White House/Black Swan

Crypto is center stage at the White House, but could a Black Swan be on the horizon?

Disclaimer: The information provided in this Substack newsletter is for general informational purposes only and should not be considered as financial advice. Investing involves risk, and past performance is not indicative of future results. Please conduct your own research or consult a financial advisor before making any investment decisions. The newsletter disclaims any liability for losses or damages arising from the use of this information.

White House/Black Swan overview:

Trump’s pro-crypto policies are stirring up volatility in the market — what’s going on?

A special feature on the coins with representation at the White House Crypto Summit

Global liquidity makes a major return, with a $40 trillion injection from China

Bearish technicals appear in Bitcoin, the S&P 500, and the DXY

Could a wave 2 low bring us another Black Swan before more upside?

The consensus across the cryptocurrency market is that this is the toughest market cycle ever. Having been through two prior cycles myself, I wholeheartedly agree. The last issue explored some of the reasons why Bitcoin may have topped, and why Ethereum and other altcoins have struggled to gather any upside momentum. A lot of these signals were contingent upon a February candle close. Unfortunately, February candles closed ugly across the board, seriously tainting the charts of Bitcoin, altcoins, the stock market, and oddly enough, the DXY (Dollar Currency Index). Typically, when the DXY tanks, risk assets like crypto experience their strongest uptrends. Risk assets also rise and fall with global liquidity, albeit with around a 70-day lag. This wasn’t always the case, but during contracting economic conditions, risk assets appear more sensitive to changes in global liquidity. Fortunately, despite the February close in risk assets looking dire, global liquidity could have arrived just in the nick of time to make this a massive fake out. The coinciding setup of Trump’s Executive Order for a Bitcoin reserve and tonight’s Crypto Summit make it feel like there could be more bull run to go in Bitcoin and alts, all during extreme macroeconomic fear and a possibly toppling stock market. This issue attempts to make sense of the confusion while exercising extreme cautious until there is more confirmation of direction.

Trump and Dump

Trump’s taking office was supposed to be a major boon for crypto, given his pro-crypto policies and vocalness about him wanting the US to be the crypto capital of the world. However, it’s done nothing but collapse since taking office. Last night, however, the man held his promise and signed an Executive Order for a strategic Bitcoin reserve. The long-term implications of this are incredible, given the legitimacy this gives to Bitcoin in the global eye and especially with other countries. One might speculate it could eventually lead to some type of arms race between countries — but things are still early and the market for now has viewed it as rather insignificant. Trump’s involvement in crypto hasn’t all been positive, however.

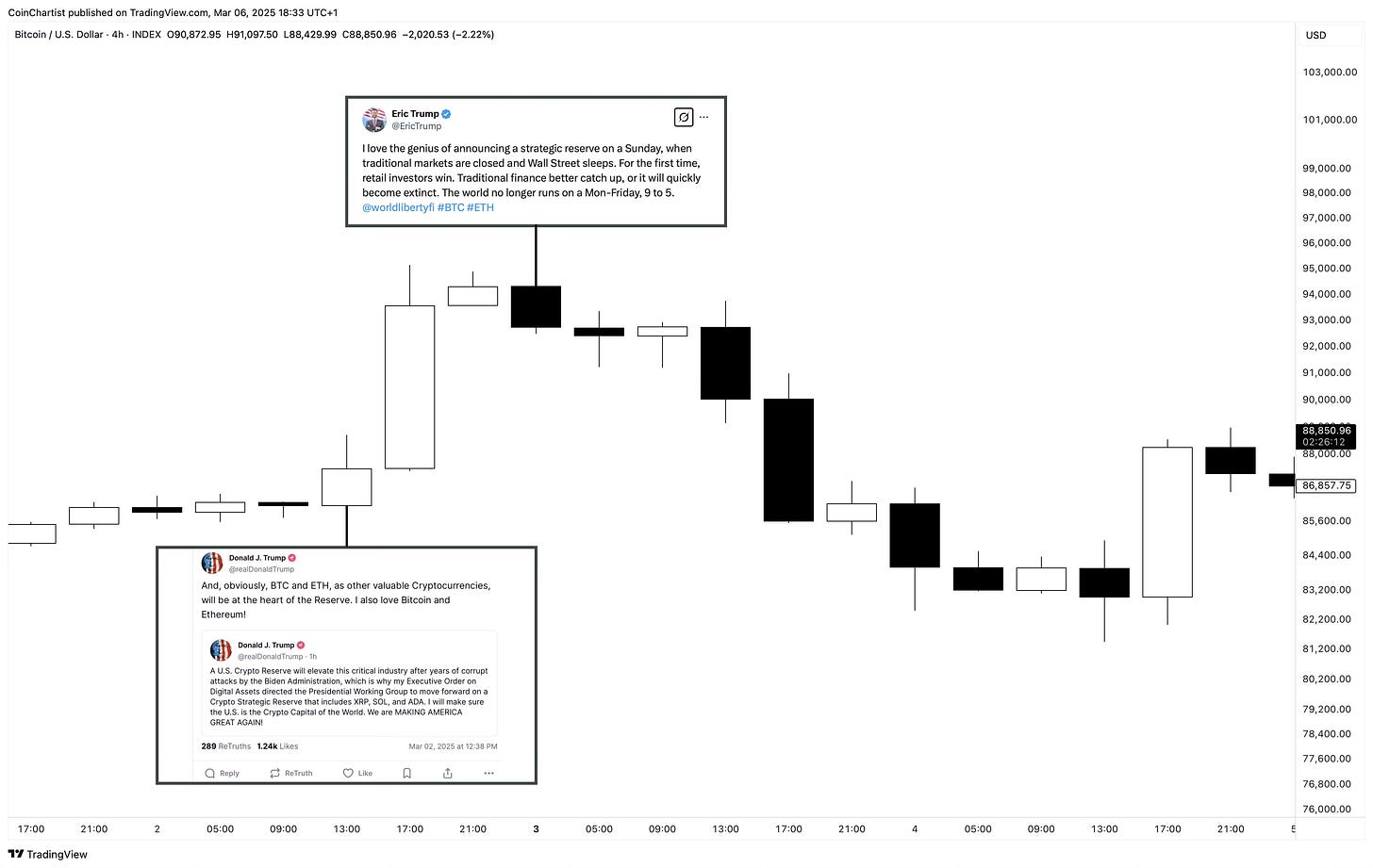

To onlookers, Trump’s involvement in crypto is causing some serious volatility. Markets in general are dealing with high volatility due to the flip-flopping of tariffs, but crypto has to also deal with Trump’s son Eric and World Liberty Financial. On a low volume weekend after a large crash in crypto, President Trump announced a strategic stockpile that would include XRP, SOL, and ADA. These coins ripped by 30%% or more and Bitcoin returned to the low $90K region. Near the height of the enthusiasm, Eric Trump tweeted about how the announcement was genius for being over the weekend, because “retail won.” Right after, the entire rally was retraced and many altcoins made new local lows. Yeah… seems like retail won.

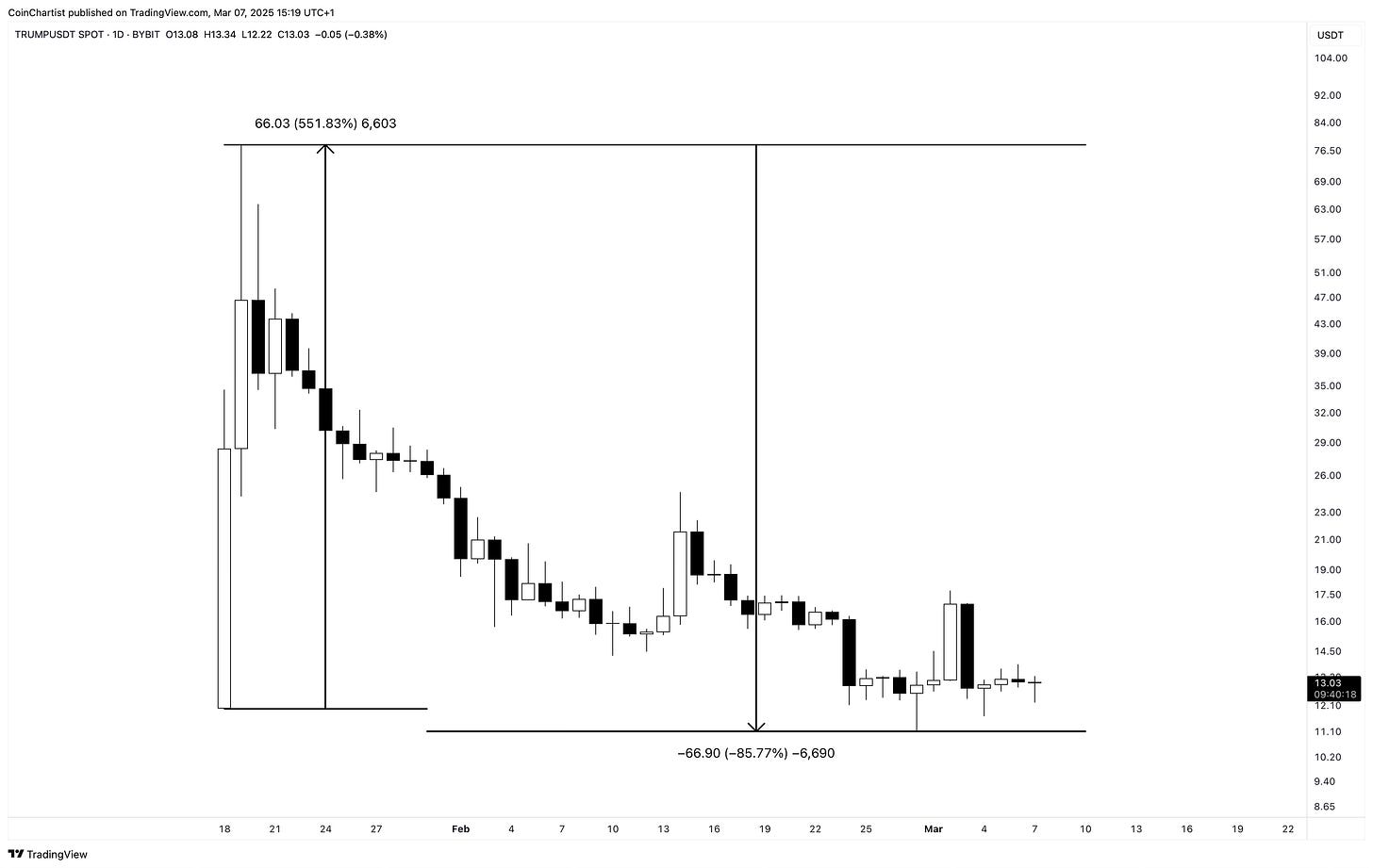

Another way Trump’s involvement in crypto screwed retail was through his Trump coin debut. It sucked any available liquidity out of all other altcoins, put an end to meme coin season, and even potentially put in a local top in Bitcoin. It’s since fallen 85% from its highest price.

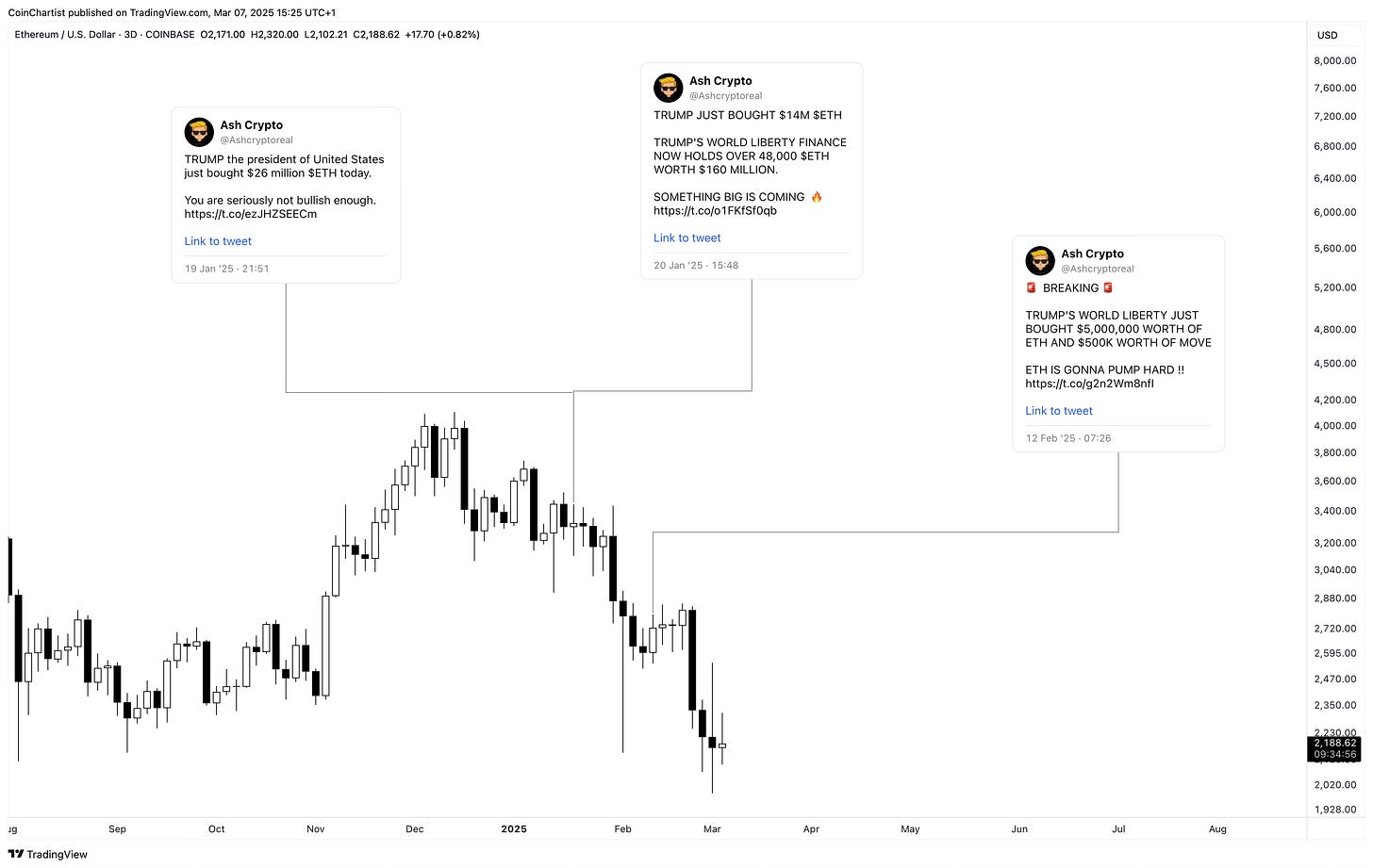

World Liberty Financial is also got some decent unrealized losses going. They bought substantial amounts of Ethereum at higher prices. A large wealthy entity can withstand a drawdown, so that isn’t too concerning. However, it feels as if this is being done deliberately to mislead retail investors into Ethereum. Transactions are visible on the blockchain, and it’s constantly being discussed on social media from large, loud accounts.

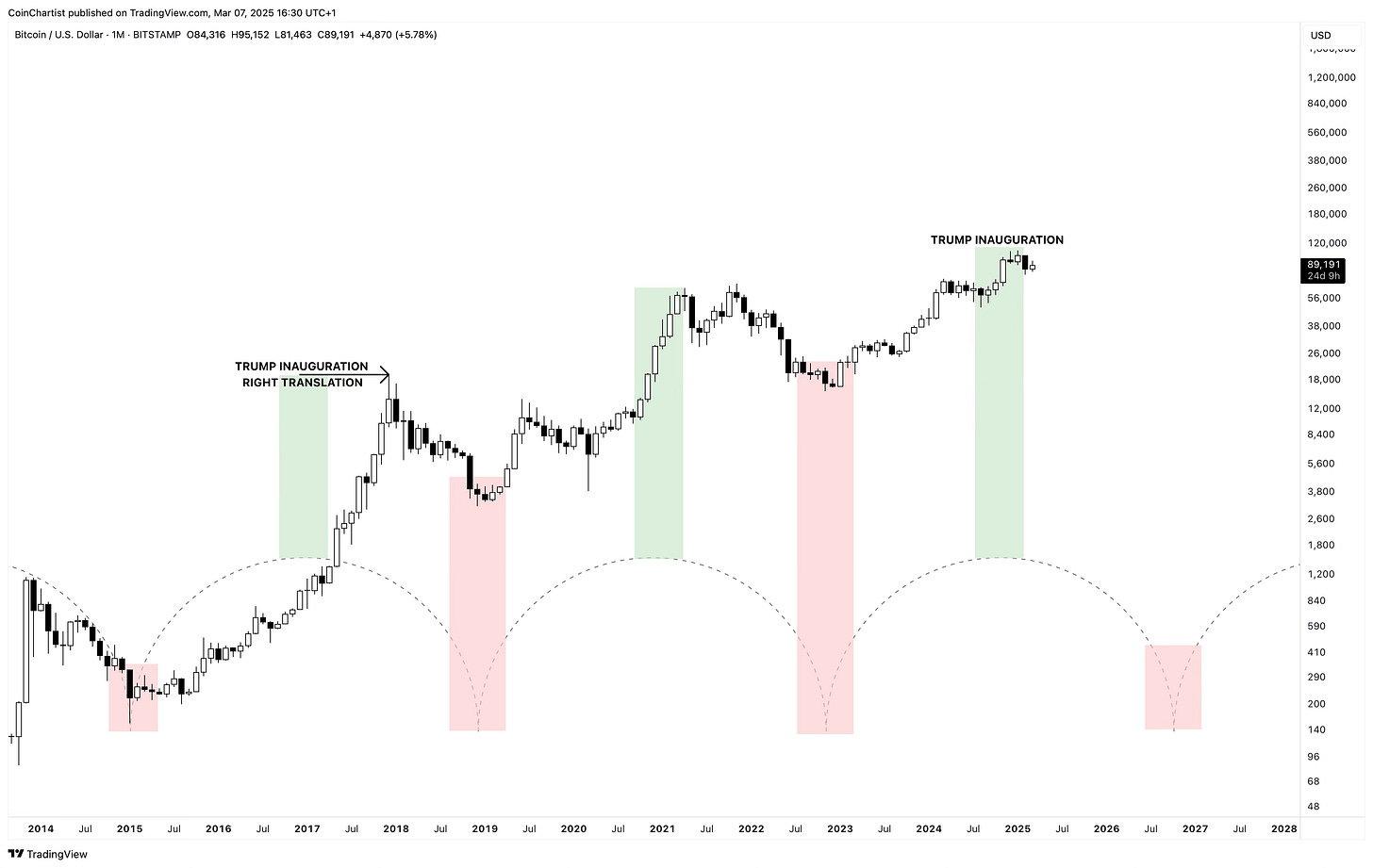

Past issues looked to Trump’s Inauguration Day as a cyclical top. Currently, Inauguration Day was the exact day Bitcoin’s reigning all-time high was set. Price began to fall the very next day and has reached a 28% drawdown so far.

As a reminder, this date wasn’t chosen out of thin air. The short-lived blast of euphoria combined with a wave count and time cycles made it clear that topping was indeed a possibility around that timing. The next cyclical low of this same rhythm is followed will be June 2025.

Using the same tools, we can see the impact on larger degree Bitcoin cycles. Bottoms occur during red boxes and troughs, while green boxes near cyclical crests put in a top. The 2025 Trump inauguration is right at dead center of the current cyclical wave crest. 2021’s top was the same, while the 2017 cycle when Trump was inaugurated the first time topped months later for a right-translated cycle top. Have we topped, or will we get a repeat of 2017? Even using these tools it is hard to tell.

What concerns me is this quote:

Bull markets climb a Wall of Worry. Bear markets slide down a Slope of Hope.

You might remember from past issues, I referred to Bitcoin’s uptrend channel as the Wall of Worry in reference to this quote. Even though we were in a bull market, fear kept people from buying the whole way up. Could the opposite be happening in crypto now that there is so much hope associated with Trump’s pro-crypto policies? Such a scenario would keep retail investors buying throughout a bear market.

Keep reading with a 7-day free trial

Subscribe to CoinChartist to keep reading this post and get 7 days of free access to the full post archives.