#57 | New Paradigm

Don't be fooled by the promise of a new paradigm, Bitcoin might be a lot closer to topping than you think.

Disclaimer: The information provided in this Substack newsletter is for general informational purposes only and should not be considered as financial advice. Investing involves risk, and past performance is not indicative of future results. Please conduct your own research or consult a financial advisor before making any investment decisions. The newsletter disclaims any liability for losses or damages arising from the use of this information.

#57 overview:

Why Trump’s pro-crypto policies and US strategic BTC reserves won’t lead to a “new paradigm”

A look at the cyclical nature of euphoria in Bitcoin

Updated wave counts reveal a shocking chart that shows just how close Bitcoin could be to topping

BTC.D gives clear signals: Altcoin season could finally be beginning

Bitcoin’s time is almost up, but price has a lot more room to run higher

Top signals in the S&P 500 plus trend exhaustion in the DXY hinting at USD weakness

A “new paradigm” in financial markets refers to a significant event that is expected to vastly change market conditions for the foreseeable future. This can be the introduction of a new technology, an economic event, etc. The event appears so important to the affected market, market participants are easily blinded by the related euphoria and hype. This is precisely why you’ll find the “new paradigm” phrase at the very top of the market cycle, at the end of the mania phase.

A new paradigm comes on quickly the moment media attention begins. After the media catches on, enthusiasm begins to build. The public, or so-called “normies” or “retail,” begin to participate actively. Their enthusiasm turns into greed, then delusion, followed by the expectation of this new paradigm to take over. While I am simply taking an educated guess along with everyone else who invests, trades, or watches markets, please use this issue’s content to stop and think about the mass psychology associated with everything I am suggesting for a narrative, then consider how the narrative lines up with the technicals.

When it comes to this cryptocurrency market cycle, the narrative to cause a market-wide takeoff has inarguably been Trump winning the Presidential race. The night before he was declared the winner, Bitcoin broke out of resistance and promptly rallied to just under $100,000. That’s because Trump had been the most pro-crypto candidate, planning to give SEC chairman Gary Gensler the boot and set up the first ever United States strategic Bitcoin reserve.

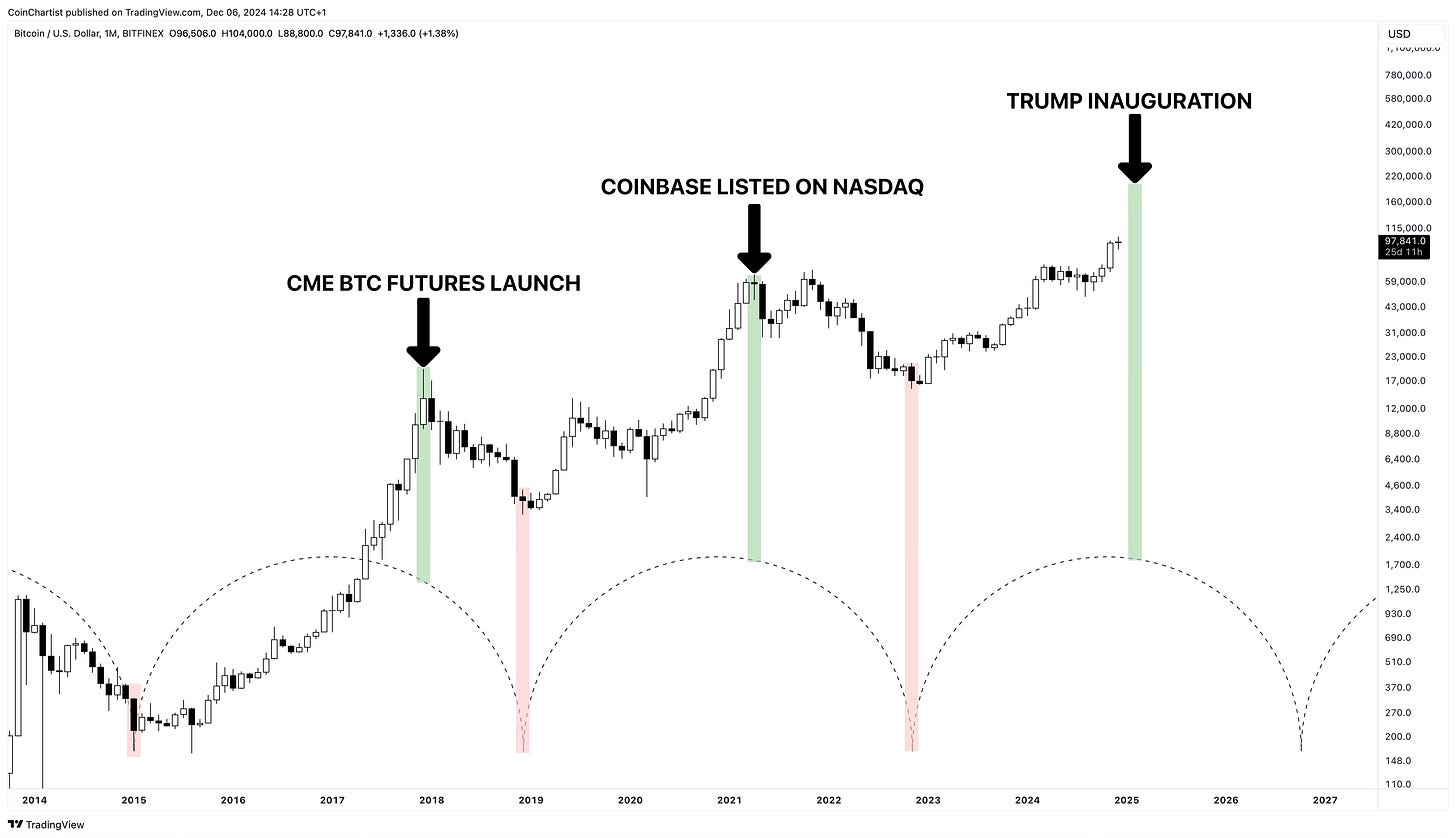

Trump’s pro-crypto world is our new paradigm this time around. With Bitcoin bullish again and recently making it above $100,000, and the US buying 200,000 BTC per year on the horizon, market participants cannot imagine a scenario where Bitcoin doesn’t keep on climbing well into 2025 and beyond. But consider the fact that Efficient Market Hypothesis says that the market is forward-looking and prices in all information the moment is available. This to me suggests that the market has already been pricing in Trump’s future policies and the strategic BTC reserves. When Trump finally takes office, this “new paradigm” could create the perfect atmosphere of euphoria and a cyclical peak. The point of the chart above is to provide examples of the last two times I recall the term “new paradigm” being used regularly – both of which became cyclical peaks. When CME Futures were about to launch, the fact that institutions could now have exposure to anything Bitcoin was said to bring a tsunami of capital. Instead it kicked off a bear market. Next, Coinbase going public on the stock market at the time caused everyone to think Bitcoin would easily cruise to $100,000 as crypto as an industry was given a stamp of approval and legitimacy it never had before. Once again, it was a cyclical peak. With Trump’s polices expected to create a new paradigm once again, it could be time for Bitcoin and other coins to put in a top.

A solid narrative is enough to convince most people. I bet if you’ve read this far, I’m making some sense. But what most narratives don’t have is evidence to support the claims. In the chart above, we can see that cyclical behavior has caused Bitcoin to put in a trough or bottom right at the same point in a recurring fashion. Cycles typically peak at the center point of each crest, but cycle peaks and troughs can be left- or right-translated. Which is just a fancy way of saying they’re a little bit off. One principle in Hurst Cycle Theory is to never expect cyclical perfection. Instead, cyclical peaks have been right-translated to some degree. Bitcoin is currently right at the four-year cycle crest, which suggests a top could happen from now through the end of 2025. But again, I think it comes much sooner.

Cycles always begin from a bottom. And while the launch of CME Futures didn’t cause prices to rise forever, the new paradigm actually came to reality eventually. Institutions did get into Bitcoin during this larger, 12-year cycle that began in late 2018. We can see the major cyclical trough aligned with the four-year cycle trough. We can also see that the second cycle of the ongoing 12-year cycle and the 12-year cycle itself are both at the crest or cycle center-point. This means that that even the larger market cycle is getting exhausted and is going to start turning down. Finally, pay attention to when the larger semi-circle makes its next trough. This alignment suggests we might not see the next bear market bottom until late 2030 – our first six-year bear market ever in crypto.

Keep reading with a 7-day free trial

Subscribe to CoinChartist to keep reading this post and get 7 days of free access to the full post archives.