#56 | The Trump Trade

Trump taking office in 2017 led to a historic bull market in crypto – will history repeat?

Disclaimer: The information provided in this Substack newsletter is for general informational purposes only and should not be considered as financial advice. Investing involves risk, and past performance is not indicative of future results. Please conduct your own research or consult a financial advisor before making any investment decisions. The newsletter disclaims any liability for losses or damages arising from the use of this information.

#56 overview:

Could Bitcoin repeat a 2016/2017-style rally in 2024/2025 with Trump reelected?

Last week’s false breakout in Bitcoin is redeemed this week as BTC makes new all-time highs – what next?

Ethereum before and after – are altcoins saved from certain doom?

Updated wave counts, the Wall of Worry, and a long-term look

Ratio analysis: Gold versus Bitcoin and the stock market versus Bitcoin

A lesson on the Relative Strength Index, crypto, and overbought levels

Following Trump’s win in the US Presidential race, Bitcoin set a new all-time high and many altcoins posted double-digit intraday gains. Altcoin charts that were once suggesting danger ahead, might now point toward a successful retest of high timeframe support. This issue analyzes the breakout in Bitcoin, the possible revival in altcoins, and speculates about how a second Trump term might impact the crypto market.

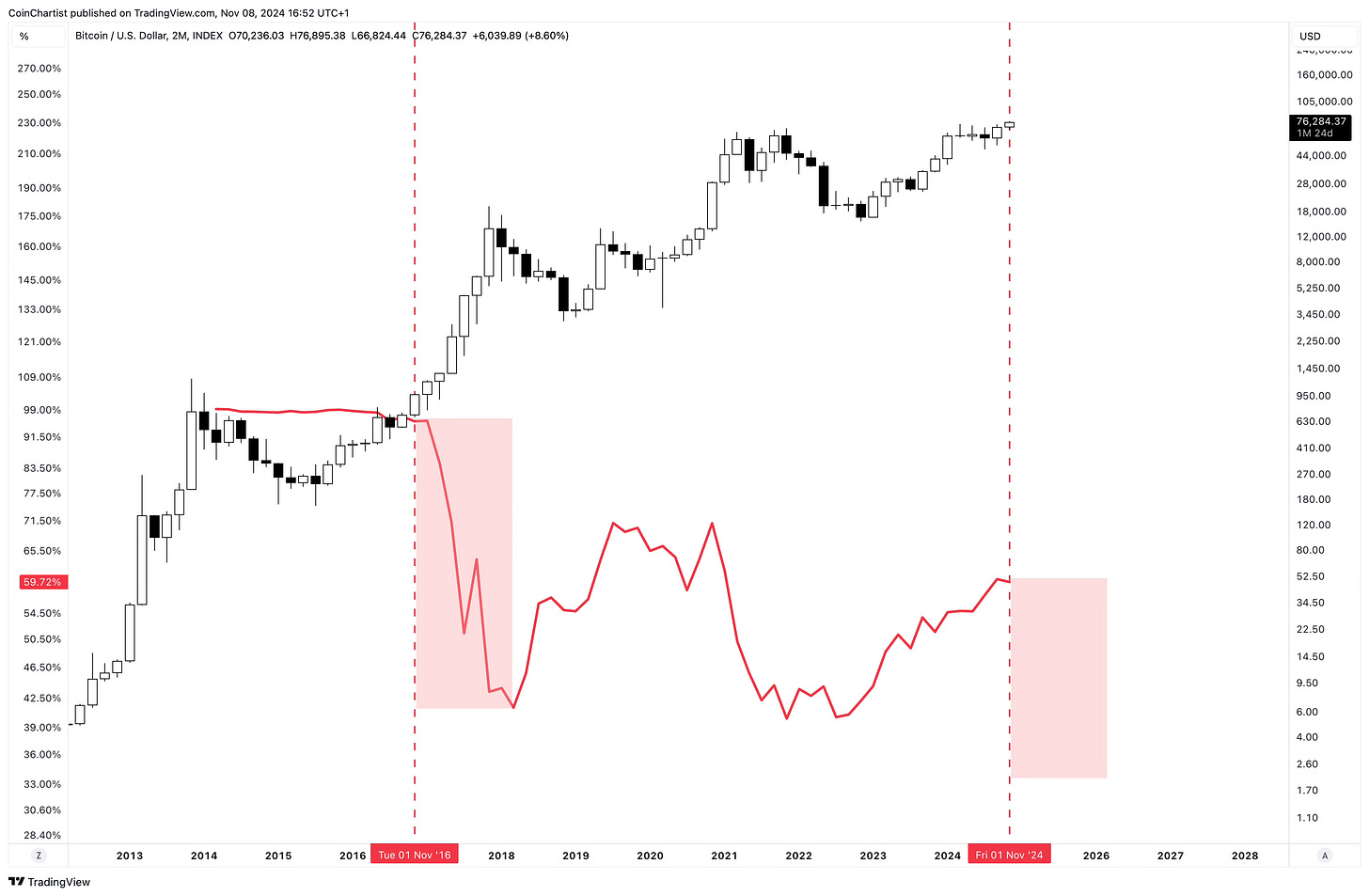

Trump was the pro-crypto candidate, so the reaction we’ve seen in Bitcoin and altcoins isn’t overly surprising now that he’s won the election. Prior to the election, several charts went around that showed how Bitcoin historically rallied into a bull market following the election. But what about looking at specifically what happened the last time Trump won the White House?

Seven years ago now, Bitcoin traded near $20,000 and it became a household name. But the rally first began in 2015, picked up steam in 2016, and then went into overdrive in 2017 following November 2016’s election. Eight year’s after Trump’s first win, he’s taken the White House once again during a Bitcoin cycle that’s most often been compared to 2016/2017’s bull market. Could we see an accelerating bull trend now that the election angst is behind us and Trump’s pro-crypto politics on the horizon? Technicals explored later in this issue support the idea. But beware – I sense that the market is ready to become euphoric extremely fast.

With a clean break above $75,000, Bitcoin very well could finally make its move toward $100,000 per coin. Much like when Bitcoin reached nearly $20,000, it made headlines and shocked the world. It will again when it makes it above $100,000. Back in 2017, the media publicity caused the public to pour their money into altcoins in search of the next Bitcoin. The chart above shows Bitcoin Dominance below the standard BTCUSD chart, highlighting what happened after the last Trump victory. Could the altcoin season we’ve been waiting for finally be here?

Although Bitcoin and Ethereum set new all-time highs in 2020 and 2021, certain coins like XRP did not. The last time XRP saw a true bull market move, happened to be just after Trump won the 2016 election.

The same could be said about Litecoin. It had a muted rally in 2020 and 2021, but could be ready for redemption now that a red wave took over the White House.

Ethereum did make a new all-time high in 2020 and 2021, but its best performance happened following a Trump win in 2016. Keep reading to get a read on technicals that potentially support the above speculation.

Keep reading with a 7-day free trial

Subscribe to CoinChartist to keep reading this post and get 7 days of free access to the full post archives.