Disclaimer: The information provided in this Substack newsletter is for general informational purposes only and should not be considered as financial advice. Investing involves risk, and past performance is not indicative of future results. Please conduct your own research or consult a financial advisor before making any investment decisions. The newsletter disclaims any liability for losses or damages arising from the use of this information.

#Special Issue overview:

Is Bitcoin impacted by the Halloween effect?

Why crypto could be waiting for the US Presidential election

Over 20 high timeframe charts on Bitcoin and Solana

A look at the monthly, two-month, and quarterly timeframes

If you’ve spent at least one full year around financial markets, you’ve likely heard of the phrase “sell in May and go away.” But do you know when you are supposed to buy those assets back? The answer is October, and this is often referred to the “Halloween effect,” or “Halloween strategy.” With Halloween just days away and Bitcoin back above $68,000, will we see the Halloween effect start to take shape across the crypto market?

The Halloween Effect: A Trick or a Real Treat?

The Halloween effect is one of many “calendar effects” such as “the January effect,” “sell in May,” the “Santa Claus rally,” “the Super Bowl indicator,” and others. Calendar effects are based on the idea that markets exhibit seasonality that can yield seemingly predictable results. Even the US Presidential election cycle recurring every four years is considered such a calendar effect.

The Halloween effect is based on the idea that stocks perform better during the period from November through April when compared to May through October (the Sell in May concept).

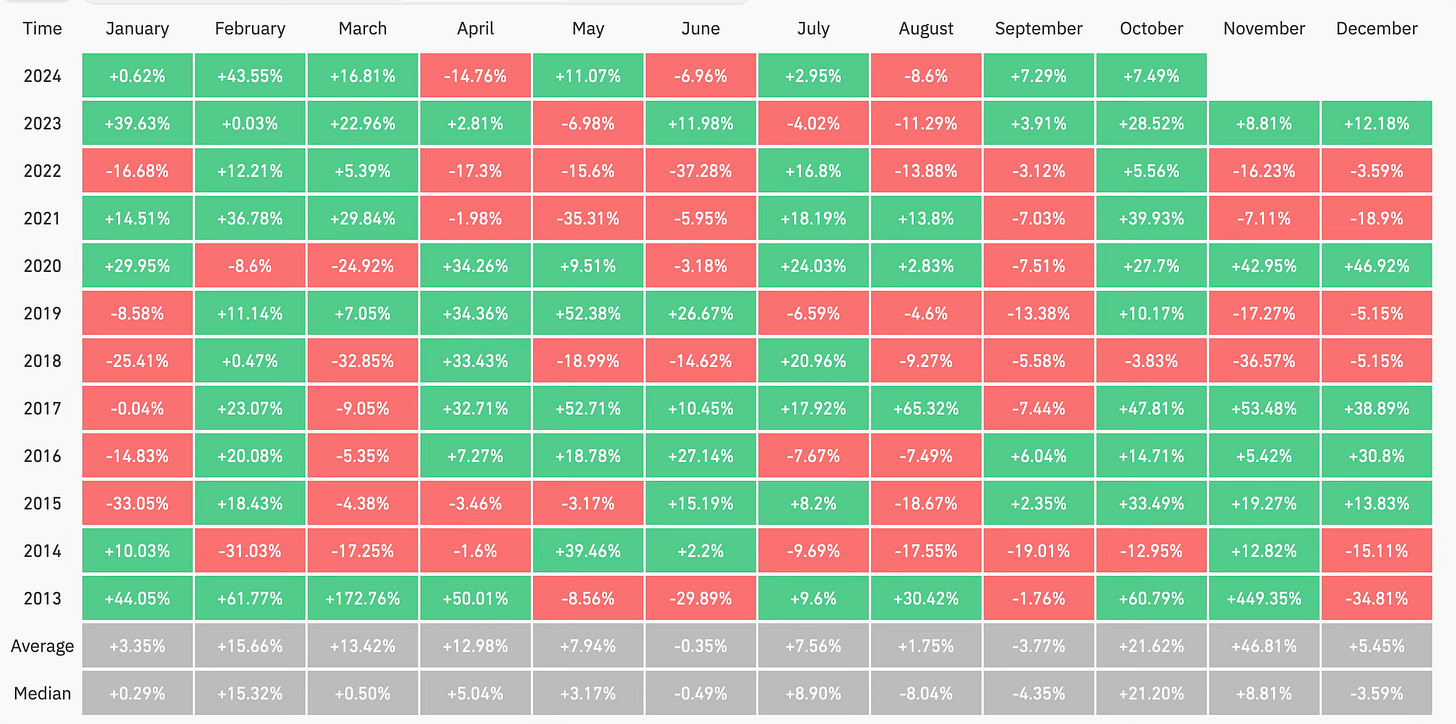

According to monthly average returns in Bitcoin since 2013, November is by far the best-performing month with more than a 46% return on average. It typically provides more than double the return of the next best month (October) and more than four times as much as the 11% all-time average monthly return. A 46% increase from current levels would take Bitcoin to just below $100,000 per coin.

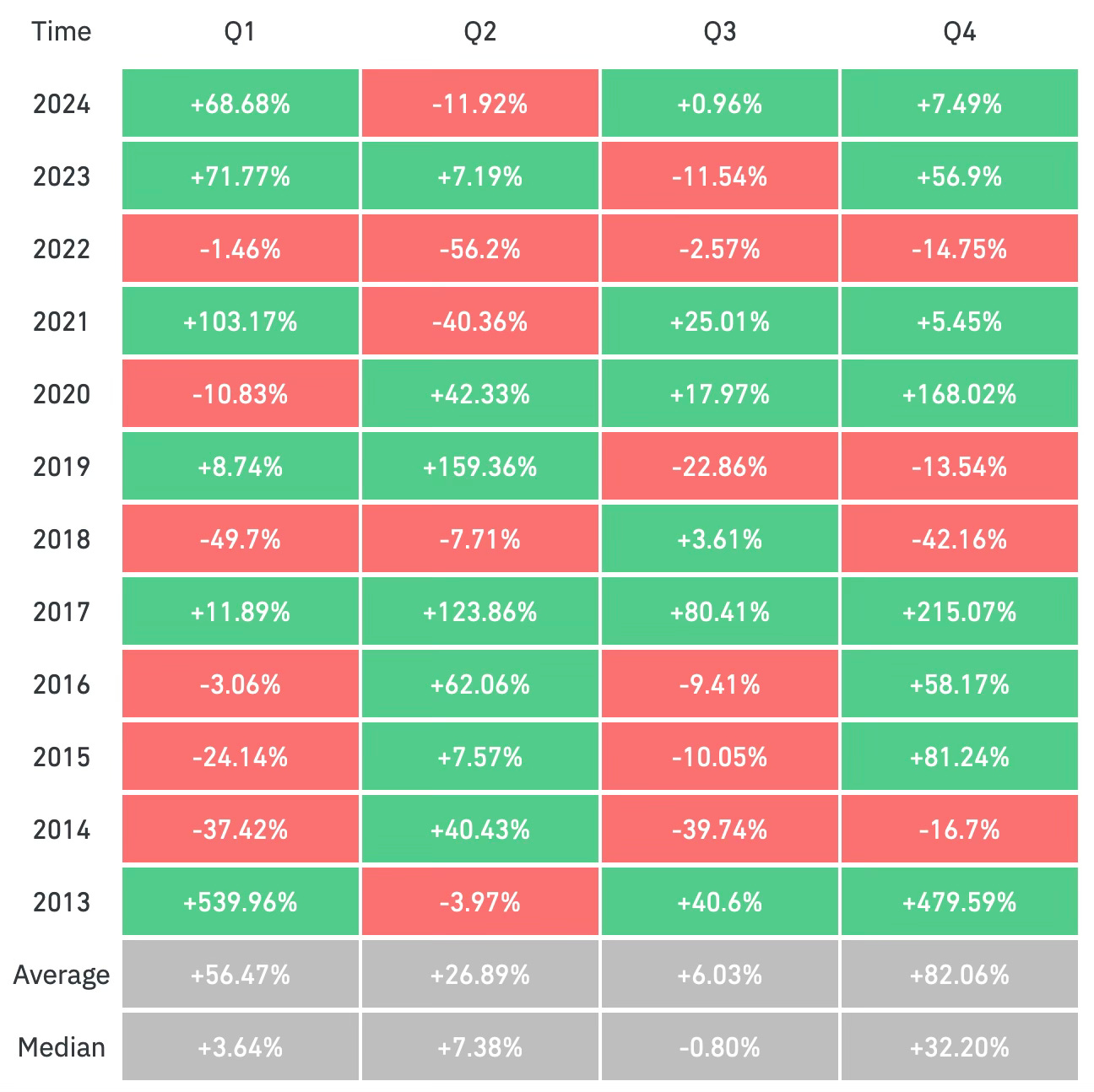

Quarterly data even better supports the idea of a Halloween effect. Q4 and Q1 are historically the first- and second-best performing quarters, with an average of 82% in Q4 and 56% in Q1. Combined this is 138% across two quarters. If Bitcoin were to increase by 138%, it would reach very close to my price targets around $160,000 per coin.

Keep reading with a 7-day free trial

Subscribe to CoinChartist (VIP) to keep reading this post and get 7 days of free access to the full post archives.