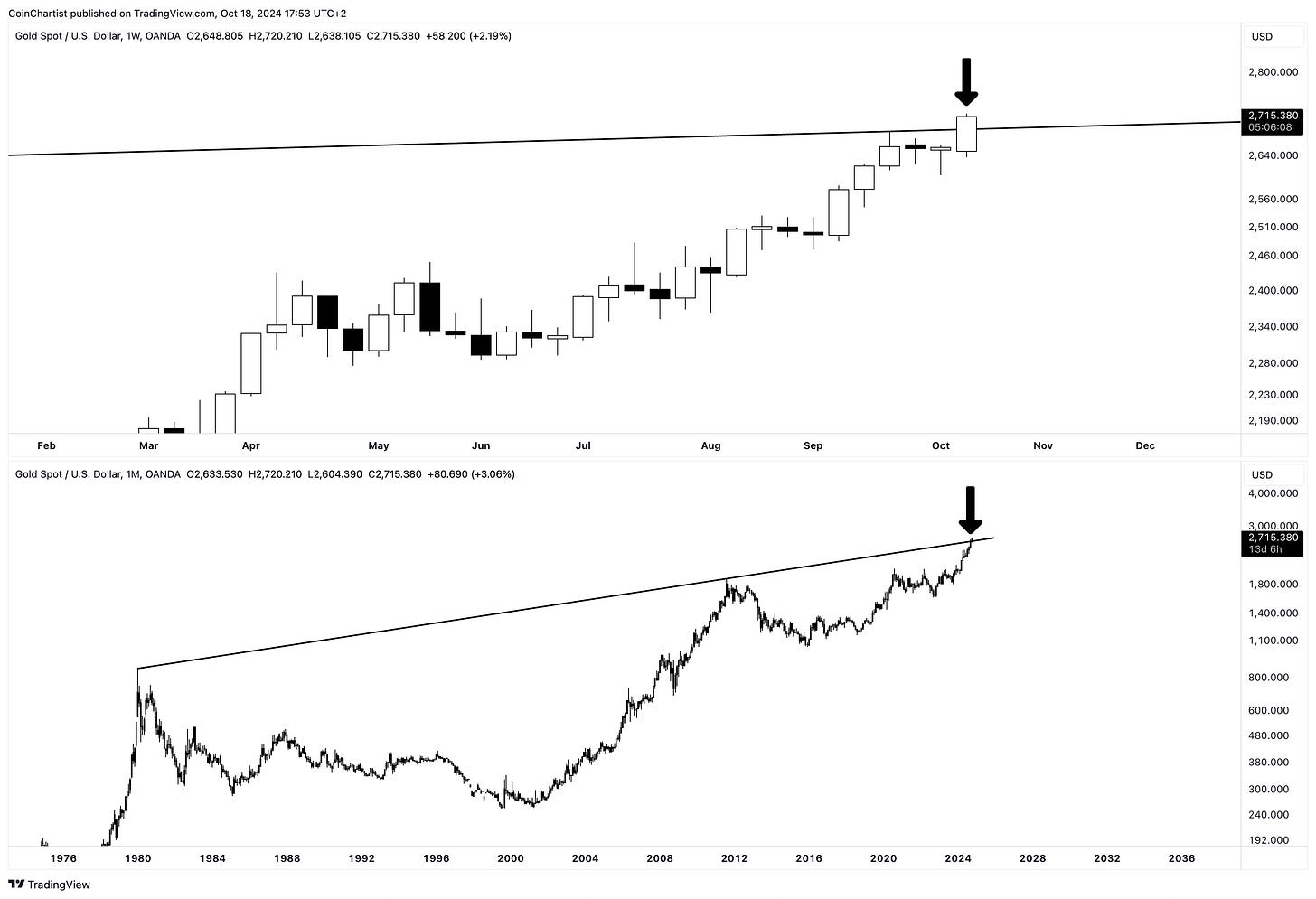

Cryptocurrencies have woefully underperformed over the last six to seven months next to Gold. Silver has lagged behind Gold but its chart looks primed for a big breakout. The below analysis shows how a peak in Gold could benefit Bitcoin, and Silver starting to move could give altcoins a big boost.

Gold could potentially be closing in on its near-term top, now that it is currently above a more than 40-year-old trend line. The top portion of the chart shows the current weekly candle and its reaction to this trend line.

Gold can clearly be seen with an upward trajectory for most of 2024, while Bitcoin started out strong, then moved into a local downtrend channel. This disparity has caused Bitcoin to struggle against Gold on the BTCUSD/XAUUSD ratio. Also note that this ratio didn’t make a new all-time high. This means Bitcoin hasn’t made a new all-time high against Gold due to Gold’s ongoing strength. However, the relationship between these two assets is starting to reverse.

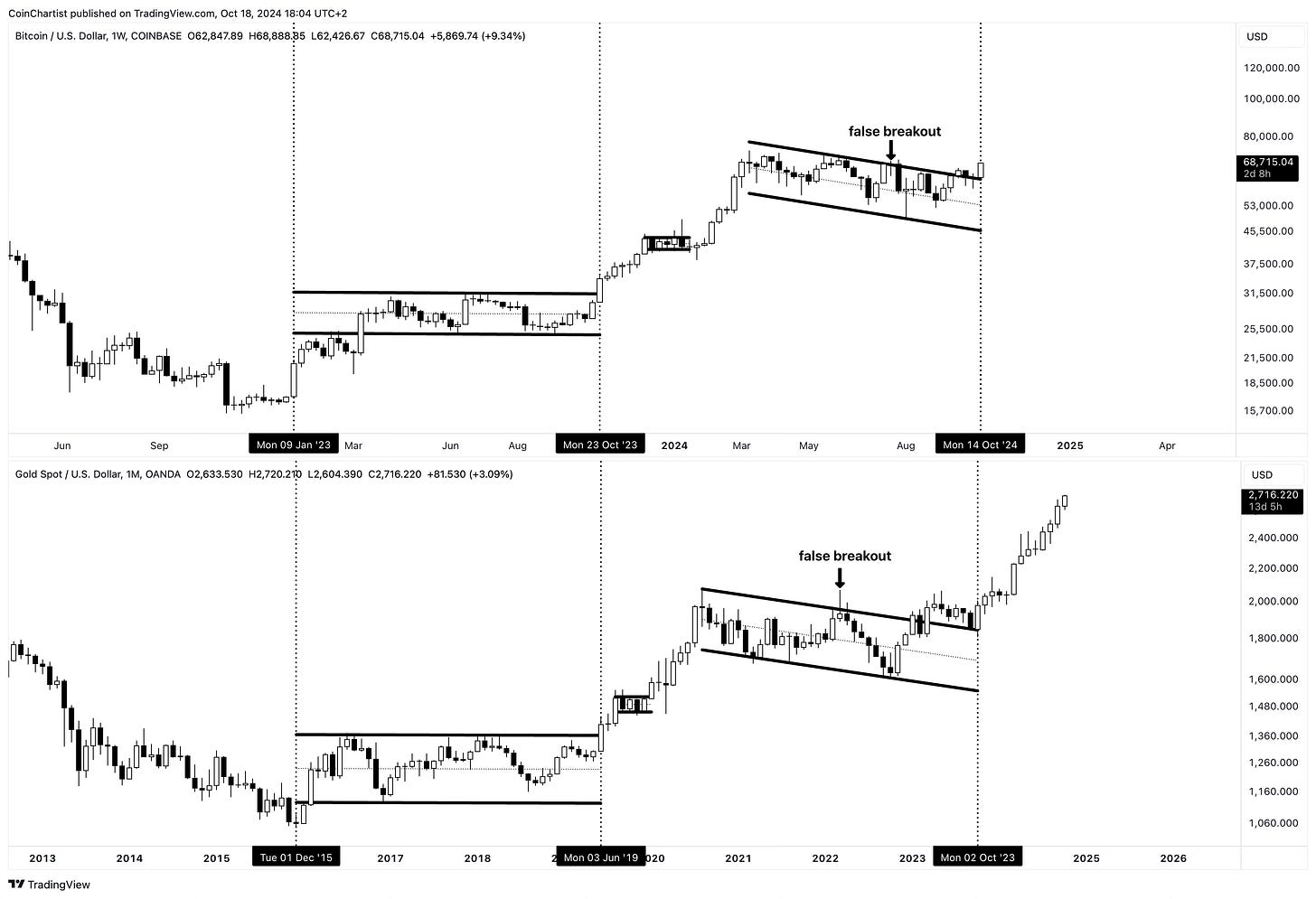

Although Gold has performed better than Bitcoin in the last six to seven months, it could be Bitcoin’s turn according to a fractal of Gold. Gold’s chart takes place across a full decade, while BTC’s chart runs from June 2022 to now. Both assets made a wave 2 sideways correction followed by a wave 4 sharp correction. The impulses leading up to each correction are also similar in behavior. If this similar price action continues, Bitcoin is preparing for a phenomenal Q4.

Much like Gold is ahead of Bitcoin by about a quarter of a year when comparing crypto’s trajectory, Silver is also potentially leading altcoins and about to lead them higher.

Silver hasn’t performed as strongly as Gold, but neither have altcoins against Bitcoin. This oddly similar relationship across Gold and Digital Gold, then Silver and shitcoins could continue. And if it does, Silver could be telling us that altcoins are almost ready to move. Keep a close eye on Silver throughout Q4. If it explodes higher, it might be hinting at what will happen next in crypto.

Closing thoughts: Especially in Bitcoin, technicals are turning up and price is reacting. BTCUSD is above $68,000 per coin as I write this closing. If Bitcoin can maintain this trajectory, the final advance should begin. Because so many people expecting this to be the top or expected new lows, many will be caught off guard and have to chase prices higher leading to overvaluation and a peak. Altcoins perform best historically as Bitcoin approaches its finale, so the timing of altcoins coming alive makes sense. Continue to watch the behavior in precious metals as a potential preview of what’s to come across crypto.

Thank you for being a CoinChartist VIP premium subscriber.

Remember to leave a comment, hit like, or restack this content.

Please feel free to contact us with any issues or inquiries by emailing coinchartist@gmail.com.

-Tony “The Bull” Severino, CMT

best one so far :)

Thanks Tony! You were one of the only people that pointed out the possibility for a longer wave 4 correction, which I didnt believe in but came out as correct in the end. This is why I'm subbed to your substack!