Special Issue | The State of Altcoins

A special spotlight on the top ten cryptocurrencies by market cap. Plus charts for low caps, Bitcoin dominance, and Tether dominance..

Disclaimer: The information provided in this Substack newsletter is for general informational purposes only and should not be considered as financial advice. Investing involves risk, and past performance is not indicative of future results. Please conduct your own research or consult a financial advisor before making any investment decisions. The newsletter disclaims any liability for losses or damages arising from the use of this information.

The State of Altcoins overview:

Every coin in the top ten cryptocurrencies by market cap is analyzed using the same methodology.

Each coin is assigned an A-F rating depending on future performance remaining in the current cycle.

OTHERS is also examined, representing the rest of the altcoin market

A detailed look at Bitcoin dominance (BTC.D) and Tether dominance (USDT.D) shows changing market conditions in favor of alts

Learn to apply these key technical tools to any altcoin to compare strength to those listed in this guide

While Bitcoin works on turning $100,000 into support, altcoins across the market are experiencing extreme volatility. Volatility does indeed move in both directions, as we’ve seen recently with some pretty nasty shakeouts in altcoins. However, most of the volatility has been to the upside, with many coins breaking out with 50% to 500% moves. By the time my next week’s newsletter reaches your inbox, Bitcoin should be on the move to $120,000ish where it’ll experience the first violent correction of 20% or more. During that recovery is when I expect altcoins to take off market-wide. The race has already started, however, and some altcoins are better poised for gains than others. As such, I’ll spend this issue giving altcoins in the top ten cryptocurrencies by market cap an A to F rating. I’ve also assigned a rating to OTHERS, representing the rest of the altcoin market. Coins rated with an A present the chart with what appears to be the best performance potential, while coins rated F present the worst possible performance potential. In each chart, we are specifically using the same key technical indicators on the same two-month (2M) timeframe. My goal with this is so that the reader can visually compare each coin to one another, and gauge how strong the chart appears to be.

Bitcoin as the crypto market barometer

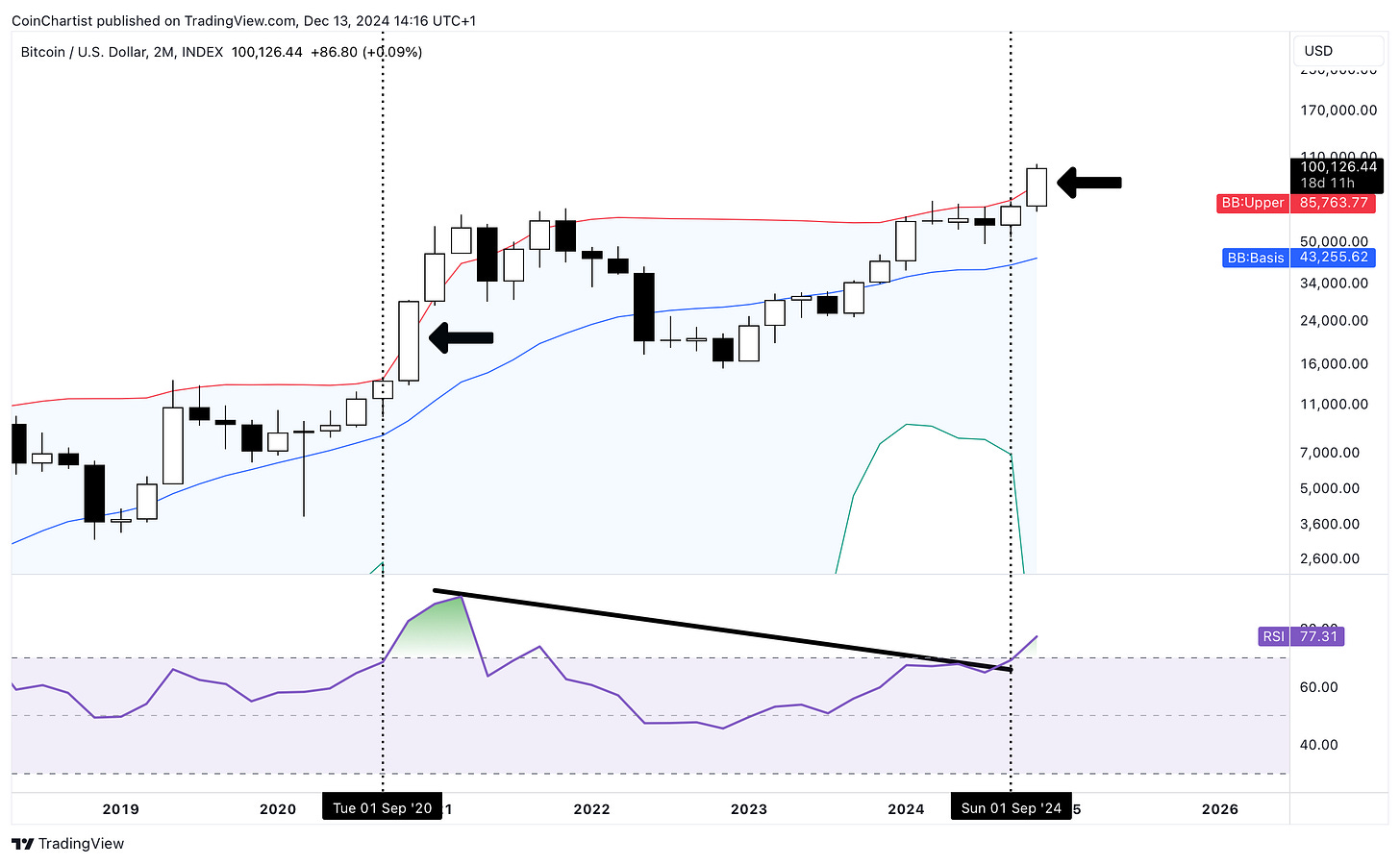

Before we dive into altcoins, we are going to begin with a look at BTCUSD on the chosen two-month timeframe. Specifically, we are using the 2M Bollinger Band and Relative Strength Index at default settings. The two-month timeframe has been chosen because it is among the last timeframes to give bullish signals. These signals are extremely late to be used for spotting reversals, and instead are a sign of extreme strength and a close proximity to the point of trend exhaustion.

Signals

Bollinger Bands

The Bollinger Bands are a 20-period simple moving average with an upper and lower band set at +2 and -2 std. deviation. The majority of price action takes place between +2 and -2 std. deviation. Therefore, it takes an extreme amount of volatility to make it outside of the bands. Moves outside of the bands generate buy and sell signals.

Bitcoin’s candlestick is above the upper Bollinger Band for the first time since 2021. Again, this is a buy signal. On such a high timeframe, it tends to confirm the strongest part of a trend.

The Bollinger Bands also widen with high volatility and tighten with low volatility. Low volatility or narrow bands tend to signal a change to high volatility is coming.

Be sure to note that Bitcoin’s Bollinger Bands are expanding after a period of tightness.

Relative Strength Index

The Relative Strength Index measures the speed and momentum behind price movements. Readings above 70 suggest overbought conditions, and under 30 suggests oversold conditions.

The term overbought is deceiving, however. It takes incredible strength to push above 70, and assets can remain overbought for a months at a time in the crypto market.

Moving above 70 on such a high timeframe is the strongest signal of a bull market, in my opinion. Pay close attention to how Bitcoin only just made it above 70 on the previous candlestick.

But Bitcoin is indeed above 70, and it means to me that it is in the “bull zone". During the last cycle, BTCUSD only stayed in the bull zone for four 2M candlesticks equalling eight months. I suspect it’ll be even less this time around.

Rating: E

I couldn’t give Bitcoin an F, but out of all of the cryptocurrencies examined in this issue, it more than likely has the least ROI potential. On a dollar basis, Bitcoin could increase by another $60,000 to $80,000 per coin. However, this represents only a 60-80% increase. Some altcoins are posting those returns in a single day or week lately. In addition, at $100,000 per coin, a full Bitcoin isn’t easy for the average person to afford.

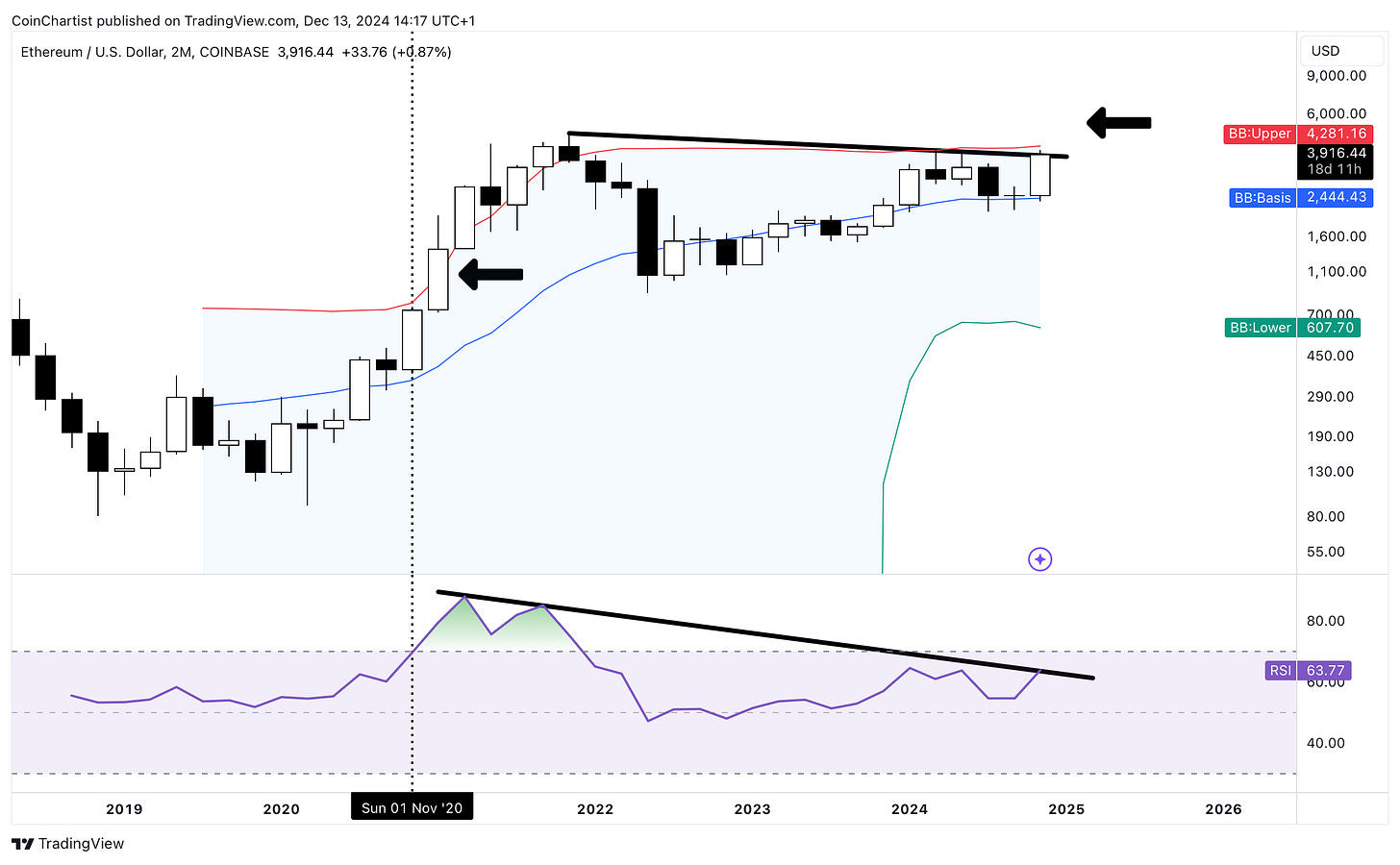

Ethereum holding back the floodgates

The biggest missing ingredient from a full blown altcoin season is the fact that Ethereum continues to lag terribly behind Bitcoin.

Signals

Bollinger Bands

Ethereum has yet to make it outside of the upper Bollinger Band, but I expect it to do so soon enough. Compare the shape of the Bollinger Bands between Bitcoin and Ethereum. Ether is just starting to expand, while Bitcoin shows strong expansion. The fact that Ether has started to expand suggests that the rest of the move will fill out during this 2M candlestick or the next. That makes Ethereum potentially ripe for a rally to at least $4281 where the upper Band is located. The Bollinger Bands do a great job at visually representing the lag in Ethereum.

Relative Strength Index

Again, compare the RSI in Ethereum below to Bitcoin above. BTC broke up out from RSI downtrend resistance, leading to a much bigger move. Ether is brushing up against that same RSI downtrend resistance, while also attempting to break up and out of horizontal candlestick resistance. ETHUSD’s RSI is also only at 63, leaving plenty of room to rise to reach the “bull zone” above 70. When the RSI hits 70, Ethereum should soar.

Rating: D

Ether got dinged on its rating due to the fact it is lagging behind Bitcoin and doesn’t have the greatest possible performance ahead of it. Ethereum targets suggest about a 3 to 4x left in it. This is better than Bitcoin’s potential ROI, but there are still potentially better opportunities left in the altcoin market.

XRP leads alt season

XRP has shocked everyone who had written it off as a “stablecoin” that only moves sideways by rallying 500% in a month. After a fast 5x, what can expect from XRP next?

Signals

Bollinger Bands

The explosiveness of the move comes from just how tight the Bollinger Bands got prior to the breakout. The lower volatility gets, the higher the volatility when there is a “regime” change as John Bollinger, the tool’s creator, would refer to it as. XRP is significantly above the upper Band generating a buy signal. The bands are expanding to the point that they’ve fallen off the screen.

Relative Strength Index

Like Bitcoin, XRP is well above 70 on the RSI. XRP had retested 50 on the RSI, and held, which is a bullish signal. Immediately moving above 70 on the RSI from there, shows the extreme speed and momentum behind the price change.

Rating: C

XRP would have had probably the best rating overall had I done this a month ago when it was 55 cents. However, it did a 5x already since then. With Ethereum expected to do a 4x on the higher end of things, I don’t think that XRP has all that much more left in its tank, either. I suspect it performs better than Ethereum will, with a 4x to 5x left to go. I think XRP takes pause around these levels for about another month of sideways, then makes a sharp move to end the impulse. Because I think this will be very difficult for buyers to sell before its over, it gets a lower rating.

Keep reading with a 7-day free trial

Subscribe to CoinChartist (VIP) to keep reading this post and get 7 days of free access to the full post archives.