Issue #12 | Patience For The Grand Finale

Why wave 5 in Bitcoin isn’t as wonderful as it sounds, a spotlight on XRP, plus the DXY, NDX, and more.

Welcome to issue #12 of CoinChartist (VIP). This week’s drop includes:

More patience may be necessary in Bitcoin

The DXY is extremely oversold. What now?

Altcoin spotlight on “not a security” XRP

A potential fractal in BTCUSD

Wave counts pointing to a grand finale…

…and a recession in the next 12 months

Disclaimer: The information provided in this Substack newsletter is for general informational purposes only and should not be considered as financial advice. Investing involves risk, and past performance is not indicative of future results. Please conduct your own research or consult a qualified financial advisor before making any investment decisions. The newsletter disclaims any liability for losses or damages arising from the use of this information.

Weeks ago, I released a special edition newsletter dubbed “Time For Fireworks?” Yet we are still waiting in crypto.

At this year’s fireworks in my local town, the grand finale was a sight to behold. Except for it wasn’t the grand finale yet.

After a show of fireworks across the night sky, they picked up pace and size in true grand finale style. It was over, and it was great. Except, moments later, fireworks started firing off again, and what came next blew my mind. It easily beat my expectations and what I had just seen prior.

Had I walked away too early, I’d have missed the best part. Considering the upside we’ve witnessed in crypto and the broader financial market, it’s easy to think we’ve seen the grand finale already. People have walked away. Whoever is left, however, could be in for the real thing.

You can also follow CoinChartist on YouTube and Twitter. Don’t forget to also like and comment to let us know how we’re doing.

It was a surprisingly volatile week in crypto, resulting in Bitcoin going mostly nowhere. BTCUSD made yet another new 2023 high — a sign of continued low timeframe higher highs. However, it has failed to break above $32,000 which is necessary for continuation.

Friday’s candlestick closed with a Bearish Engulfing pattern, which could signal further correction and a trend interrupted. Price also fell back into the Bollinger Bands after post-narrowing breakout, which isn’t a great sign. The LMACD shows strengthening bearish momentum on the daily. This confluence could point to further short term correction in Bitcoin.

Learn more about the Bearish Engulfing here.

There is a noticeable discrepancy between spot BTCUSD (left) and BTC CME Futures (right) charts. When this occurs, trusting CME is typically a better call. There are two possible outcomes in my opinion: opening below the mid-BB and gapping down at open, or holding above it and gapping upward. Down sends Bitcoin back to $26,000.

Note: The premium Wave Watch section much later in the newsletter heavily details possible bullish and bearish outcomes via updated wave counts.

On the weekly timeframe, the LMACD shows momentum crossed bullish. Not pictured, Bitcoin’s weekly RSI also failed to reenter overbought conditions — a positive indicator of a powerful bull run. However, three short-bodied Japanese candlesticks in a row signal indecision at this level. This supports the possibility of the chance of short term correction.

Corrective behavior would more than likely remain very short term — possibly less than 4 weeks. Switching to the 4-week BTCUSD chart, we can see a significant bullish crossover of the LMACD. Pay attention to when the signal crossed bearish and how momentum dragged prices lower. Now imagine the opposite happening now that it’s crossed bullish. Finally, a Rising Three Method bullish continuation pattern will confirm with Sunday’s close. After a short correction, this continuation pattern should provide upside over the next 3-5 candles. This suggests the next 3-4 months roughly will be extremely bullish.

Learn more about the Rising Three Method here.

Last week’s DXY calls were spot on, with the Dollar Currency Index dropping 2.25% to below the 100 level. The US Dollar in my opinion, is well into a severe bear market. This theory will be further explained under Wave Watch, but for now, let’s dig into the Dollar and the Nasdaq..

The DXY has breached the neckline of a Complex Head and Shoulders pattern. Complex versions of the reversal pattern can feature several shoulders or more than one head. The target of this structure has a target of low 90s. However, it may retest the neckline as part of a “dead cat bounce.”

Learn more about the Complex Head and Shoulders here.

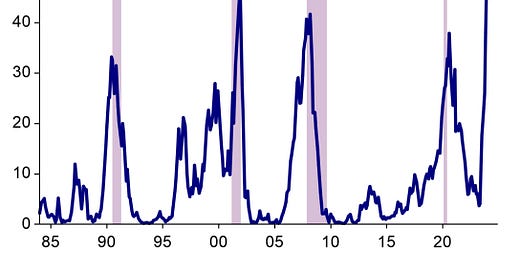

The daily DXY is the most oversold since July and December 2020. The technical environment in both the DXY and Bitcoin are more reminiscent of July 2020. This could suggest Bitcoin’s corrective wave count, which we’ll explore thoroughly, isn’t as quite ready to lift off as we’d hoped (but it’s still not far).

Further higher timeframe comparisons highlight what we can potentially expect for corrective behavior. It is important to note for those unaware, the significance of the DXY is to gauge the strength of the US Dollar. Bitcoin trades on exchanges as BTCUSD. This means the price of Bitcoin is quoted in USD. If the USD side of that pair is strong, the BTC side is usually weak and vice versa. Therefore, the DXY can tip us off as to what might happen in Bitcoin.

Everything tends to move when the US Dollar is weak, including cryptocurrencies, precious metals like Gold and Silver, oil, and even stocks. The new comparison above shows the same exact points in time but compared with the NDX, highlighting tech stocks outperforming crypto at this point. However, it’s shortly after this next correction in crypto and stocks that Bitcoin usually begins to wildly outperform. Scroll back up to see again what I am referring to.

Before we get into the Wave Watch section being teased throughout this issue, I wanted to stop and put the spotlight on XRP. The timing in the collapse of the DXY above is especially interesting considering the change in regulatory climate in crypto. This week, coincidentally, XRP was deemed not a security by a US judge. This suddenly changed the mood in altcoins as a whole.

The Bitcoin being swapped into altcoins, namely XRP can be seen in BTC Dominance. In addition to a possible rejection at high timeframe resistance, the monthly LMACD shows weakening momentum.

Meanwhile, monthly momentum on XRP Dominance is getting stronger, about to potentially push above the zero line for the first time since 2017. The last time this happened, XRP’s Market cap represented 20% of the entire crypto space. This is now 3%. The Average Directional Index also shows a trend that is strengthening alongside a downtrend breakout.

XRP charts across the highest timeframes appear ultra strong, despite already nearly doubling in price after the ruling this past week. For example, monthly Stochastic is showing more strength than at any other point in the last six years.

Keep reading with a 7-day free trial

Subscribe to CoinChartist to keep reading this post and get 7 days of free access to the full post archives.