Special Issue | $100,000

The psychological setup for $100,000+ and our euphoric bull market peak.

Disclaimer: The information provided in this Substack newsletter is for general informational purposes only and should not be considered as financial advice. Investing involves risk, and past performance is not indicative of future results. Please conduct your own research or consult a financial advisor before making any investment decisions. The newsletter disclaims any liability for losses or damages arising from the use of this information.

#Special Issue overview:

Bitcoin trades just below $100,000 – what next?

BTCUSD technicals confirm once-in-a-cycle strength

Wave counts show why the bull run could be over sooner than expected

Cyclical timing points to Inauguration Day as the potential peak

Why $100K BTC could ignite altcoins, starting with XRP

Special spotlight on XRP charts

Bitcoin begins to outshine the rest of finance – BTC vs Gold, Oil, Stocks, and more

As I type this, Bitcoin is over $99,000 per coin — less than 1% away from the most critical psychological level in the history of the first ever cryptocurrency. Mass crowd psychology is arguably the most important aspect of financial markets, and there has been no more talked about psychological level, making this a moment of particular importance. This issue speculates on how the crypto market as a whole might react to the major milestone.

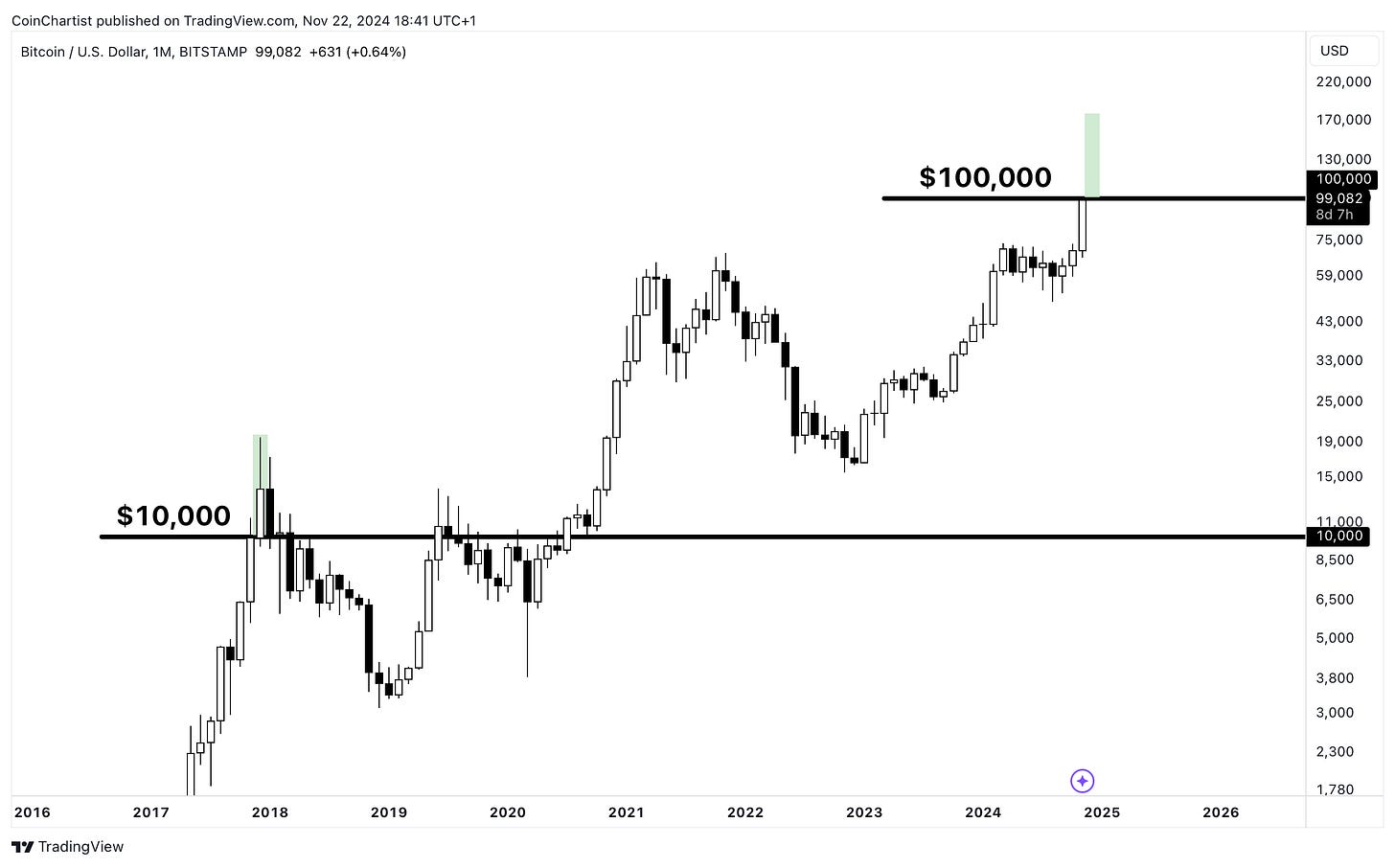

I’m fortunate enough to have experienced two full market cycles, starting from the 2017 top. My first BTC purchase was for just under $10,000 in late 2017. Things moved significantly faster than I was prepared for, and just weeks later Bitcoin was flirting with $20,000. Between feeling like a genius for doubling my money so fast and the media-driven euphoria surrounding Bitcoin, it seemed like the rally was unstoppable and it was easy to make money.

Unaware at the time, Bitcoin reaching $10,000 didn’t just send it soaring higher, it also drew the attention of investors seeking out “the next Bitcoin.” Altcoins would 10-100x in days to weeks. I feverishly amassed a portfolio of what in hindsight was complete garbage, and yet I managed to make a small fortune.

It all happened so fast. And then it was over. Most coins were down 50% two months later, and eventually saw a 90% or more decline before finding a bottom.

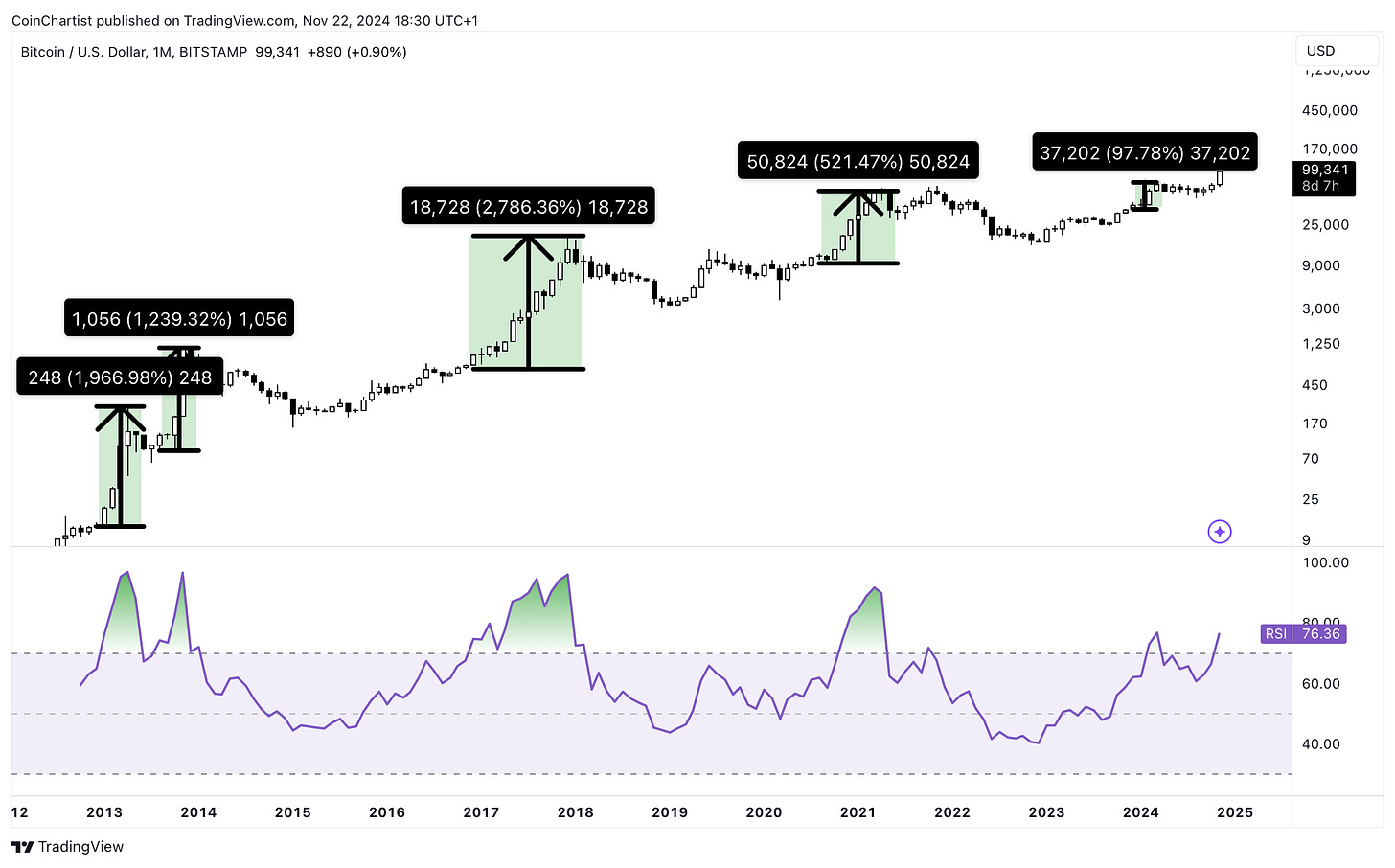

If you’re shocked by how fast Bitcoin got close to $100,000 — don’t be. A mature bull trend moves very sharply towards its end, leading to a blowoff top. Bitcoin has been climbing for two full years and the media has barely paid attention. Retail hasn’t returned since FTX and the higher Bitcoin gets price wise, the more retail gets priced out of owning any.

The 2021 double top created a unique situation. Had Bitcoin reached $100,000 back then, the whole world was ready to pull the trigger and sell. Today, BTCUSD is at such level and there is barely any euphoria in Bitcoin and certainly not in altcoins.

However, I believe it is coming and it’s coming fast. Most Bitcoin peaks have coincided with important launches such as futures or Coinbase being listed on the stock market. This time around I expect it to be Inauguration Day.

I can already see taking shape it in my X feed. As I talk about how fast this bull market will unfold, or discuss top targets and strategies, I am met with those that ask questions like “don’t you think with institutional adoption, ETFs, US strategic reserves, Gensler leaving, etc. Bitcoin could be in a supercycle?”

That type of thinking is what keeps people from selling at the right time — when everyone is euphoric and blinded by profits. The added euphoria of Trump’s inauguration and Gensler’s last day as SEC Chair make this a perfect recipe for a peak (Gensler coincidentally is leaving on Inauguration Day).

Furthermore, I expect the psychological impact of passing $100,000 to be similar to Bitcoin passing $10,000. It should blast toward a final top very fast, nearly doubling in value during that time. In 2017, this took under three weeks. This time I think it takes under three months.

Passing $100,000 psychologically makes Bitcoin extremely expensive, especially to retail that would rather own 1M coins of some obscure altcoin than spurge on 0.1BTC. The media attention of $100,000+ Bitcoin should once again ignite that gold rush type behavior in search of the next Bitcoin and give us a true altcoin season.

And then it’s all over again. Probably for many years, and longer than previous bear markets. Yes, the US will finally have crypto-friendly regulation and the US will be buying for their strategic reserve. But they won’t be buying your bags from you over $100,000 — they’ll be doing it at lows during the lengthiest bear market yet.

Bitcoin technicals make a breakout extremely clear, and onlookers have no choice but to pay attention.

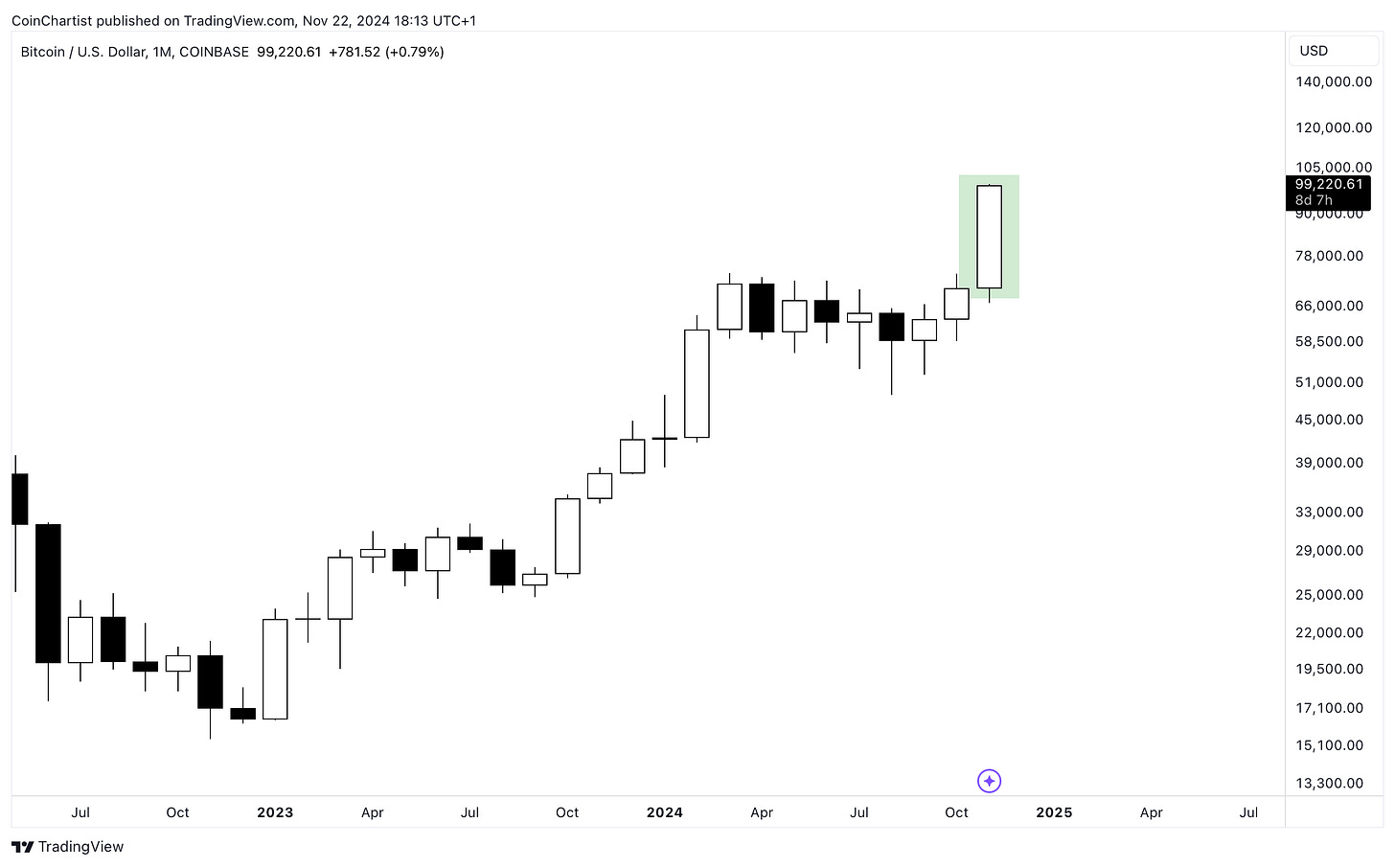

The November monthly candlestick is a massive bullish Marubozu. There is currently a 41% gain on the month, 5% shy of the November average.

This chart provides a closer comparison of how fast Bitcoin went from $10,000 to nearly $20,000 and its top for that cycle versus today. It took only one monthly candlestick to surpass $10,000, nearly double to $20,000, and put in a peak. While I do expect things to move fast ahead of us, I don’t think it moves as fast as it did in 2017 — the market lacks the breadth it had back then.

Monthly RSI is back in the bull zone. This is when Bitcoin is its strongest. The RSI is about to make a higher high this cycle, which should add to overall strength.

Keep reading with a 7-day free trial

Subscribe to CoinChartist (VIP) to keep reading this post and get 7 days of free access to the full post archives.