Confusing Crossroad

The crypto market looks mixed, making for a confusing situation. This issue attempts to figure it out.

Disclaimer: The information provided in this Substack newsletter is for general informational purposes only and should not be considered as financial advice. Investing involves risk, and past performance is not indicative of future results. Please conduct your own research or consult a financial advisor before making any investment decisions. The newsletter disclaims any liability for losses or damages arising from the use of this information.

Confusing Crossroad overview:

An update on Bitcoin Dominance as we near the monthly close and why it favors altcoins in the near term.

Ethereum makes a new all-time high and technicals look ripe for a major rally.

Chainlink continues to show signs of following Ethereum, and possibly outperforming it.

Despite bullish altcoin setups, Bitcoin isn’t looking so hot - what this could mean for altcoins.

Strategy (MSTR) has turned bearish for the time being. Could this have an impact on Bitcoin – and what about altcoins?

Updated BTCUSD Elliott Wave counts that could explain why all of this is happening according to wave degree.

An alarming stock market chart is making rounds. Check out what it could mean for financial markets – including cryptocurrencies.

If you notice, this issue is late. Admittedly, the direction of the market is some of the least clear I’ve seen in a long time. Bitcoin Dominance has turned over, which should give altcoins a boost. Altcoin charts look primed for more upside, pending buy signals at the end of this month. However, Bitcoin — the primary market driver historically — doesn’t look strong at all. In fact, it is starting to look weak overall. In my eight years watching the crypto market, I have never witnessed a situation where altcoins performed well, but Bitcoin was correcting. To be fair, Bitcoin performing so well and leaving altcoins completely behind is also a relatively new phenomenon, occurring in 2023 and 2024. Could we finally see the opposite — alts doing well while Bitcoin corrects? Or will a weak Bitcoin stop altcoins in their tracks? This issue addresses these key issues and highlights the technicals that support this idea — an idea I am uncomfortable with. My discomfort around this idea is why this issue is late, but the charts are what they are. Please keep this in mind as you read through this issue and be ready for anything.

Diving Dominance

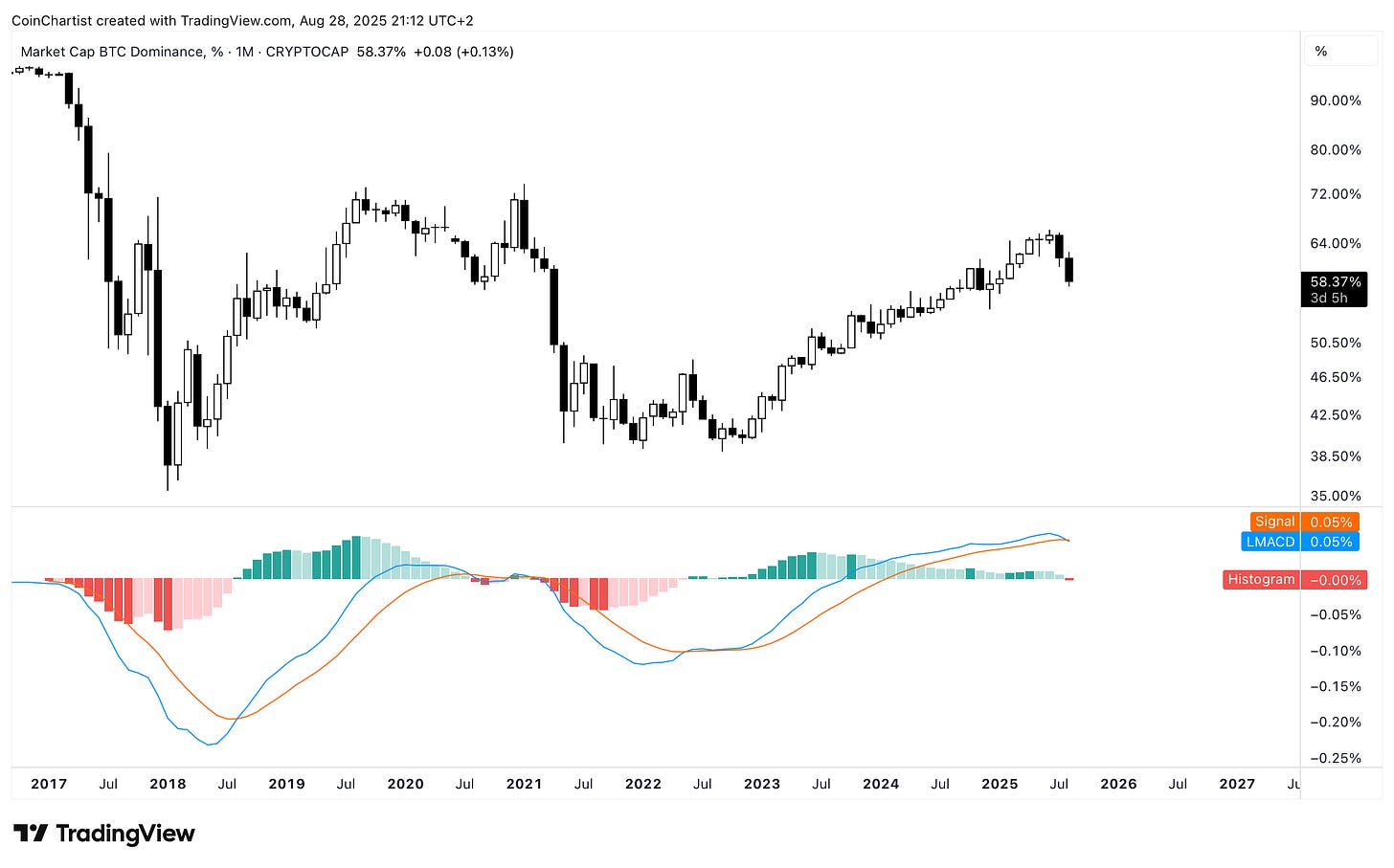

Bitcoin dominance (BTC.D) should confirm some bearish technical signals by the end of the month. These signals tend to be bullish for altcoins as they suggest alts will outperform Bitcoin.

The monthly LMACD has formed a bearish crossover on the monthly after two large black candlesticks. This represents momentum turning over to favor alts.

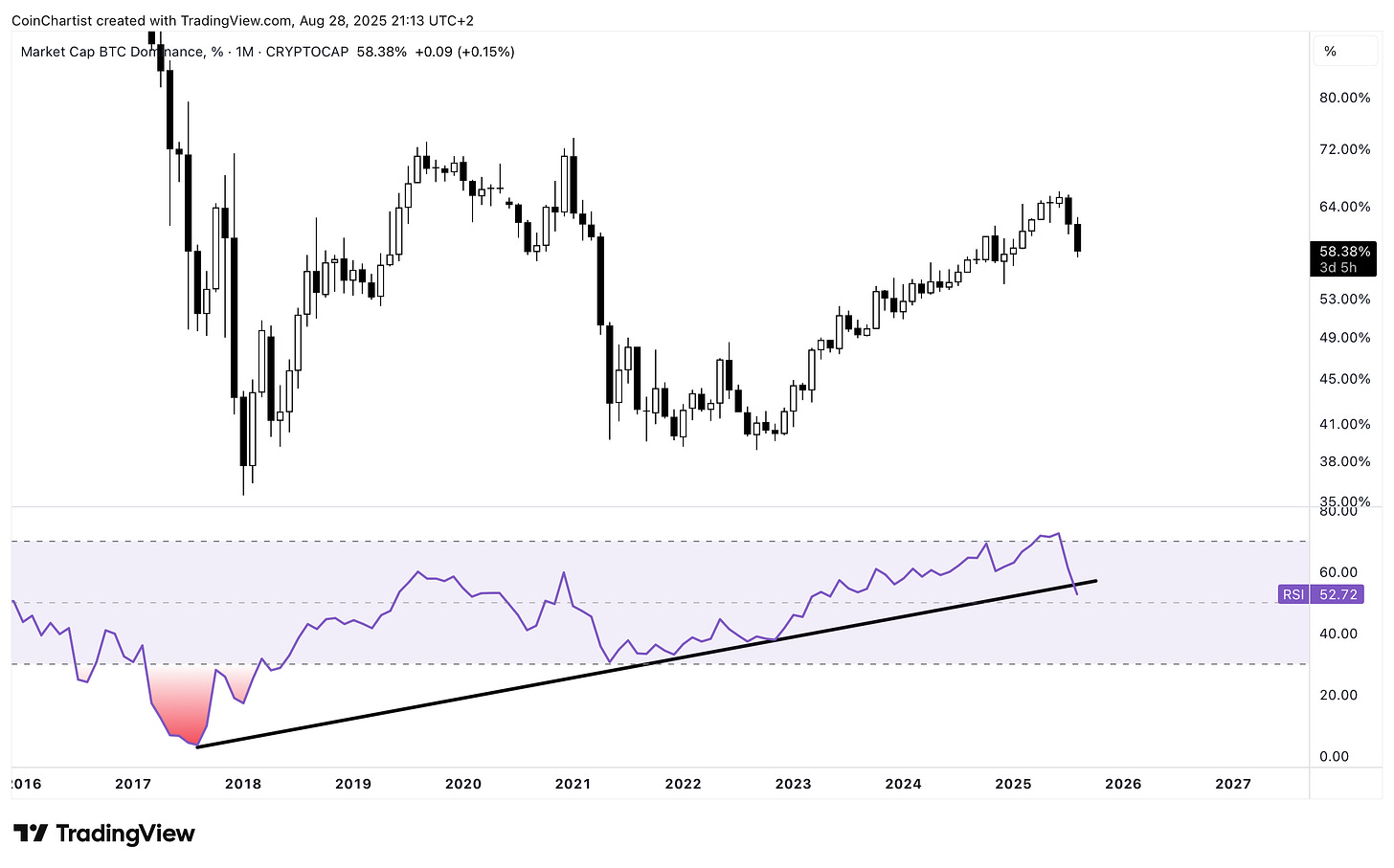

BTC.D has been in an uptrend on the RSI since 2017, taking the indicator all the way into oversold territory above 70. Not only has the RSI fallen well below 70, it is now breaking below a long-term uptrend line.

These signals point to some kind of altcoin season — although it may look different than what we’ve seen in the past.

Ethereum All-Time High

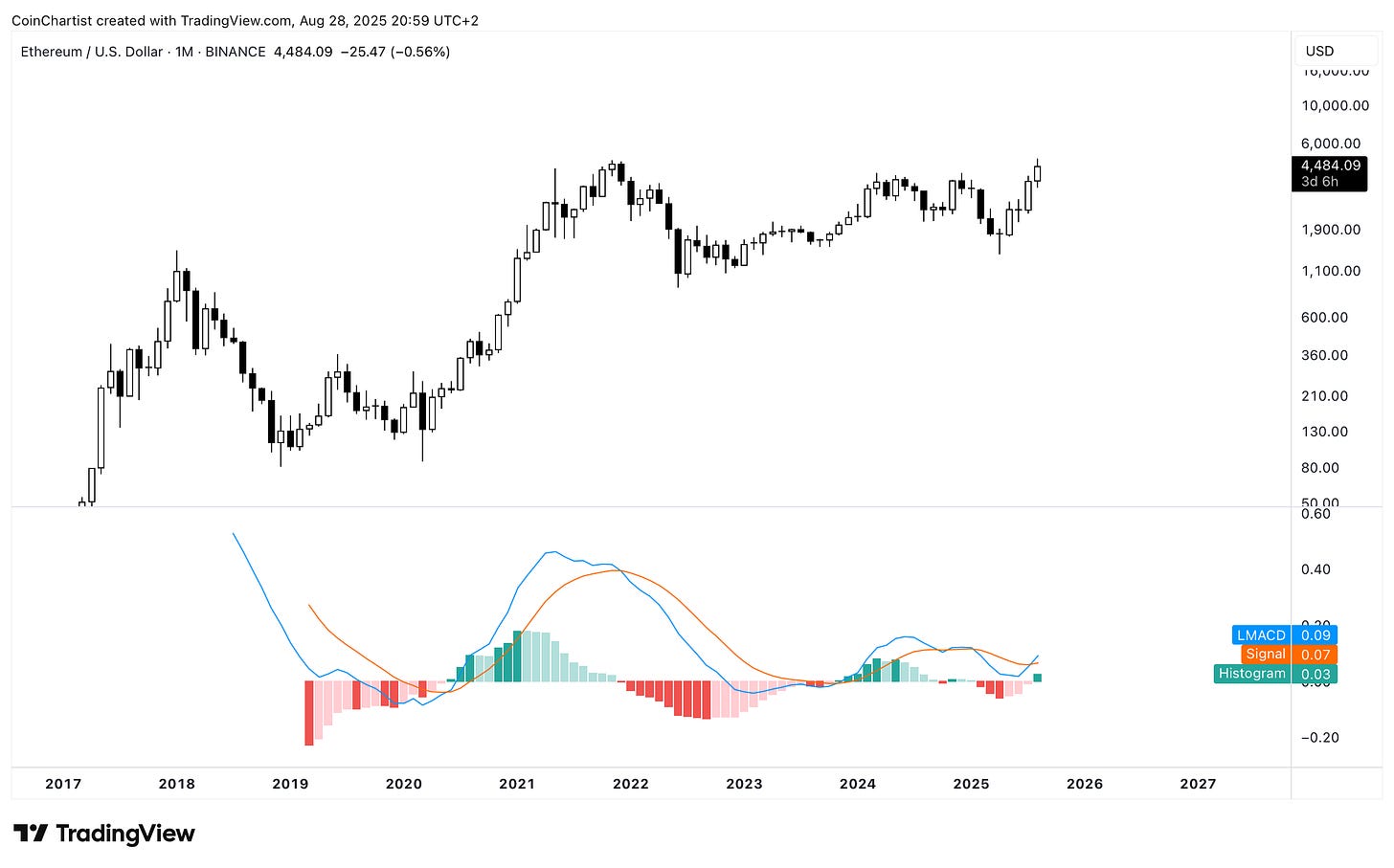

Ethereum made a new all-time high this month and looks ready for more upside.

Ethereum’s monthly candle is above the upper Bollinger Band and the bands are starting to expand. This is a buy signal and should lead to a sustainable uptrend.

The monthly LMACD has crossed bullish adding another buy signal. This suggests momentum has turned bullish.

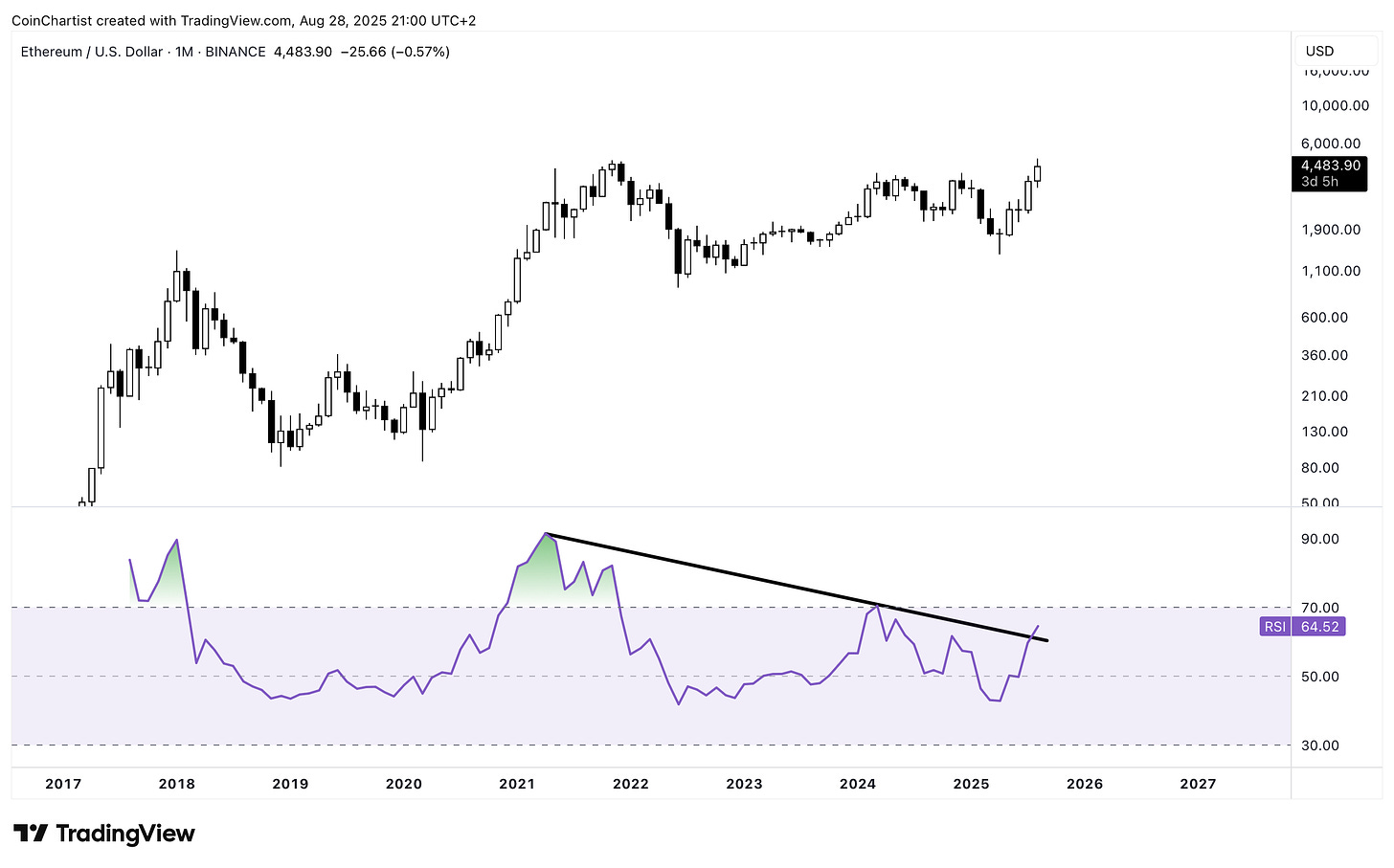

ETHUSD monthly has broken up out of a RSI downtrend line and is inching closer to a reading of 70. Above 70 is incredibly bullish and the level in which cryptocurrencies make their largest moves.

Keep reading with a 7-day free trial

Subscribe to CoinChartist to keep reading this post and get 7 days of free access to the full post archives.