#58 | Presidential Pivot

The market is nowhere close to a cyclical peak, so it is time to pivot our Inauguration Day expectations to alternative theories.

Disclaimer: The information provided in this Substack newsletter is for general informational purposes only and should not be considered as financial advice. Investing involves risk, and past performance is not indicative of future results. Please conduct your own research or consult a financial advisor before making any investment decisions. The newsletter disclaims any liability for losses or damages arising from the use of this information.

#58 overview:

A lengthier correction means no cyclical BTC peak at Inauguration Day

Watching the head and shoulders pattern in Bitcoin — and why it could fail

Bitcoin nowhere near a peak — cyclical top signals reviewed

Explaining why the top is much higher with Elliott Wave “extended fifth of a fifth”

Are low cap altcoins in trouble? A new bearish pattern could favor large caps for now

Macro is back with Bitcoin’s wave extension: S&P 500 and Gold examined

Let’s kick off this issue with low timeframes. Specifically, the head and shoulders pattern the entire market is talking about. This pattern to me feels like bait for those who believe the top in Bitcoin could be in after losing $100,000. Shorts are piling in currently after yet another defense of the neckline. Bitcoin did make a new low and wick below the neckline, but today’s daily candle is above the neckline once again.

Notice there are two versions of Bitcoin in the chart: BTC CME Futures to the left, and BTCUSD to the right. The point of this comparison is to show how the LMACD behavior is different despite similar price charts. Although I missed this a week ago, this was telling us the recent move up that formed the right shoulder was a fake move. The BTCUSD version triggered a bullish crossover and buy signal, while the BTC CME version stayed red and in an active sell signal. The LMACD is at the zero line on the histogram currently, which often acts as a level where the tool begins to turn back in the other direction. As such, a bullish crossover and a failed head and shoulders pattern is still a possibility. I understand that this take on the head and shoulders could appear to include unreasonable bullish bias, however, you don’t usually see a larger right shoulder than the left, and Bitcoin has a habit of busting head and shoulders patterns during uptrends and cruising on higher.

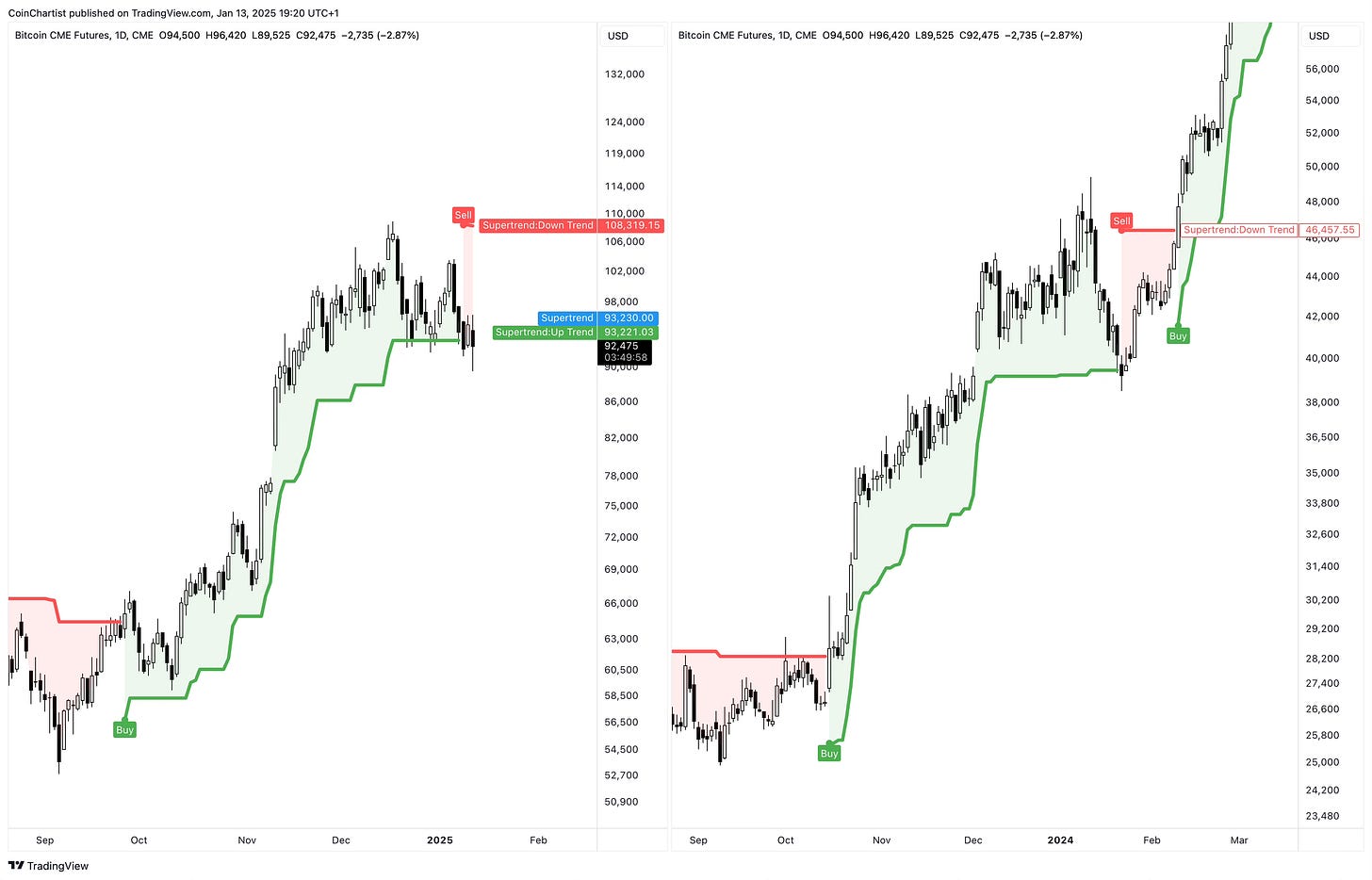

The former then (2024) versus now comparisons from previous issues were done using the BTCUSD chart. While several technicals have since deviated on the BTCUSD chart, on the BTC CME chart they remain very similar, hinting there’s a chance the correction ends with less depth than expected. In this then versus now comparison, the correction ended shortly after the SuperTrend triggered a sell signal. This same signal triggered three daily candles ago – could that be enough downside, similar to back then?

It’s not just the SuperTrend, it’s also the 50-day Moving Average. BTCUSD charts lost this Moving Average last week, while BTC CME is only just losing it now. Perhaps that was necessary before we get the expected bounce.

BTC CME just touched the Ichimoku cloud for the first time today. Last time around, however, price fell fairly deep into it but never touched the bottom of the cloud. The top of the cloud could be the only touch of support that’s needed, or we might need to fall deeper into the cloud before we bottom.

This comparison of the LMACD and RSI also potentially suggests there’s more selling ahead. In 2024, the RSI reached as low as 38 before bouncing. Today, BTC CME is at 45 on the RSI. The LMACD also swept just below the zero line on the histogram into negative. This is only just starting to happen today.

The last comparison between now and 2024 could hint at the breakaway gap needing to be filled before price continues higher toward new ATHs. In 2024, the gap was filled, with the bottom of the rising window acting as support. Today, a breakaway gap much lower remains unfilled, making for a juicy target for bears. This could point to price reaching as low as $77,000.

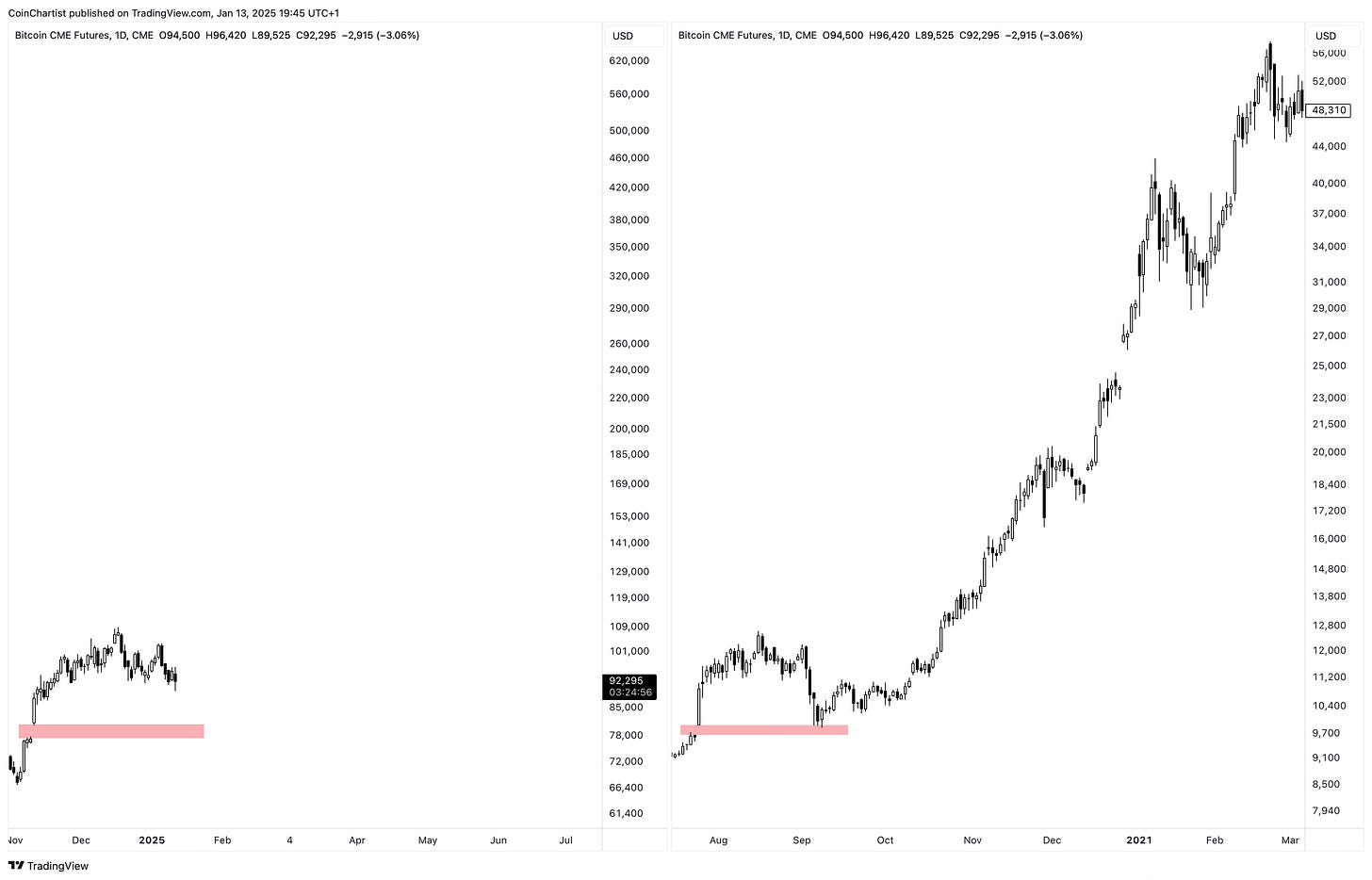

I did, however, discover this other comparison to Bitcoin in 2020, just before the big bull run. This idea could potentially play into the alternative Elliott Wave count and updated cycle theory that I explore later in this issue, so keep it in mind.

Interestingly, the LMACD and RSI are showing similar technicals readings and behaviors as back then. It is worth noting that even back then, the RSI fell to around 38. As a reminder, BTC is currently at a reading of 45 on the RSI.

It is highly dramatic and I want to be clear I do not expect such a massive sized rally to follow this correction, but I did want to show what happened after this comparison. Again, keep this chart in mind later when I’m explaining the extended fifth of a fifth wave theory in the Wave Watch section of the newsletter.

Summary: In Bitcoin bull markets, head and shoulders patterns often fail, and at the moment, technicals aren’t convincingly bearish. Ultimately, if there is further correction, the bull market will continue when it is finished – we haven’t reached a cyclical peak yet.

“We haven’t reached a cyclical peak yet.” It feels like a bold call, but there is a lot of evidence to support the statement. In this Special Spotlight, I am reviewing several tools that have effectively called past cyclical peaks to highlight that Bitcoin isn’t even close to peaking from a price perspective. As for how much time is left for this to happen, we’ll explore that more later in the Wave Watch section.

Above we have the Pi Cycle Top indicator that has accurately fired at every major cyclical peak. Bitcoin is nowhere near the upper moving average, currently located at $137,000. What’s notable is that BTCUSD has always went above this moving average. The actual signal that suggests a top is in occurs when the two moving averages cross. This could indicate that Bitcoin has a lot more to go price wise, as the averages continue to rise along with price action.

Keep reading with a 7-day free trial

Subscribe to CoinChartist (VIP) to keep reading this post and get 7 days of free access to the full post archives.