Special Issue | Merry Dips’mas

Everybody loves a good holiday dip. Especially when dips are for buying.

Disclaimer: The information provided in this Substack newsletter is for general informational purposes only and should not be considered as financial advice. Investing involves risk, and past performance is not indicative of future results. Please conduct your own research or consult a financial advisor before making any investment decisions. The newsletter disclaims any liability for losses or damages arising from the use of this information.

Merry Dips’mas overview:

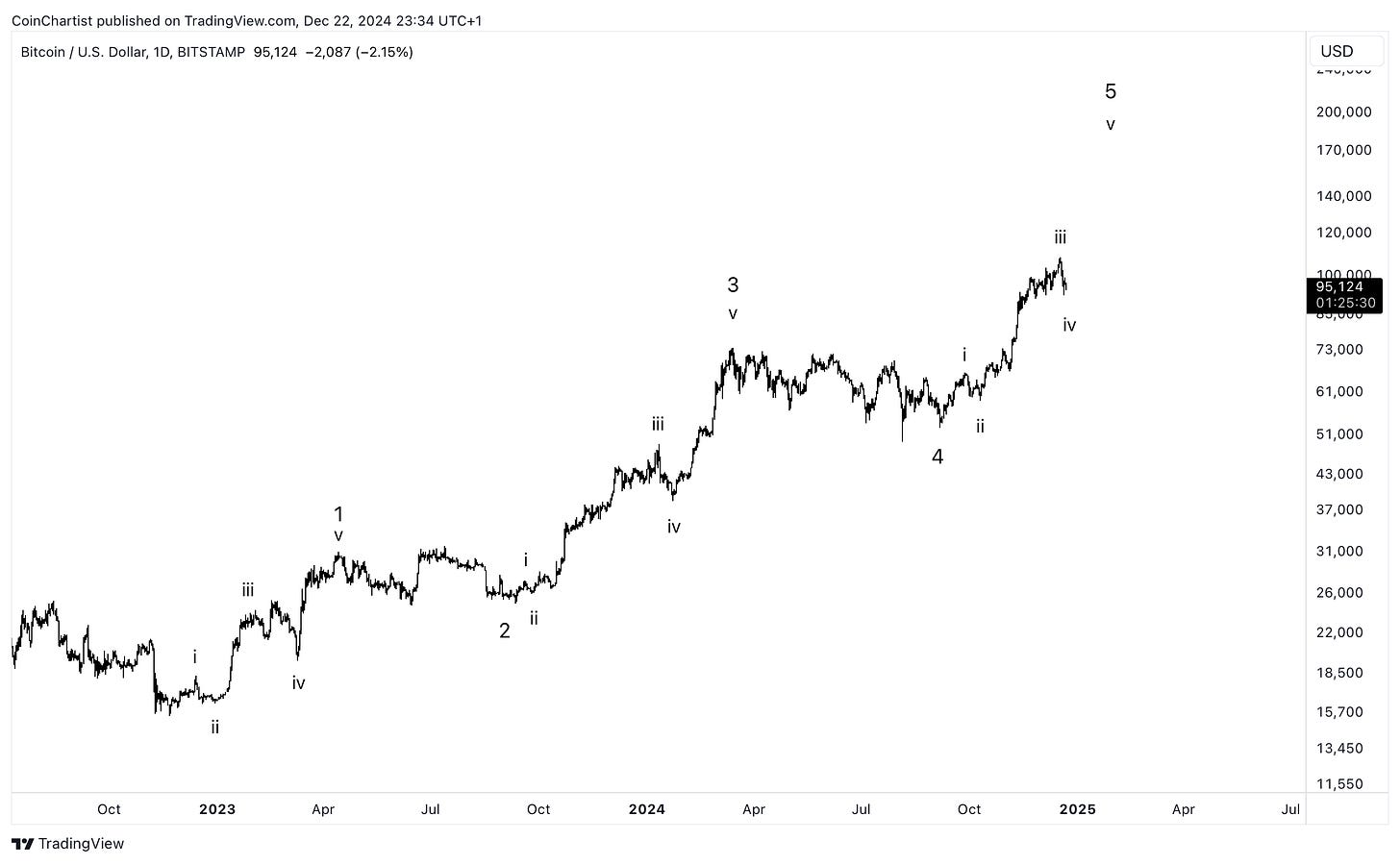

Combining Bitcoin wave counts with technicals to gauge where in the cycle we are

Is the correction in Bitcoin already over? Or do we have more sideways to suffer?

A roadmap for price action into early 2025

Bitcoin dominance shows high timeframe trend change signals favoring altcoins

Santa Clause rally? January Effect? Why altcoins are poised for outperformance over Bitcoin

This issue was initially focused on the “delusion” phase of the market cycle, but a quick 15% correction in Bitcoin turned greed back into fear in a flash. Market participants switched abruptly from “BTC strategic reserves and Trump policy means Bitcoin will go up forever” to wondering if “the top is in.”

Anticipating corrective behavior in Bitcoin

No, the top isn’t in, but we are getting closer and picking up in pace. This latest correction was one that was anticipated, but arrived faster than expected. This either tells us that price action is indeed speeding up toward a potential January 2025 peak (or shortly following in February), or that we are potentially in a lower degree correction.

Above, we have a loose wave count where subwave iii has ended and we’ve moved into a corrective subwave iv.

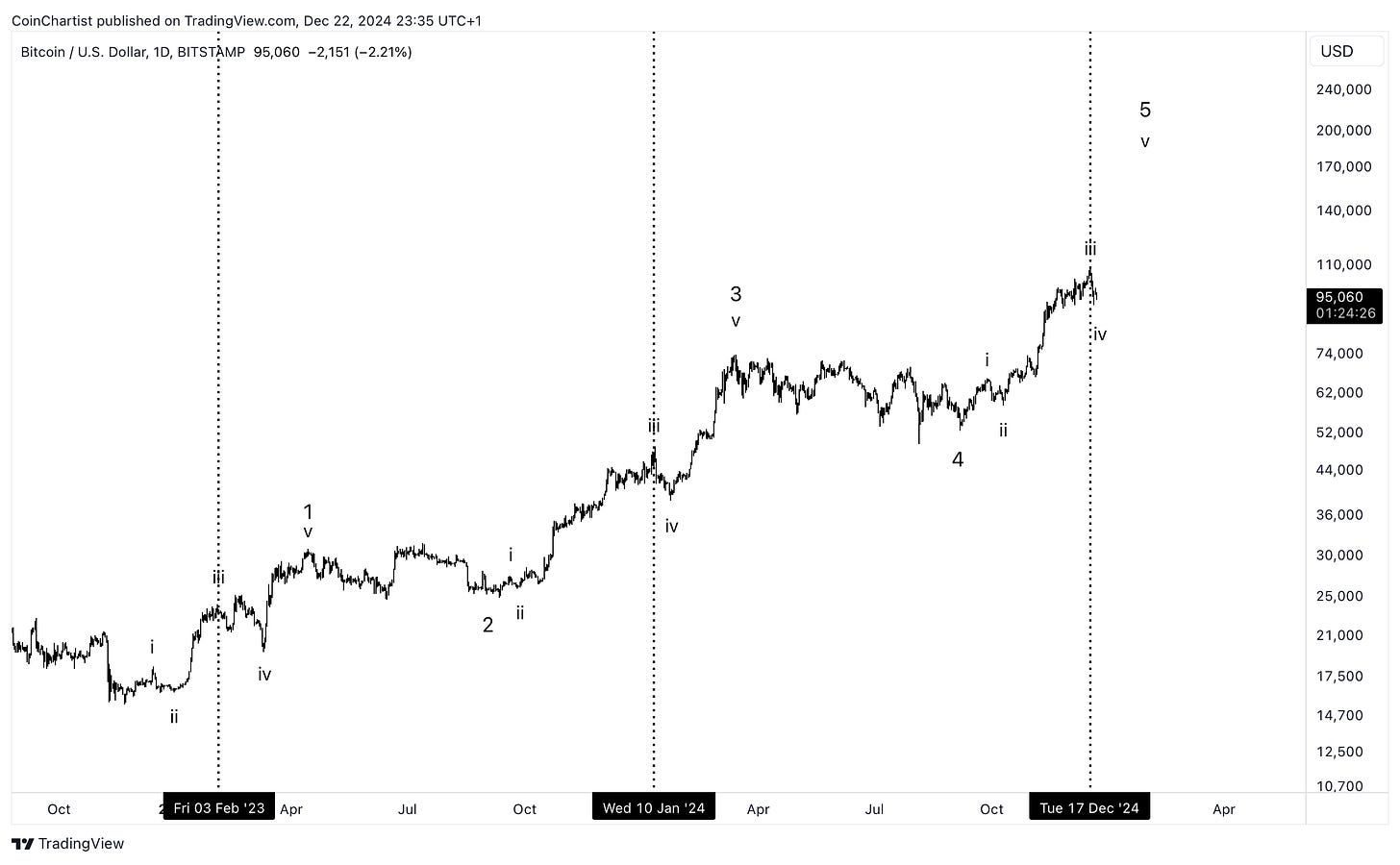

In the above image, I’ve added vertical lines representing the top of each subwave iii and the last minor degree correction before each peak.

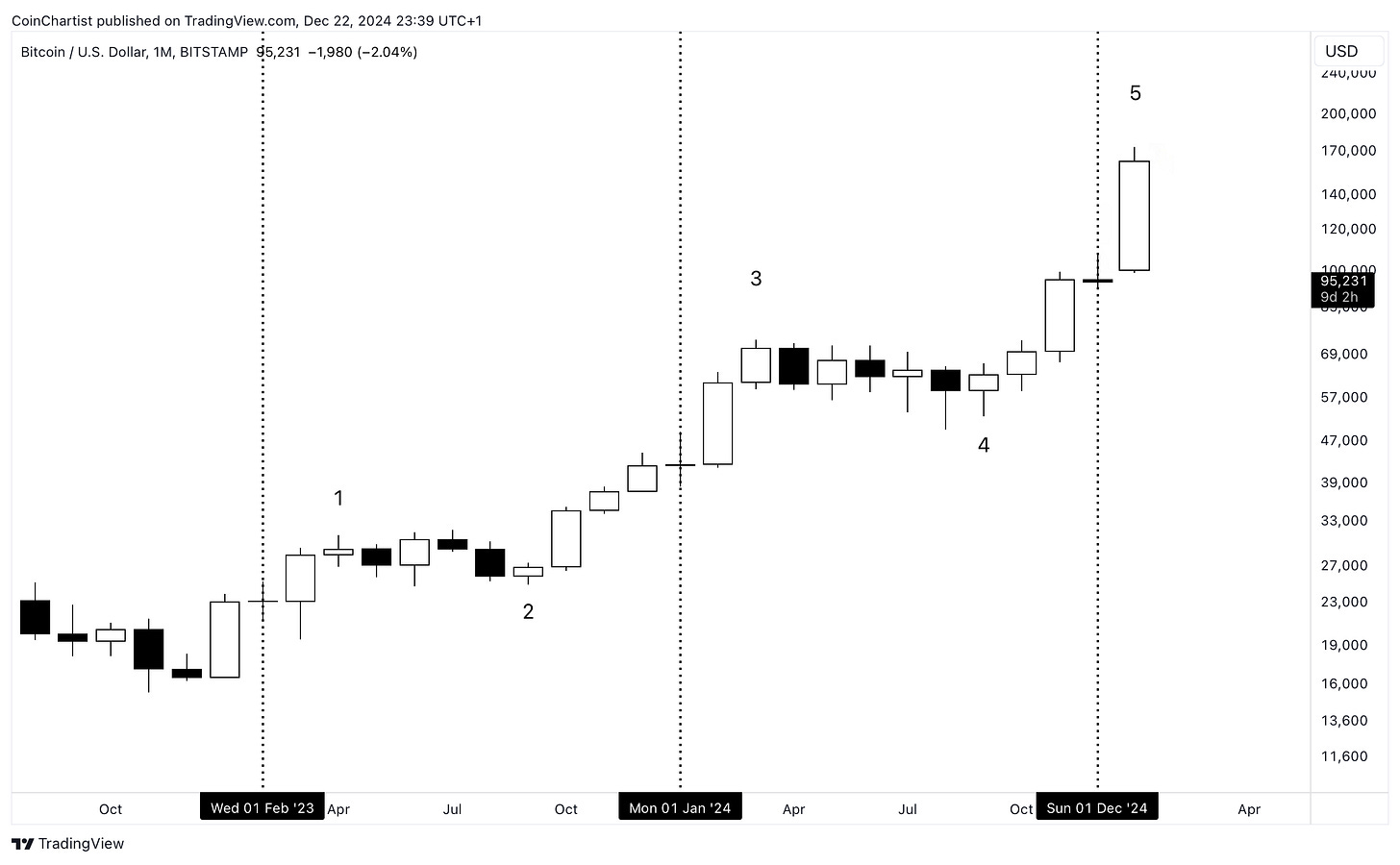

With subwave counts removed, the vertical lines line up with three very similar Doji candles — one in Feb 2023, one in Jan 2024, and another one forming now.

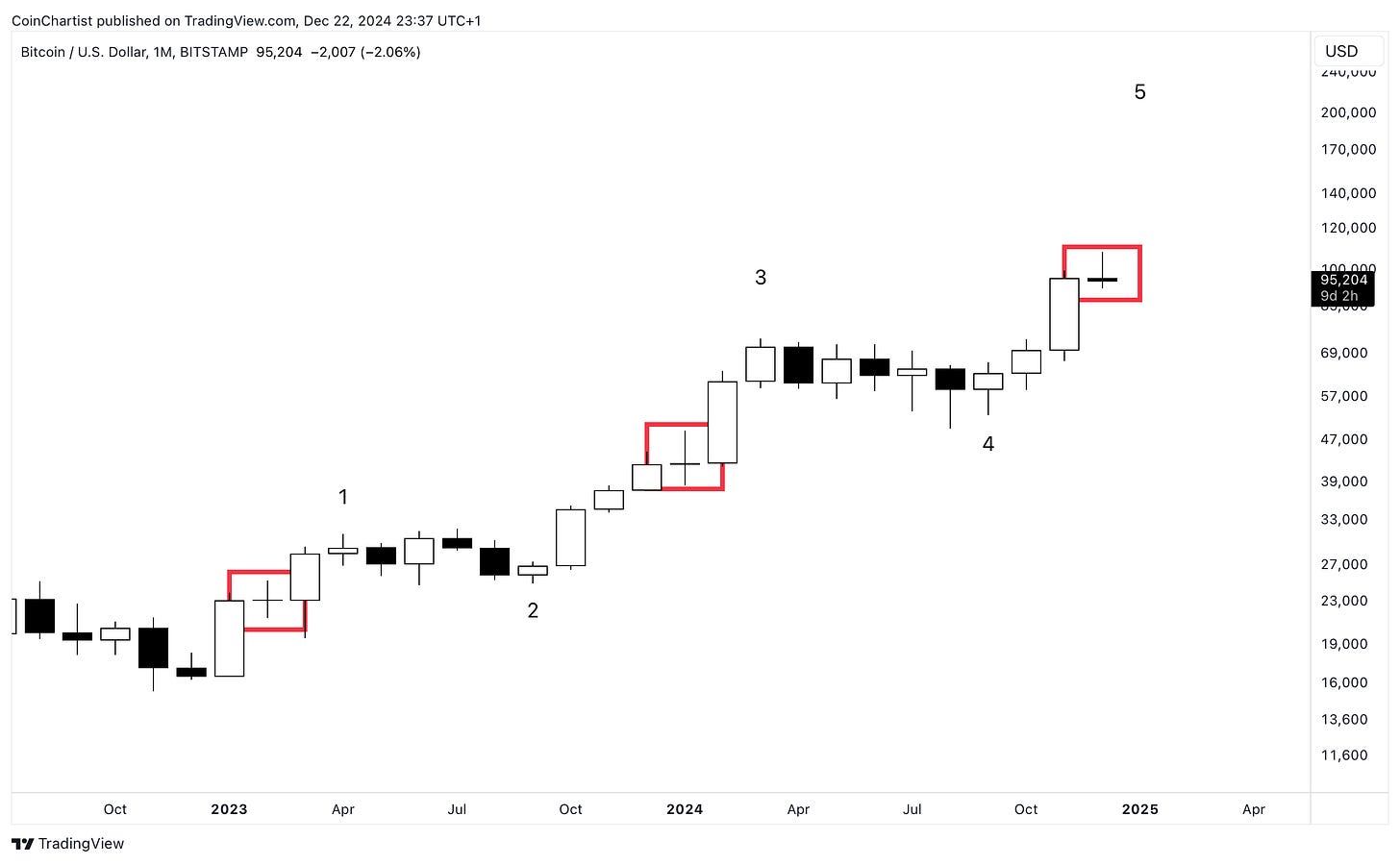

With the vertical lines removed, we can see the Doji more clearly within each red box. Doji tell us there was a pause in the market from indecision. Oftentimes after a Doji a decision is made, resulting in either a reversal or strong continuation.

Keep reading with a 7-day free trial

Subscribe to CoinChartist (VIP) to keep reading this post and get 7 days of free access to the full post archives.