Issue #10 | Time For Fireworks?

Will this month in crypto finally spark a grand finale, or will July turn out to be another dud?

Welcome to issue #10 of CoinChartist (VIP). This week’s drop is a special edition that includes:

Bitcoin updates on the monthly, and H1 2023 close

Litecoin leads crypto recovery with strength not seen since 2017

6M macro charts on the Nasdaq and Apple, plus the DXY monthly

Wave counts in Bitcoin and Ethereum

Big changes in altcoins according to Bitcoin dominance

Please subscribe for premium and support CoinChartist.io, or share CoinChartist (VIP) with friends and family. You can also follow CoinChartist on YouTube and Twitter. Don’t forget to also like and comment to let us know how we’re doing.

This week’s issue will be very different in format. I specifically held its release until after the daily close last night, which provided me with brand new data and charts on the 1M and 6M timeframe in Bitcoin, altcoins, and traditional markets. Since all of these charts tie together to tell a story, this newsletter will be presented as such, without the sub-sections and separation. Enjoy!

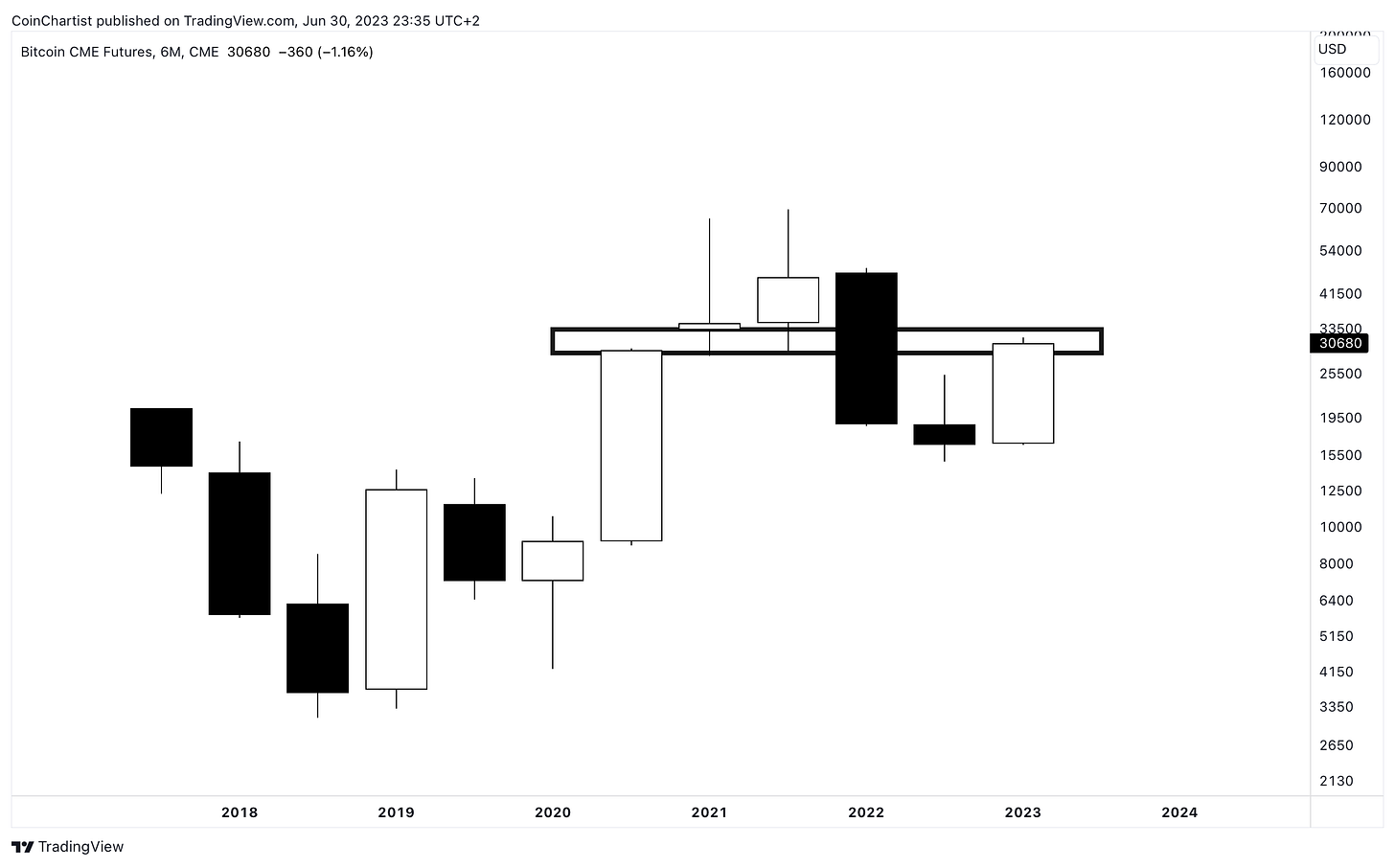

The first half of 2023 failed to produce the full-strength morning star pattern in BTCUSD. A more powerful pattern would have resulted in the 6M engulfing most of the H1 2022 candle. However, more than 50% of the H1 2022 candlestick has been engulfed, so it was enough to reach the buy trigger.

The chart above is specifically the BTC1! CME Futures chart, chosen to highlight the “gap” between the 2020 close and 2021 open. In Japanese candlestick analysis, gaps are referred to as windows. Price is above the bottom of this rising window, but didn’t quite make it through it completely. This leaves plenty of ambiguity left on the highest timeframe chart, unfortunately.

A different morning star pattern still could give crypto a jolt. The Nasdaq 6M also just closed with a much stronger morning star. As you may recall from last week’s issue, a morning star is a potential bullish reversal pattern. Considering the correlation between BTCUSD and the NDX, there is still plenty of room for bullish stock market sentiment and recent profits to flow into cryptocurrencies.

The chart above depicts the BTCUSD 1M Stochastic and a situation that better resembles 2013, 2014, 2017, or 2020 — not 2019. The Stochastic is currently extending into overbought conditions. This is typically a negative in most assets, but as several charts in this issue will demonstrate, overbought conditions in crypto can lead to the largest moves.

The Fisher Transform is also highlighting more underlying strength than 2019. The 1M Fisher opened with a reading of 1.48. Above 1.50 has led to some of the sharpest uptrends in Bitcoin history. The four previous instances of BTCUSD pushing above 1.50 on the Fisher produced on average over 2017% ROI.

The 1M BTCUSD close confirmed a bullish crossover on the LMACD. The histogram staying green is imperative to a sustained rally. The 1M candle also closed above the Bollinger Band basis line. This line is now located at $28,600 and could be tested in the coming days. The pair of signals further validate a confluence of positive high timeframe technicals developing.

In contrast to Bitcoin’s bullish charts, the DXY Dollar Currency Index gave corresponding bearish signals. For example, the DXY closed below the Bollinger Bands basis line, and 1M Stochastic continues to trend toward oversold. Notably, 1M Stoch reaching oversold conditions has always synchronized timing-wise with major crypto bull markets

The big news in traditional finance was Apple (APPL) reaching a $3 trillion dollar market cap this week. APPL closed its 6M candle with the most powerful and bullish morning star pattern featured in this issue. Stoch is also turning upwards. But neither of those things are a reason for the chart.

Find out the reason for mentioning Apple (hint: Bitcoin’s market cap), access ten more exclusive charts, and learn about the fate of top altcoins by upgrading to become a paid subscriber. You can also refer users to earn a free subscription.

Keep reading with a 7-day free trial

Subscribe to CoinChartist to keep reading this post and get 7 days of free access to the full post archives.