Risk-On

The crypto market appears about to make a major break out higher and we might finally see an altcoin season. Are you ready?

Disclaimer: The information provided in this Substack newsletter is for general informational purposes only and should not be considered as financial advice. Investing involves risk, and past performance is not indicative of future results. Please conduct your own research or consult a financial advisor before making any investment decisions. The newsletter disclaims any liability for losses or damages arising from the use of this information.

Risk-On overview:

Examining the macroeconomic risk-on signal that is prompting an increase in risk appetite

How strengthening fundamentals in crypto, driven by global adoption, are pushing momentum in the bulls’ favor.

Altcoin season? Several Bitcoin Dominance signals suggest it could finally be here

Using Bitcoin to demonstrate how to use the RSI for breakouts and strength signals

A special feature analyzing altcoins using RSI breakouts, strength triggers, and the Bollinger Bands on high timeframes to confirm trend expansion.

Altcoins covered include: ETH, XRP, LTC, XLM, LINK, SOL, BNB, TRX, ADA, and DOGE

Suddenly, there’s a different energy across the cryptocurrency market. It took longer than most expected and the journey was a lot more difficult than past market cycles, but it appears as though the best part of the bull run is beginning.

Bitcoin made yet another higher high, confirming an uptrend and continuation. XRP has followed suit as a market leader. Perhaps even more significant, the TOTAL cryptocurrency market cap index has also posted a higher high – a key 'confirmation' element that was missing until now. Ethereum has doubled in value since the April low in one of the sharpest recoveries I’ve ever witnessed. Capital will continue to rotate into altcoins further down the list from here as money is made.

But why is this happening? And after so many rejections and nearly teetering into a bear market, can this be trusted? This issue explores the emerging bull market and how this impacts altcoins in particular. I also cover what strength signals help spot major breakouts. Finally, I analyze XRP, ETH, LTC, LINK, XLM, SOL, BNB, TRX, DOGE, ADA, and more in one of my largest altcoin-focused issues ever.

What Has Changed?

The dust is settling on Trump’s tariff war, and the economy is stabilizing enough for the market to move to a risk-on phase, according to some macroeconomic indicators.

The chart above shows the Copper/Gold ratio, flipping in favor of Copper. Below this ratio, is the TOTAL cryptocurrency market chart, with two green phases highlighted. During these phases, the Copper/Gold ratio flipped risk-on like we are seeing now, and the cryptocurrency market posted some of its largest gains ever. With the ratio now favoring Copper again, the market is risk-on.

Copper is an industrial metal heavily used in construction, manufacturing, electronics, and in particular, energy infrastructure. With AI demanding more significant energy infrastructure, it makes sense to see Copper heating up. Copper rising implies the economy is ready to grow.

On the Gold side of the ratio, Gold stalling or topping out, could imply that investors are feeling less defensive or fearful of inflation or economic instability. This too can lead to more risk appetite.

Fundamental Strength

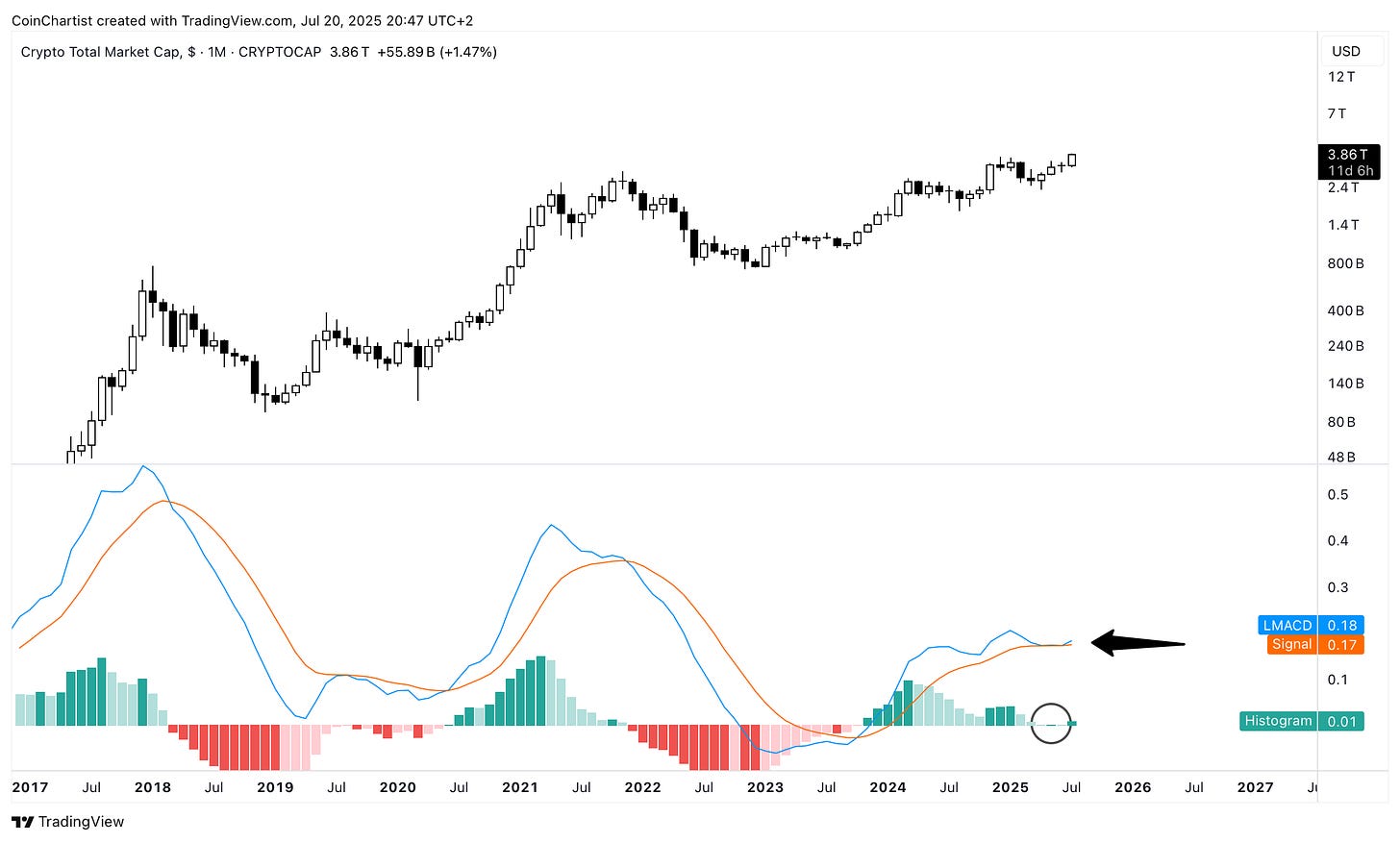

The pro-crypto policy in the United States and global adoption is, without a doubt, making a difference in keeping the market crypto market particularly strong. When Trump took office and pro-crypto policies began to roll out, it initially triggered a 'sell the news' type event. By narrowly avoiding a major bearish momentum signal and defending it for several months, the market is now convincingly bullish.

We can see this defense of a bearish momentum crossover in the circle on the chart above. The arrow shows the LMACD line and signal line diverging upward, which suggests bullish continuation. This is happening above zero, meaning that this is happening from a position of strength. The larger, dark green tick on the histogram indicates that bullish momentum is strengthening again. Although the last six months or so were confusing for investors, the next trend direction is becoming increasingly clear and soon should be undeniable.

Altcoin Season?

Everyone knows the story “The Boy Who Cried Wolf.” Only a handful of analysts in the crypto industry (Ben Cowan comes to mind) didn’t call for an altcoin season. Everyone else called for it so many times it now feels like a running joke that it will never arrive. But it could actually be here this time and many won’t believe it.

In a previous issue, I highlighted how the last reversal into altcoin season started once Bitcoin Dominance (BTC.D) tagged the TDST Resistance line projected by the TD Sequential indicator. Then BTC.D dropped like a rock. As of today, BTC.D is working on a massive Bearish Engulfing candlestick on the monthly that has erased several months of Bitcoin overpeformance in just days.

The indicator above shows the RSI falling below 70. This is sell signal, especially after the RSI makes a lower low. Just below the blue line marking out the lower low, is a green uptrend line running since July 2017. If BTC.D can close below that RSI uptrend line, we could see strong altcoin over performance. BTC.D is also breaking down from an uptrend line on price drawn from the 2022 low.

BTC.D’s monthly candle body is below the Trend Wrangler. It needs to close below it by the end of the month, but the potential is significant if it can confirm. BTC.D hasn’t closed a single monthly candlestick below the Trend Wrangler since late 2022/early 2023. Remember, you can get access to the Trend Wrangler and other tools by becoming a premium subscriber.

Top Choice Altcoins and a Lesson with Bitcoin

The next section will feature altcoins from the top ten along with standouts like LTC, XLM, and LINK.

But first we’ll use Bitcoin to demonstrate how to read and interpret the altcoin charts ahead.

Bitcoin (BTC)

In this first example, we can see that markets respond best when the RSI:

Breaks a downtrend line (red)

Makes a higher high (blue)

Note: Passing above 50 and 70 on the RSI are also triggers to increasing strength

Here, we can see that Bitcoin is close to triggering some significant breakouts. The monthly RSI is right below a red downtrend line and just above it will trigger a buy signal from a higher high. The double combination of triggers so close to one another should lead to some serious strength.

Ethereum (ETH)

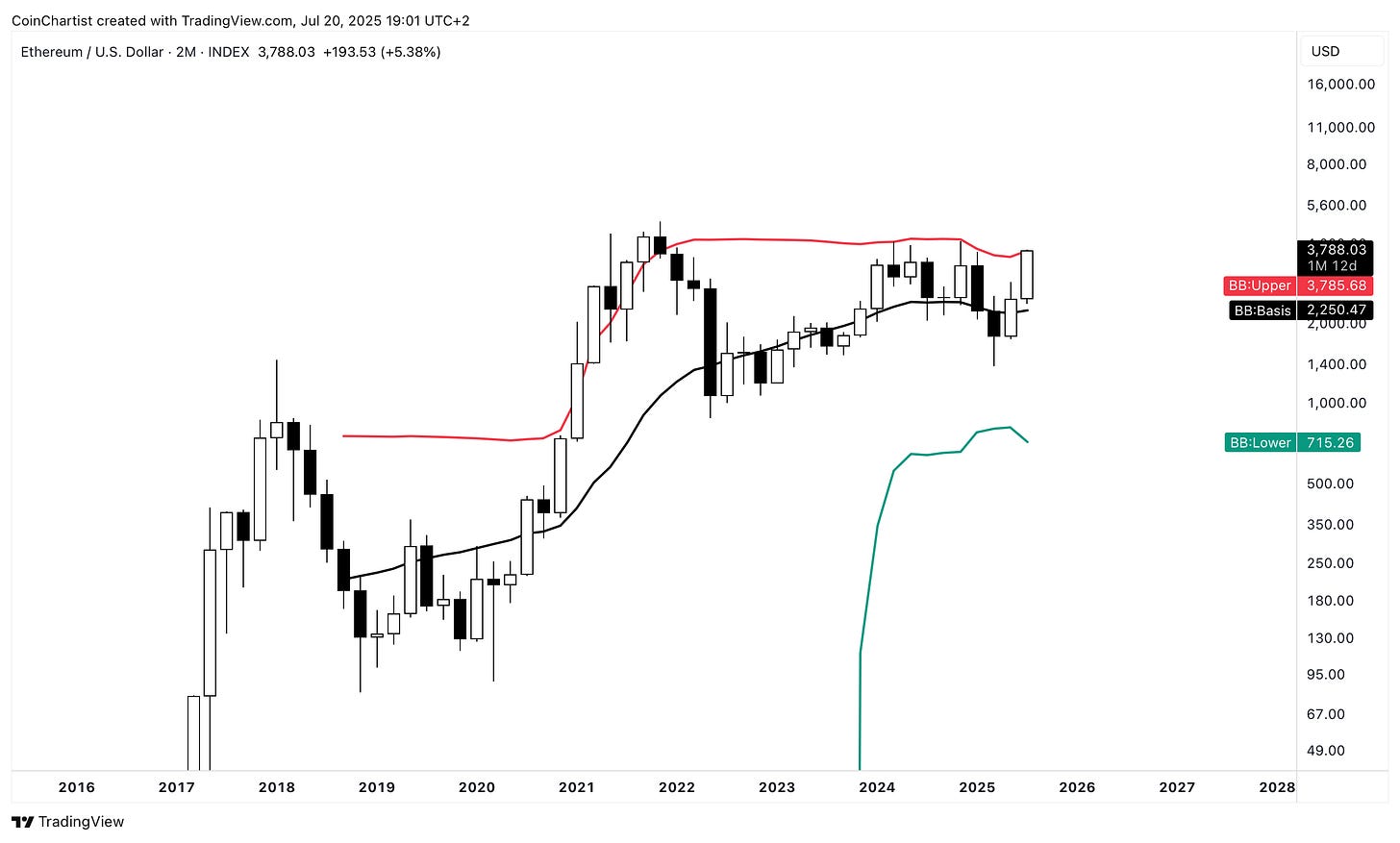

Ethereum’s sharp reversal has been so fast and furious that it’s right up against both a downtrend line and a higher high on the RSI. This is a double signal where even though Ethereum has already done 100% in like two months, it might just be the start of the upside. After just being so bearish, this could lead to quite the chase and/or hesitancy to enter.

On the highest timeframes, this shows signs of a true explosive move – possibly one of the biggest ever in crypto. ETHUSD is above the upper Bollinger Band on the 2M timeframe while the bands are starting to expand from the tightest reading ever.

Below here, premium subscribers will enjoy access to altcoin charts for XRP, LTC, DOGE, XLM, ADA, BNB, SOL, TRX, and LINK.

Keep reading with a 7-day free trial

Subscribe to CoinChartist to keep reading this post and get 7 days of free access to the full post archives.