Issue #27 | The Ethereum Issue

Why Ethereum is destined for $10K and Bitcoin could be back at ATHs in December.

Issue #27 of CoinChartist (VIP) overview

The Bitcoin trend is strengthening — what confirmation looks like

All about the king of altcoins: Ethereum

An Ethereum-focused Wave Watch with updated wave counts, targets, and timing

Putting Ether up against the stock market and money supply

Could Bitcoin ATHs in December be a “sure thing?” See the special spotlight

Remember, a premium subscription comes with access to custom technical indicators like the Raging Bull, Trend Wrangler, and more.

Disclaimer: The information provided in this Substack newsletter is for general informational purposes only and should not be considered as financial advice. Investing involves risk, and past performance is not indicative of future results. Please conduct your own research or consult a financial advisor before making any investment decisions. The newsletter disclaims any liability for losses or damages arising from the use of this information.

Bitcoin price continues to grind higher, making new 2023 high after high. A series of higher highs and higher lows is the pure definition of an uptrend. The majority of portfolio managers don’t trade on intuition – they use technical trading systems they backtested that trigger and take positions when certain conditions are met. As BTCUSD cruises higher, it is starting to give signals of strength that are almost certainly causing these technical systems to enter – hence why the trend is beginning to strengthen further.

Evidence of this can be found in the Average Directional Index on the 1W rising above 20. The tool is specifically designed to signal when a trend has begun by reaching above a reading of 20. The same reading appeared back in August 2020. However, the DI+ (green) is much higher today versus back then, showing even more strength on the bull side.

Trending assets tend to “walk” the Bollinger Bands, which Bitcoin has begun to do on the 1W timeframe. This can continue for a lot longer than bears can stay solvent. Shorting during a phase like this is a poor strategy. Remember, that the trend is your friend, and the trend is currently up. Pro tip: When the bottom Bollinger Band begins turning back up after an extreme expansion, it tends to signal the the trend has ended.

The Bitcoin trend will move to an even more advanced stage of momentum the moment it makes a higher high on the LMACD. Pay attention to how price reacted after the LMACD made a higher high back in 2020. I’ve also drawn the massive, six-month-long bullish divergence that developed at the bottom – it is the only one to form at a BTC bottom ever.

Bitcoin might not see further correction until it reaches the top of the Ichimoku Cloud on the 1W, located at roughly $42,000. In 2020, BTCUSD corrected at the top of the Cloud. That level could produce the next significant consolidation in Bitcoin price action, but even then, it shouldn’t be too long of a sideways phase.

That is if it happens at all. Turning on the Ichimoku on the 1M shows that BTCUSD has made it above the Cloud, above the Tenkan-sen, and is in the midst of pushing above the Kijun-sen. This suggests there is very little monthly resistance overhead. Pay close attention to each time BTCUSD surpassed these levels. A clear bullish trend unfolded.

Since this is the Ethereum issue, we will focus the entirety of Altcoin Alert on the king of the altcoins: Ether. Ethereum will continue to be a focal point throughout the rest of the issue, with ETH-specific editions of Wave Watch and Macro Monitor. However, stay tuned for a Special Spotlight on Bitcoin at the end.

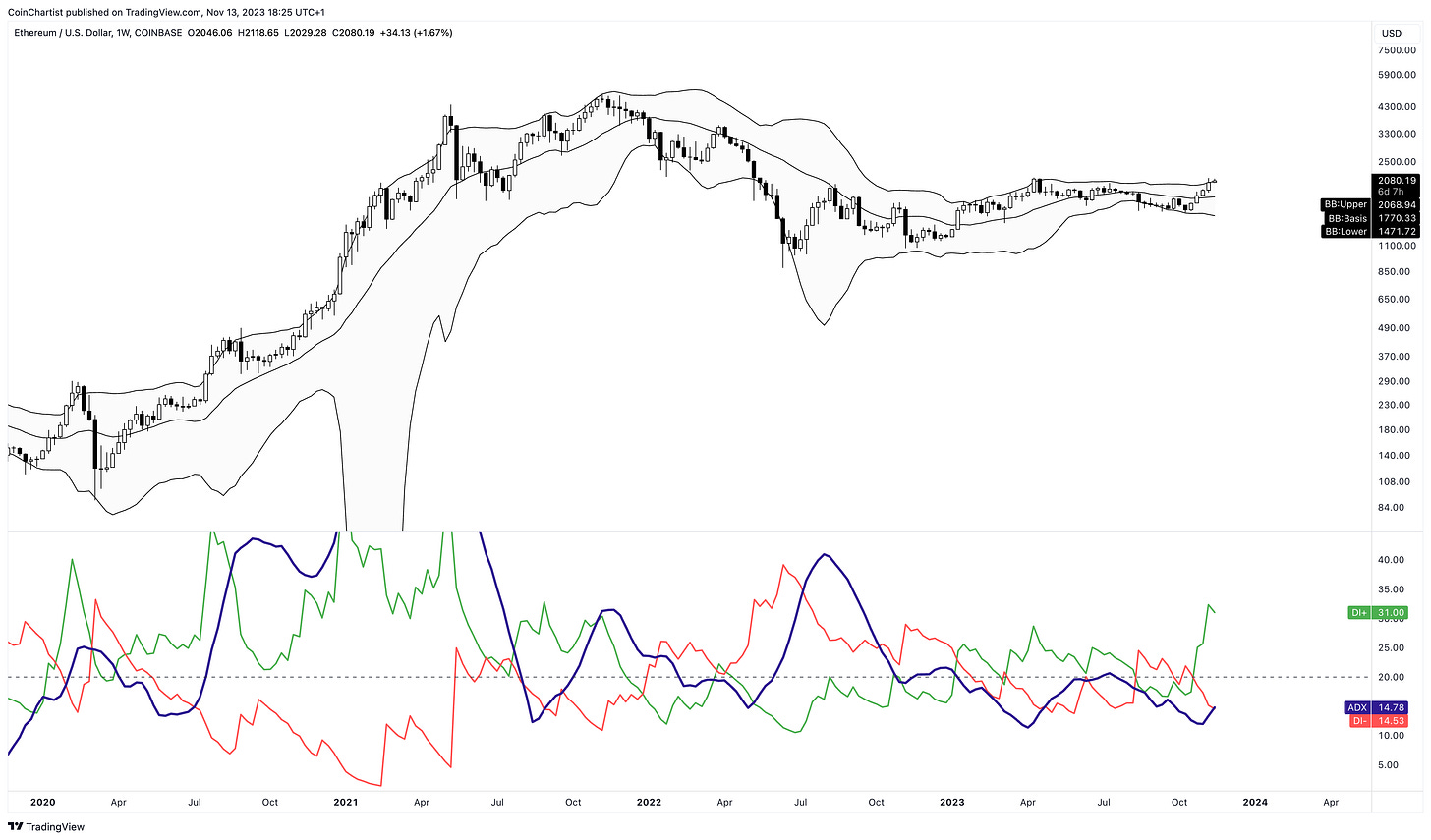

For the sake of packing more technicals into each chart, I’ve got both the Bollinger Bands and the Average Directional Index turned on. Compare the price action depicted in this chart versus the same location of price action in Bitcoin from above. Ethereum has yet to begin trending with a reading above 20 on the ADX, nor has it broken above the upper Bollinger Band. But these signals are likely coming soon.

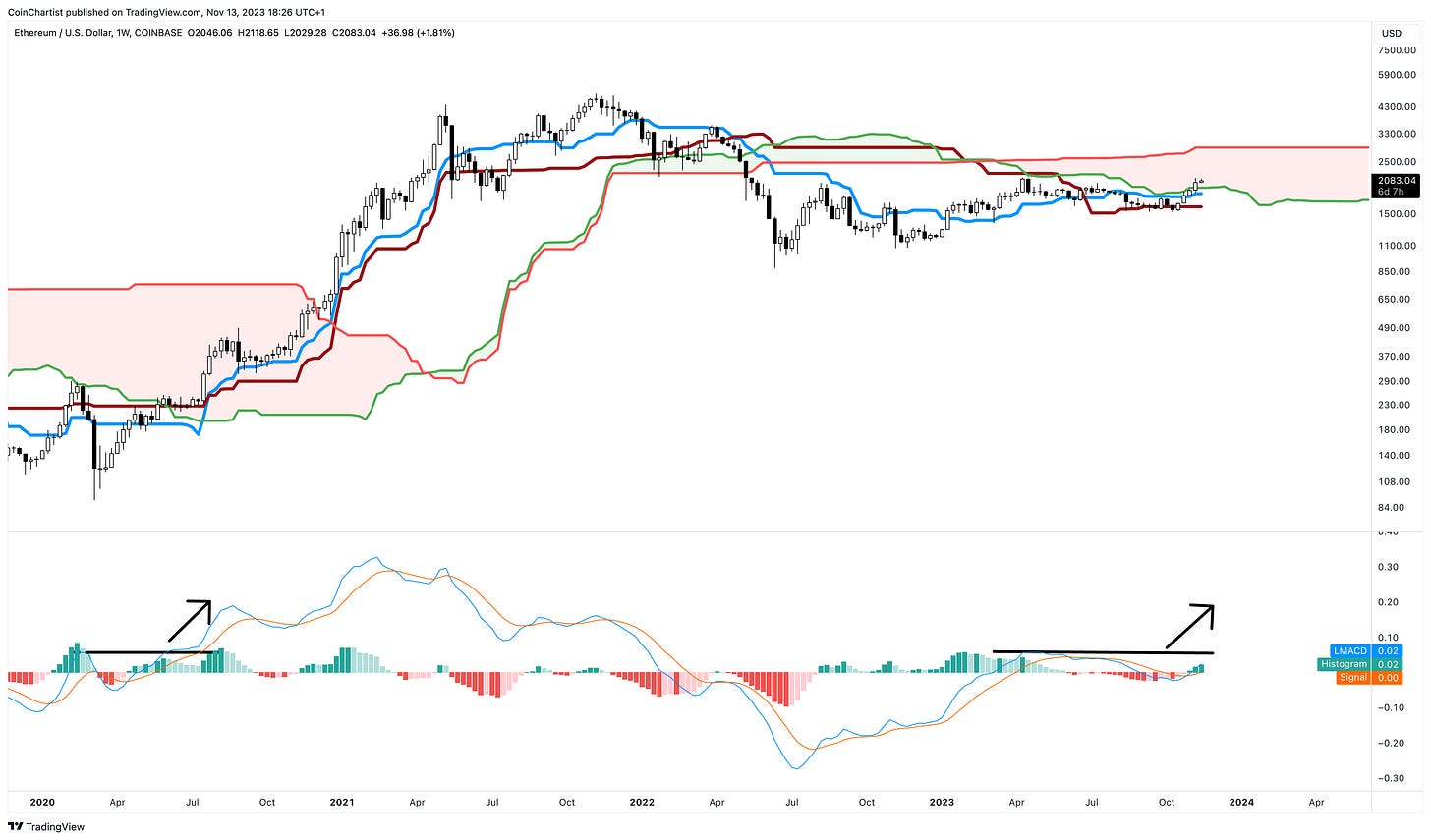

Here, we can see that ETHUSD is much lower within the Ichimoku Cloud than BTCUSD, and much further away from Bitcoin from making a higher high on the LMACD. The point of this is to show that Ethereum is lagging behind Bitcoin, but should switch to over-performance soon enough.

ETHUSD 1W was finally able to crack above its TDST downtrend resistance. ETHUSD must form a perfected TD9 series before the green TDST stair-stepping support moves upward. The stair-stepping action represents flipping resistance levels into support.

Moving into higher timeframes, we can see that the 1M Ether chart just pushed into overbought territory on the Stochastic. While this can indeed mean that a reversal is coming, is tends to more often than not in crypto represent a powerfully trending asset. Each time the Stochastic has confirmed a 1M above 80 on the Stock, there was a massive push higher. This is also happening as ETH heads toward the upper Bollinger Band. Remember, pushing above this level suggests a trending asset, so a close above $2,450 in November is critical for this setup to continue. These volatility cycles appear with a recurring rhythm that suggests the expected breakout should arrive right on time.

Strong bullish reversals begin when the Stochastic leaves oversold levels below 20. Remaining under 20 indicates a strong downtrend, much like staying above 80 suggests an uptrend is strong. But if ETHBTC can push back above 20 this will generate a buy signal on the 1M Stochastic and kickstart Ether’s over-performance above Bitcoin.

That’s it for free content. Premium subscribers get the following:

An Ethereum-focused Wave Watch with updated wave counts, targets, and timing

Putting Ether up against the stock market and money supply

Could Bitcoin ATHs in December be a “sure thing?” See the special spotlight

Remember, a premium subscription comes with access to custom technical indicators like the Raging Bull, Trend Wrangler, and more.

Keep reading with a 7-day free trial

Subscribe to CoinChartist to keep reading this post and get 7 days of free access to the full post archives.